© International Monetary Fund

Guidance Note for Surveillance under Article IV

Consultation

IMF staff regularly produces papers proposing new IMF policies, exploring options for reform,

or reviewing existing IMF policies and operations. The following document has been released

and is included in this package:

The Staff Report on Guidance Note for Surveillance under Article IV Consultation

prepared by IMF staff and completed on March 19, 2015.

The staff report was issued to the Executive Board for information.

The policy of publication of staff reports and other documents allows for the deletion of

market-sensitive information.

Electronic copies of IMF Policy Papers

are available to the public from

http://www.imf.org/external/pp/ppindex.aspx

International Monetary Fund

Washington, D.C.

May 2015

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV

CONSULTATIONS

EXECUTIVE SUMMARY

This note provides country teams with guidance on bilateral and multilateral

surveillance in the context of Article IV consultations. It covers the following issues:

Focus on stability. Stability is the organizing principle of surveillance. Article IV

consultations should focus on the conduct of economic and financial policies

pursued by members to promote present and prospective domestic and balance

of payments stability, as well as global economic and financial stability. For the

latter, Article IV consultations should discuss spillovers from members’ economic

and financial policies that may significantly affect global stability, including

alternative policy options that would minimize their adverse impact.

Operational guidance. The note provides detailed guidance, suggestions and

references in areas covered in surveillance including risks and spillovers, fiscal

policy, macrofinancial and monetary policy, BOP stability, structural policies and

data issues.

Communication and Engagement. Effective two-way communication is key to

surveillance, including with the authorities (to help staff’s advice get traction), the

Executive Board (to support effective peer review), and the public and other

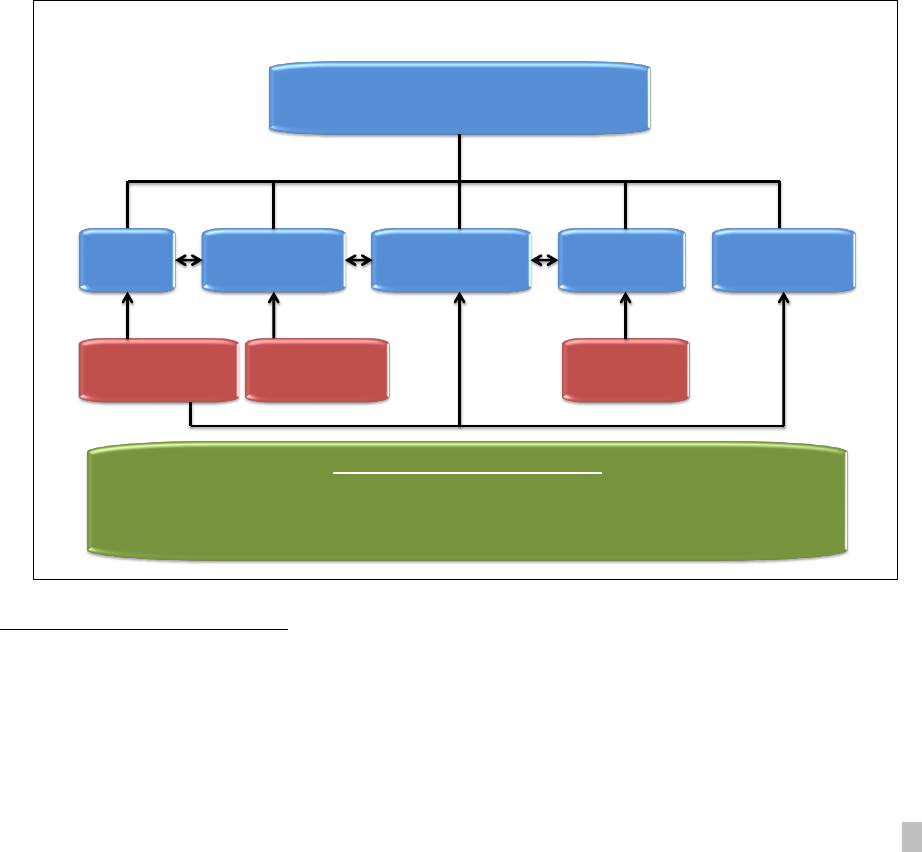

stakeholders (to gain support for necessary policy adjustments). Surveillance

messages need to be clear, concise, and focused. The Fund needs to be

evenhanded, in line with the principle of uniformity of treatment, for surveillance

to command the confidence of the membership.

Process and formal requirements. A number of procedures, rules, and

requirements are summarized in this note.

This Guidance Note is not intended to provide a checklist for issues to be covered

in Staff Reports. While economic and financial stability is the overarching objective,

selectivity in Staff Reports remains critical. Staff needs to exercise judgment in how to

apply the guidelines for each specific member, and there is scope for staff to innovate and

push the analytical content beyond current practices.

March 19, 2015

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

2 INTERNATIONAL MONETARY FUND

Approved By

Siddharth Tiwari

Prepared by an SPR team led by Gavin Gray comprising Zsofia Arvai,

R. Sean Craig, Mame Astou Diouf, Lawrence Dwight, and

Michael Perks, under the guidance of Taline Koranchelian.

CONTENTS

LIST OF ACRONYMS _____________________________________________________________________________ 3

I. INTRODUCTION _______________________________________________________________________________ 5

II. SCOPE OF SURVEILLANCE ____________________________________________________________________ 8

III. OPERATIONAL GUIDANCE—KEY ISSUES __________________________________________________ 12

A. Risks and Spillovers ___________________________________________________________________________ 12

B. Fiscal Policy ___________________________________________________________________________________ 17

C. MacroFinancial Analysis and Monetary Policy _________________________________________________ 21

D. Balance of Payments Stability _________________________________________________________________ 28

E. Structural Policies _____________________________________________________________________________ 36

F. Data Adequacy for Surveillance _______________________________________________________________ 41

IV. COMMUNICATION AND ENGAGEMENT___________________________________________________ 41

V. SURVEILLANCE PROCESS AND REQUIREMENTS ___________________________________________ 44

BOXES

1. Best Practices in Surveillance ___________________________________________________________________ 7

2. 2014 Triennial Surveillance Review: Operational Priorities ______________________________________ 8

3. Surveillance in Small Developing States _______________________________________________________ 11

4. Risks and Spillovers: Key Concepts ____________________________________________________________ 13

5. The Risk Assessment Matrix ___________________________________________________________________ 14

6. Techniques for Risk and Spillover Analysis ____________________________________________________ 16

7. Guidance on the ESR, EBA, and EBA-Lite ______________________________________________________ 32

8. Key Questions on Specific Jobs and Growth Challenges ______________________________________ 40

9. Drafting Guidelines ___________________________________________________________________________ 42

10. Publication and Transparency Guidelines ____________________________________________________ 43

FIGURES

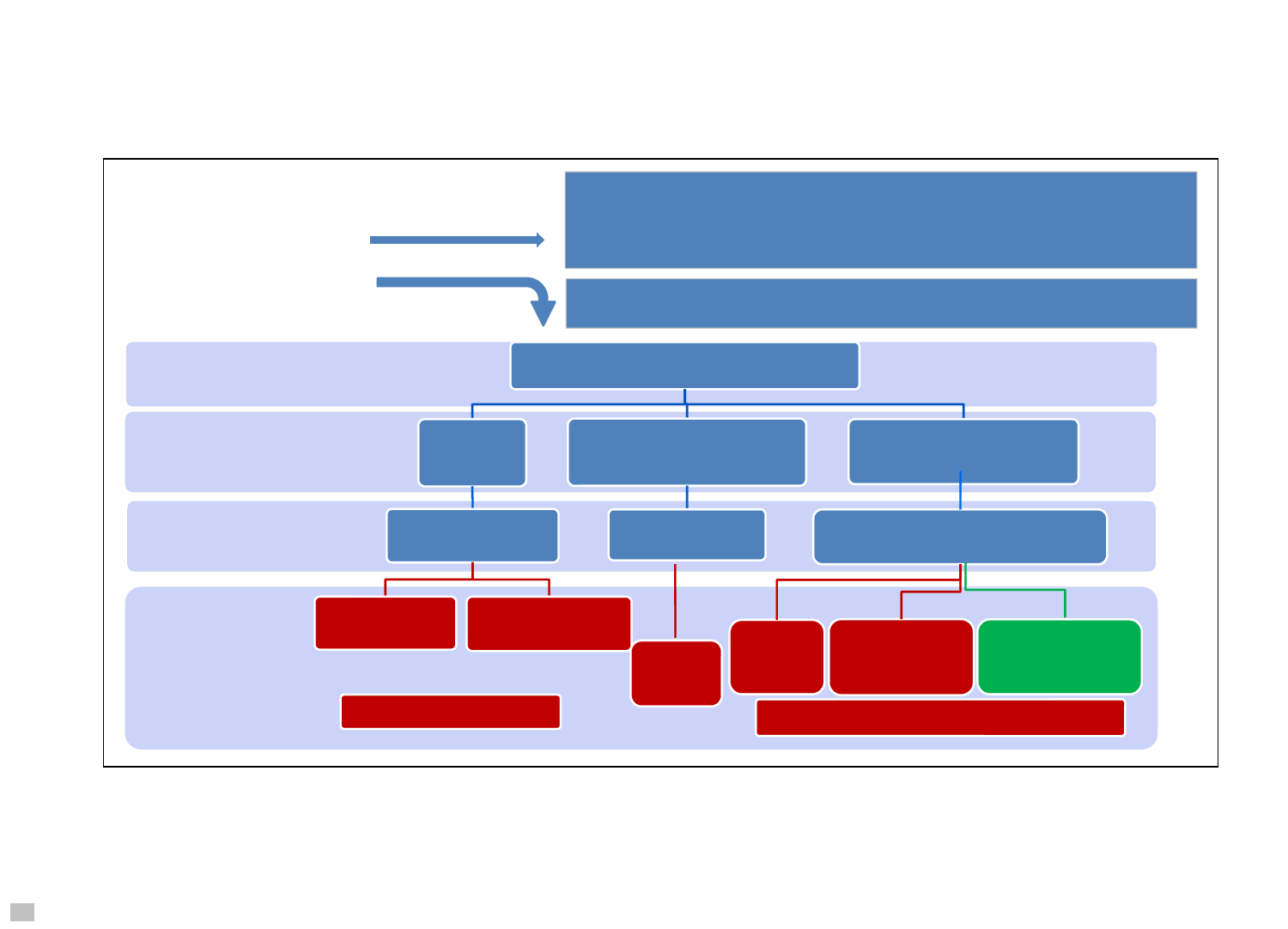

1. Key Elements of Surveillance at the Fund ______________________________________________________ 6

2. Conceptual Framework for Balance of Payments Stability Analysis ____________________________ 29

3. Criteria for Coverage of Structural Issues in Surveillance ______________________________________ 36

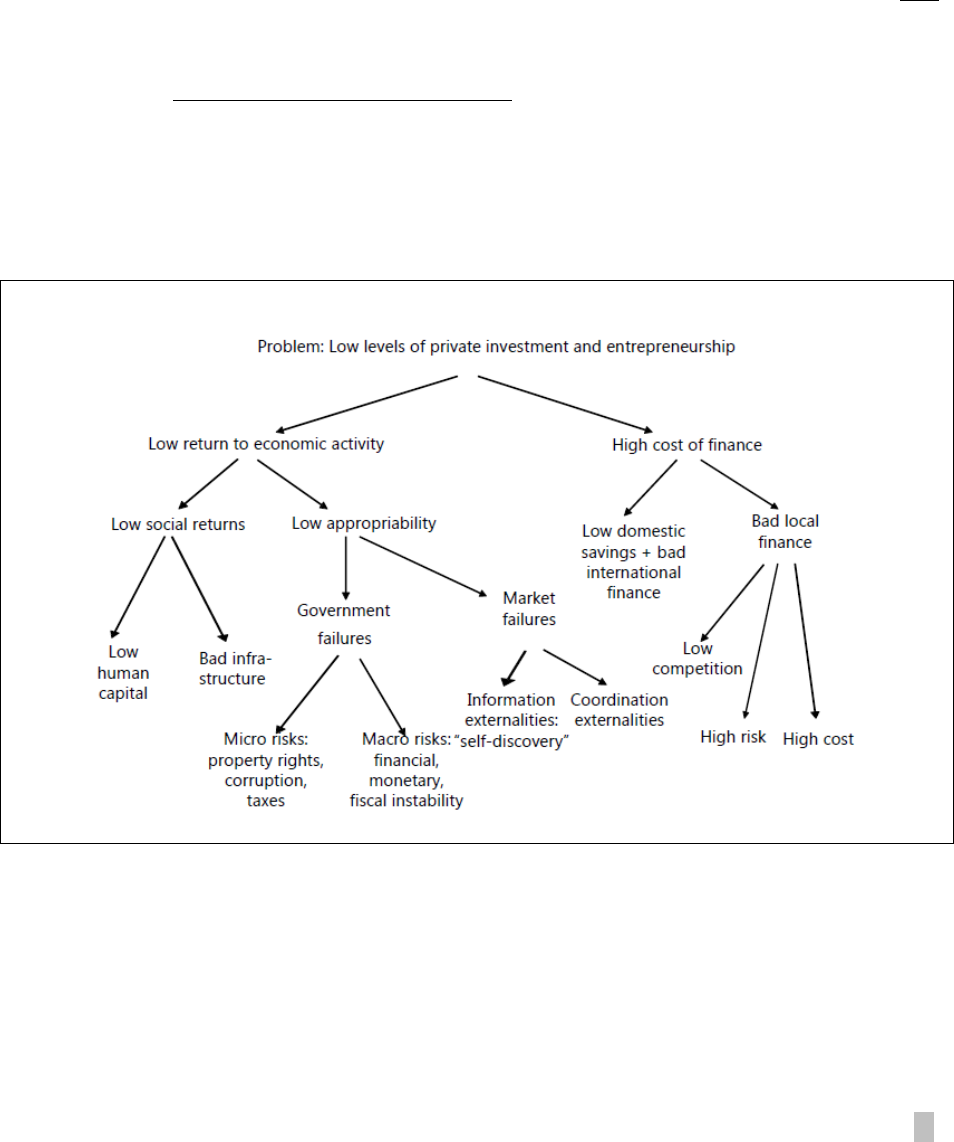

4. Growth Diagnosis Decision Tree ______________________________________________________________ 37

5. Article IV Cycles _______________________________________________________________________________ 47

ANNEXES

I. Legal Framework and Principles _______________________________________________________________ 48

II. Consultations with Members of Currency Unions _____________________________________________ 52

III. Formal Requirements in Article IV Staff Reports ______________________________________________ 54

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 3

LIST OF ACRONYMS

AML Anti-Money Laundering

AREAER Annual Report on Exchange Arrangements and Exchange Restrictions

BSA Balance Sheet Analysis

CA Current Account

CFM Capital Flow Management Measure

CFT Combating the Financing of Terrorism

COM Communications Department

CSO Civil Society Organization

DSA Debt Sustainability Analysis

DSGE Dynamic Stochastic General Equilibrium

EBA External Balance Assessment

EPA Ex-Post Assessment

EPE Ex-Post Evaluations of Exceptional Access Arrangements

ER Exchange Rate

ESR External Sector Report

FAD Fiscal Affairs Department

FCL Flexible Credit Line

FSAP Financial Sector Assessment Program

FTN FSAP Technical Note

GFSR Global Financial Stability Report

GNI Gross National Income

G20 The Group of Twenty

G-RAM Global Risk Assessment Matrix

GVAR Global Vector Auto Regression

ICD Institute for Capacity Development

ILO International Labour Organization

ISD Integrated Surveillance Decision

LEG Legal Department

LICs Low-Income Countries

LOE Languages Other than English

LOT Lapse of Time

MAC Market Access Country

MIC Middle-Income Country

MCM Monetary and Capital Markets Department

NPL Non-Performing Loan

OECD Organization for Economic Co-operation and Development

OFC Offshore Financial Center

PFM Public Financial Management

PLL Precautionary and Liquidity Line

PPP Public-Private Partnership

PSI Policy Support Instrument

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

4 INTERNATIONAL MONETARY FUND

PRGT Poverty Reduction and Growth Trust

RAM Risk Assessment Matrix

REER Real Effective Exchange Rate

RES Research Department

RFI Rapid Financing Instrument

RCF Rapid Credit Facility

ROSC Report on the Observance of Standards and Codes

SEC Secretary’s Department

SEI Selected Economic Indicators

SDDS Special Data Dissemination Standard

SDS Small Developing States

SIP Selected Issues Paper

SPR Strategy, Policy and Review Department

STA Statistics Department

TA Technical Assistance

TSR Triennial Surveillance Review

UFR Use of Fund Resources

UMP Unconventional Monetary Policy

WEO World Economic Outlook

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 5

I. INTRODUCTION

1. This note provides guidance to staff on the conduct of surveillance in the context of

Article IV consultations.

1

Surveillance involves the continuous monitoring of members’ economic

and financial policies and the global economy.

2

In Article IV consultations, staff holds pointed

discussions with country authorities on the economic situation, the authorities‘ policies

3

and how

these affect the country‘s stability—as well as global stability through spillovers where relevant—and

desirable policy adjustments. These discussions are reported to the Fund‘s Executive Board for its

consideration. The goal, through thorough analysis, candid discussions, and peer review, is to

promote the stability of individual members’ economies and global economic and financial stability,

which is a necessary condition for the effective operation of the international monetary system.

2. Close engagement and effective communication are critical for the Fund to achieve

traction in its surveillance. High quality advice is necessary but not sufficient to gain traction.

4

Engagement and consultations with the authorities go beyond producing the Article IV consultation

report, which is only one of the outputs of surveillance. The Fund’s ability to gain traction with its

policy advice also depends on the confidence and trust its advice inspires, which is influenced by the

perceived evenhandedness of surveillance.

3. Article IV reports should be selective and focus on the issues and themes that are

relevant for stability with clear advice on an appropriate mix of policies.

5

While this Guidance

Note presents issues in a comprehensive manner, staff is not expected to cover all the issues raised

here as if it were a checklist (except where specifically noted in Section V). Rather, selectivity is

critical, bearing in mind the focus on individual members’ stability as well as the effective operation

of the international monetary system—in particular through maintaining global economic and

financial stability. A thematic approach, focusing on economic challenges or goals rather than

individual sectors, can facilitate the analysis and presentation of intersectoral connections and policy

1

This note replaces the Guidance Note for Surveillance under Article IV Consultations of October 10, 2012. It reflects

the priorities agreed as part of the 2014 Triennial Surveillance Review (TSR). The terms Article IV consultation and

Article IV are used interchangeably in the remainder of this document.

2

Article IV of the Articles of Agreements requires the Fund to (i) assess members’ compliance with their obligations

under Article IV, Section 1 and, in particular, to exercise firm surveillance over the conduct of their exchange rate

policies (bilateral surveillance), and (ii) oversee the operation of the international monetary system to ensure its

effective operation (multilateral surveillance). As a means of enabling the Fund to discharge its surveillance

responsibilities, Article IV imposes on members procedural obligations to consult when requested by the Fund.

Annex I provides further guidance on the legal framework for surveillance.

3

The discussion of the baseline focuses on established policies: those policies that are in place as well as policies

announced that are, in the best judgment of the team, likely to be implemented.

4

See The Role of the IMF as Trusted Advisor (2013).

5

The concept of the mix of policies is intended to be broader than the more conventional fiscal-monetary policy mix.

Rather the “mix of policies” covers the wider range of policy levers appropriate to a member’s circumstances, which

could include financial, structural and exchange rate policies in addition to fiscal and monetary policies.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

6 INTERNATIONAL MONETARY FUND

interactions. It would also enhance discussion of and advice on the broader mix of policies, which is

essential in Article IV staff reports.

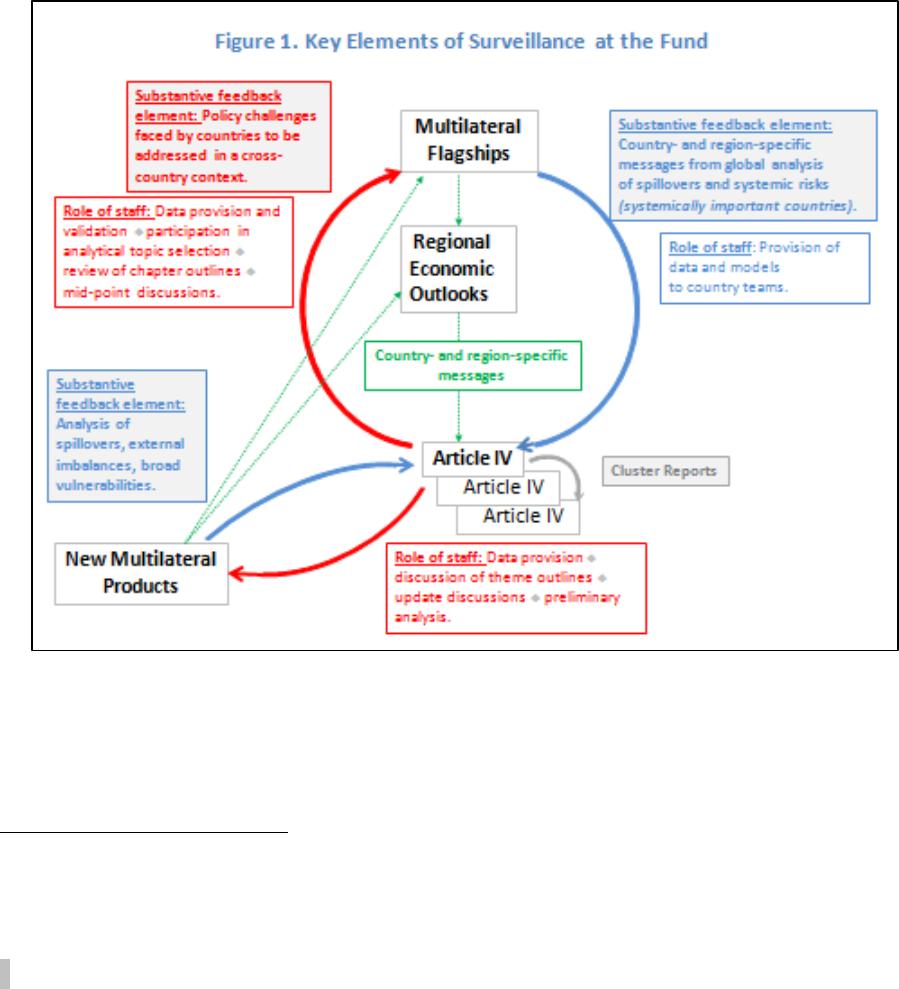

4. Effective surveillance requires candid, forward-looking analysis that leverages

multilateral surveillance. Staff reports and discussions should take a forward-looking view,

including a discussion of current and medium-term objectives and policies, as well as possible policy

responses to the most relevant contingencies.

6

Realistic projections based on established policies

are a critical input to this. Integrating the key results and messages from multilateral surveillance will

help ensure that staff adequately takes into account global trends and risks in its near- and

medium-term views (See Figure 1). Staff advice is more effective when it is specific and takes into

account the member’s specific circumstances and implementation capacity. (See Box 1: best

practices in surveillance).

6

As is long-standing practice, alternative policy scenarios with a quantified framework can also help illustrate the

impact of reforms.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 7

Box 1. Best Practices in Surveillance

The following qualities should permeate all aspects of surveillance work:

Collaboration. Surveillance is based on dialogue with country authorities and other stakeholders, and

persuasion. While this dialogue should be continuous, it is particularly important to seek country

authorities‘ opinion on issues of interest to them before an Article IV consultation. Staff can also draw on

the expertise of other international institutions.

Candor. Effective dialogue requires candor, both in discussions with country authorities and in staff

reports, including about risks.

Evenhandedness. Surveillance should be evenhanded (see Section Communication and Engagement),

whether economies are large or small, advanced or developing, and pay due regard to country

circumstances.

Practicality. Staff advice should be specific and take into account country specific circumstances and

implementation capacity.

Forward-looking. Staff reports and discussions should be based on realistic projections and discuss

current and medium-term objectives and policies and possible policy responses to the most relevant

contingencies.

Multilateral perspective. Where relevant, Article IV consultations should discuss potential or actual

spillovers as required by the Integrated Surveillance Decision (ISD) and can draw from experiences in

other countries.

Selectivity. While this Guidance Note presents the issues in a comprehensive manner, staff should not

view it as a prescriptive list. Reports should be focused and selective, except for certain issues that must

routinely be covered (as identified in Annex III). Rather, country teams should exercise judgment in

selecting issues for in depth coverage, and take a risk-based approach, leveraging the expertise of

functional departments and other institutions.

Timeliness. To ensure that Article IV staff reports are up-to-date when discussed at the Board and

published, staff should minimize the time between the end of discussions with authorities and the Board

meeting.

5. This note takes into account the recommendations of the 2014 Triennial Surveillance

Review (TSR) (see Box 2) and is structured as follows: Section II describes the scope of

surveillance, including key elements of the ISD. Section III provides operational guidance for key

analytical and policy areas that arise in surveillance: (i) risks and spillovers; (ii) fiscal policy;

(iii) macrofinancial analysis and monetary policy; (iv) balance of payments stability; (v) structural

policies, and discusses surveillance in low-income countries and data issues.

7

Section IV covers

communication and engagement, providing guidance on how policy dialogue and evenhandedness

can promote traction. The last section describes the formal steps and requirements for Article IV

surveillance. The note addresses surveillance issues in a comprehensive way, and thus its coverage

goes beyond the 2014 TSR recommendations.

7

While section III discusses a wide range of issues that teams are likely to cover in surveillance, the 2011 and 2014

TSRs have also identified a number of specific operational priorities. Box 2 details the 2014 priorities.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

8 INTERNATIONAL MONETARY FUND

Box 2. 2014 Triennial Surveillance Review: Operational Priorities

The 2014 TSR emphasizes the following priorities for surveillance:

Risks and Spillovers. Integrate bilateral and multilateral surveillance, include alternative risk scenarios in

Article IV consultations as relevant, and revive national balance sheet analysis.

Macrofinancial Surveillance. Make macrofinancial analysis an integral part of Article IVs, and step up

advice on macro-prudential policy to address financial risks.

Structural Policy Advice. Recognize all macro-critical structural issues

1/

and their macroeconomic

implications. Follow the principles of macro-criticality, and Fund expertise or interest from ‘critical mass’ of

the membership in determining whether to provide advice.

Cohesive and expert policy advice. Move towards thematic Article IV staff reports, build advice on cross-

country policy experiences, strengthen the integration of TA in surveillance, and enhance collaboration with

other international organizations in specific areas.

Client-focused approach. Monitor engagement and expand the coverage of follow-up on past policy

advice in Article IV staff reports.

______________________________________

1/ An issue is macro-critical if it affects, or has the potential to affect, domestic or external stability. See Section E on Structural

Policies for more details.

II. SCOPE OF SURVEILLANCE

6. Stability is the organizing principle for surveillance. Under the ISD, Article IV consultations

are a vehicle for both bilateral and multilateral surveillance. The former involves the Fund’s surveillance

over an individual member’s conduct of exchange rate and domestic economic and financial policies

and its related obligations, while for the latter the Fund examines the impact of the member’s policies

on global economic and financial stability and therefore the international monetary system (IMS). As

such, Article IVs have a dual mandate: to assess whether a member’s policies are promoting its own

economic and financial stability—both in terms of balance of payments and domestic stability—and

the stability of the global economic and financial system.

8

7. Article IV consultations should cover all economic and financial policies that affect the

member’s own stability. These always include exchange rate, monetary, fiscal and financial sector

policies. Other policies, such as structural policies that aim to raise growth should be assessed if they

are macro-critical, i.e., affect the stability of the country.

9

8. Article IVs will normally cover inward spillovers and, given the dual stability mandate,

should also cover “outward” spillovers, where necessary:

8

For Article IV surveillance, domestic stability is thought about in terms of “orderly economic growth with reasonable

price stability” and balance of payments stability in terms of “orderly underlying economic and financial conditions

and a monetary system that does not tend to produce erratic disruptions.” Global economic and financial stability is

best understood through examples of instability, including the malfunctioning of the international monetary system,

global recessions and global financial crises. See Modernizing the Legal Framework for Surveillance—An Integrated

Surveillance Decision, (June 26, 2012), paragraph 6.

9

Section III E discusses in more detail the specific criteria for coverage of structural policies.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 9

Inward spillovers. Article IVs should assess the actual or potential impact of global developments

and policy actions in other countries on a member’s economic and financial stability.

Outward spillovers. Article IVs should examine spillovers from a member’s policies in two

circumstances: (i) if a member’s policies are not promoting its own stability, or (ii), if the member’s

policies are promoting its own stability, but they could nevertheless significantly affect global

stability.

10

In such cases, Article IVs should examine the most significant actual and potential

outward spillovers, irrespective of the transmission channels, which members are obliged to

discuss with the Fund and provide relevant data.

11

The Fund cannot require members to change

their policies when these promote the member’s own stability but adversely affects global stability.

However, it should recommend policy alternatives that would improve global stability, while

continuing to promote the member’s own stability.

12

9. Growth is not strictly a goal of Article IV consultations, but in practice often falls within

its scope given the extent to which it affects stability. Article IVs can consider whether policies are

directed towards keeping the economy operating broadly at capacity, and fostering high potential

GDP growth to the extent that this significantly influences stability. Issues relating to job creation and

income distribution may also be examined if: (i) they have a bearing on stability; (ii) they are important

objectives for the member, and staff provides policy advice to help achieve them; or (iii) the member

requests that staff discuss these issues.

10. Within this broad mandate and required coverage of policies, Article IVs should reflect,

and be tailored to, member circumstances. The Article IV should be anchored in the context of a

member’s medium-term economic objectives and planned policies, including contingency plans. It

should respect the member’s national social policies and other objectives.

Surveillance in Low-Income Countries (LICs)

11. While surveillance obligations apply across the membership, surveillance in LICs is

normally geared towards ensuring that policy choices promote countries’ own stability.

Outward spillovers are typically not systemic and therefore seldom covered. The focus and range of

issues to cover is somewhat different from those in more developed economies, reflecting LICs’

specific circumstances. Issues include:

Vulnerability to adverse shocks. Many LICs have narrow export bases, low productivity growth,

heavy reliance on foreign aid and thin buffers. This leaves them vulnerable to adverse external

shocks such as commodity price shocks, natural disasters, and growth shocks in partner countries.

10

Judgment is required to assess whether a country’s policies are sufficiently powerful to affect global stability.

Outward spillovers are deemed significant if by themselves, or in combination with spillovers from other members’

policies, or through their regional impact, they would enter the macrofinancial policy considerations of members

representing a significant portion of the global economy.

11

In other cases, the staff can discuss outward spillovers unless the authorities object.

12

Members are only obliged to change their policies for the promotion of their own stability. Where there is a

conflict between domestic policies needed to promote a member’s own stability and those needed to minimize

outward spillovers, the member’s own stability should take precedence.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

10 INTERNATIONAL MONETARY FUND

Debt sustainability. Close attention to debt vulnerabilities, and in depth discussion of policies

and debt management can help avoid debt distress, in particular for highly indebted LICs.

Structural issues. Job creation and growth are at the center of surveillance in LICs, with a

particular focus on sectoral policies to alleviate structural bottlenecks.

Shallow financial markets. Apart from frontier markets, LICs financial markets are thin and not

integrated into international capital markets. Thus, macrofinancial surveillance is geared towards

financial deepening and strengthening supervisory and regulatory capacity.

Macro-critical social issues such as poverty reduction, economic inclusion, human capital

development and macro-critical governance issues should receive particular attention.

12. Article IVs should discuss capacity limitations and capacity development activities as

relevant. In many LICs, institutions and administrative capacity are weak and there are issues with

data quality and availability (data dissemination). These factors limit the range of policies that can be

implemented and impede the pace of reforms. Policy advice should account for such constraints,

and as needed, staff could discuss progress with capacity development activities in macro-critical

areas, in collaboration with ICD and departments providing TA. Collaboration with the World Bank

and other development agencies is paramount, as core expertise in most topics relevant for LICs is

housed in these institutions.

Surveillance in Small States

13. Article IVs in small developing states (SDS) should also be tailored to their particular

circumstances (See Box 3). These countries are often vulnerable to external shocks due to narrow

production and expert basis, reliance on trade tax revenues, frequent natural disasters. Many of

them have pegged or heavily managed exchange rates, limiting their ability to adjust to shocks.

Fund surveillance can usefully focus on issues such as growth and job creation, measures to

strengthen resilience, competitiveness, policies to promote fiscal and debt sustainability, and

initiatives to strengthen the financial sector.

Surveillance in Members with Fund-Supported Programs

14. Article IVs in program countries address the same issues as other cases—i.e., the

contribution of policies to the country’s own and global stability. Article IV consultations in

countries with Fund-supported programs provide an opportunity to step back from the near-term

program needs and take a fresh look at the member’s longer-term needs and desirable policies.

Article IV coverage should deal with all relevant issues, particularly critical medium- or longer-term

policy issues, and draw on the findings of the most recent Ex-Post Assessment (EPA) or Ex-Post

Evaluation of Exceptional Access Arrangement (EPE) if available.

Surveillance in Currency Unions

15. Members’ obligations are unaffected by their devolution of authority over a subset of

economic policies (i.e., monetary policy) to the union.

13

Surveillance in currency unions also

13

See Fund Surveillance Over Members of Currency Unions and Biennial Review of the Implementation of the Fund’s

Surveillance and of the 1977 Surveillance Decision—Overview (see Annex II).

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 11

requires discussions with the regional institutions responsible for devolved policies in order to

provide context for bilateral discussions with individual members. The Article IV plays an important

role in helping to integrate country-level and union-wide surveillance. See Annex II for more details.

Box 3. Surveillance in Small Developing States

1/

Owing to their size and frequent exposure to natural disasters, small developing states (SDS) do not

benefit from economies of scale, are very vulnerable to external shocks, and experience higher

macroeconomic volatility. The lack of economies of scale hampers the provision of public goods and

services, including key public infrastructure, despite high ratios of public spending and debt to GDP in a

number of SDS. Hence, many SDS lack competitiveness, have narrow production and export bases, and rely

heavily on imports and trade tax revenue, making them vulnerable to external shocks. SDSs are also severely

affected by emigration, natural disasters, and climate change, and are more likely than other members to be

in fragile situations. Most SDS have pegged or heavily managed exchange rates, which limits their ability to

adjust to shocks. Their non-bank financial sector tends to be large whereas financial systems are shallow and

vulnerable, with high NPLs, poor asset quality, heavy lending to the public sector; and generally weak

supervisory and regulatory institutions.

In light of these common challenges, policy dialogue with SDS would add value if it focuses on five

priority areas (G.R.O.W.T.H.):

2/

Growth and job creation. The effects of macroeconomic policies, migration, and remittances on GDP

growth and employment, sectoral issues, the private sector contribution, and labor market structure are all

core issues. Surveillance should discuss gross national income (GNI), which may differ from GDP if many

sectors are foreign-owned.

Resilience to shocks. Staff should discuss risks, including from supply and terms of trade shocks, and

transmission channels. The availability of insurance mechanisms: self-insurance (fiscal and external buffers),

external insurance

3/

and pass-through to the private sector to strengthen resilience are also important.

Overall competitiveness. Analysis and advice should cover the desirability and feasibility of exchange rate

adjustment or internal devaluation, structural inefficiencies, and regional initiatives to improve

competitiveness.

Workable fiscal and debt sustainability options. Advice should include policies to strengthen fiscal

frameworks and sustain fiscal consolidation to address heavy debt burdens, complemented with structural

reforms, supporting policies, or debt restructuring if necessary.

Thin financial sectors. Staff should discuss policies for deeper and more competitive financial sectors, as

well as measures to strengthen supervision and regulation. The roles of the public sector and non-bank

financial institutions should be accounted for.

Analysis and advice need to be tailored to country specifics. SDS are heterogeneous. For example, Pacific

Island SDSs are less prone to public debt sustainability issues than those in the Caribbean, but usually have

lower growth and per capita incomes, and are more reliant on aid. Surveillance should be tailored

accordingly. In particular, for SDS in fragile situations staff should draw on the Guidance Note on the Fund’s

Engagement with Countries in Fragile Situations.

_________________________________________________

1/

Small states are countries with a population of fewer than 1.5 million. The Fund membership includes 42 small states, of

which 33 are developing countries.

2/

See the IMF Board Paper, Macroeconomic Issues in Small States and Implications for Fund Engagement, and the Staff

Guidance Note on the Fund’s Engagement with Small Developing States.

3/

Examples include sovereign insurance mechanisms (e.g., the Caribbean Catastrophe Risk Insurance Facility and the

Pacific Catastrophe Risk Insurance Pilot Program), International Financial Institutions and aid.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

12 INTERNATIONAL MONETARY FUND

III. OPERATIONAL GUIDANCE—KEY ISSUES

16. This section provides guidance on the key operational areas to be covered in Article IV

consultations. The topics discussed below are intended to help staff in the conduct of surveillance; their

actual coverage, including in staff reports, reflects staff’s judgment on what issues are the most

important for stability given the country circumstances. The section does not cover all areas in the same

depth, as the thinking in some policy areas, e.g., monetary policy and structural issues is evolving.

17. Interactions across sectors are vital for surveillance, and teams should be mindful of

the consistency of the policy mix. The effectiveness of each policy area depends on the stance of

other policies. A thematic approach —i.e., organizing the staff report around major economic goals

or challenges—can help to prioritize and tailor the depth of coverage in the key operational areas

and ensure consistency of the policy advice, while observing the requirements of Article IV

consultation coverage. Teams should explain the rationale for the chosen themes relative to stability

concerns and, as necessary, explain briefly why other issues are assessed to be less important.

A. Risks and Spillovers

18. Risk and spillover analysis is critical for assessing domestic and global stability. Risk

analysis involves identifying domestic and external risks, and assessing their probability and likely

impact, both domestically and spillovers to other countries. Given the role of surveillance, the Fund’s

spillover work focuses on spillovers with adverse impact (see Box 4).

14

In addition to covering risks

(or potential spillovers), Article IVs should also cover actual spillovers, such as how current policies in

other countries are affecting medium-term baseline projections.

Risk Assessment

19. Article IV consultations should include a well-articulated risk assessment tailored to

country circumstances and integrated throughout the staff report. Staff identifies the key risks,

both those around the baseline and tail risks, and discusses them in depth with the authorities. The

risk assessment should assess the probability of risks materializing, keeping in mind that risks could

be correlated, and their likely impact, drawing on a thorough analysis of the transmission channels.

The risk assessment should motivate policy discussions: where feasible, staff should propose actions

to lower the probability of risks materializing or to mitigate their impact if they materialize

(insurance), and suggest possible contingent actions (contingency planning). The key points of the

risk assessment should be recalled in the staff appraisal, and staff is strongly encouraged to

summarize their assessment in a customized Risk Assessment Matrix (RAM) (see Box 5).

20. The risk assessment should be based on an evaluation of vulnerabilities, the external

environment and domestic developments:

14

Article IVs can also cover positive spillovers.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 13

Vulnerabilities represent weak economic and financial fundamentals which, if unaddressed,

could interact with state-contingent risks to stability.

External risks. The assessment of external risks should be guided by the Global Risk Assessment

Matrix (G-RAM) and area departments’ views on regional risks (see below). External risks

comprise also those arising from shocks from another country (and not necessarily within the

region). Staff needs to identify these risks, if they would not feature in the G-RAM or regional

risks.

Domestic risks should include major economic and financial risks, including the risk that

policies are not fully implemented, as well as political risks, where relevant.

Box 4. Risks and Spillovers: Key Concepts

Risks are potential shocks that have some probability of materializing with an impact on

macroeconomic or financial conditions in a country or across countries. They can be domestic or

external, and related to exogenous or policy shocks.

Linkages refer to the links between sectors within an individual economy or across countries, which can

act as transmission channels for shocks.

Spillovers refer to the cross-border transmission of shocks. These can be global or affect one or more

countries, and occur through a variety of channels. Spillovers can arise from exogenous shocks or,

importantly, a country’s actual or potential policies (policy spillover—see below). The impact of spillovers

depends on the size and nature of the underlying shocks and of the transmission channels associated

with macroeconomic and financial cross-border linkages.

The analysis of inward spillovers involves evaluating the channels through which external shocks affect

a country and quantifying their impact. It covers actual spillovers and potential spillovers. The former is

when risks have already materialized (as “shocks”) or policies adopted, allowing the spillovers through

the different channels to be observed and estimated directly. Potential spillovers correspond to risks

that have not yet materialized or prospective policies.

Policy spillovers. The Fund has focused on identifying policies that generate spillovers. This helps

increase the awareness in “source” countries of the impact of their policies on others, which can

facilitate policy cooperation.

Spillbacks are a special case of spillovers where one country’s outward spillovers affect a number of

other countries, whose economic situation deteriorates, leading to adverse feedback effects

(“spillbacks”) on the source country.

21. In cases where one or a combination of risks (external or domestic) could have a

material impact on the economic outlook, staff could prepare alternative quantified risk

scenarios. Such scenarios can shed greater light on the transmission channels and impact of risks,

and the trade-offs that would materialize, helping inform policy advice. Scenarios based on global

risks should be based on the G-RAM to help ensure consistency.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

14 INTERNATIONAL MONETARY FUND

Box 5. The Risk Assessment Matrix

Staff is strongly encouraged to use a Risk Assessment Matrix (RAM) which provides a structured framework

for analyzing risks and their possible impact. RAMs cover major global, regional, or country-specific

macroeconomic, financial sector and geopolitical risks, as well as risks to implementation. RAMs include:

(i) key risks that could materially alter the baseline path; (ii) the team’s assessment of the relative likelihood

of realization of each risk, and (iii) an assessment of the economic impact should these risks materialize;

While the design of the RAM is flexible and staff is encouraged to innovate, to ensure consistency of global

risks across Fund products, these should always be drawn from the Global Risk Assessment Matrix (G-RAM).

The G-RAM lists key global and regional risks, and associates a broad probability of realization to each

(low-medium-high). The G-RAM is updated regularly to provide an up-to-date and consistent set of risks

around the staff’s baseline forecasts, and can be shared confidentially with country authorities. The RAM is

expected to be updated to reflect regular and ad-hoc updates to the G-RAM, and its wording and the

ratings should be consistent with the G-RAM.

There is a strong presumption that the RAM will be shown to country authorities as a basis for a discussion

of risks during the mission, and only in exceptional circumstances where it would be deemed unhelpful

should staff not do so. RAMs are required in Policy Notes, and there is a preference for including RAMs in

Article IV staff reports to help provide a deep and meaningful discussion of risks. However, mission chiefs

may, at their discretion, opt out when they feel that the downsides outweigh the benefits. Such a choice

should be the exception rather than the rule, and well justified on a case-by-case basis. Staff Reports without

RAMs are expected to provide a deeper and more meaningful discussion of risks in the main text to ensure

they meet the required standard. If a RAM is not included, this needs to be flagged explicitly to

management in the cover note along with the rationale for not doing so.

In general, RAMs should reflect staff views at the time of the policy note. Staff may update the RAM during

or after the mission if warranted by discussions with the authorities, G-RAM updates and other material

events, but revisions are not required for relatively minor changes. Changes should be communicated to the

authorities and their views should be sought, except if it would be deemed unhelpful. When warranted,

revisions to the RAM can be undertaken right up to the Executive Board meeting by issuing a staff

supplement.

Inward Spillovers

22. In addition to covering external risks (i.e., potential inward spillovers), surveillance should

assess actual inward spillovers in all cases. This is the assessment of how a country is, or might be,

affected by developments and policy actions in other countries and in global markets. This involves

incorporating into the baseline projections for the country the macroeconomic projections and global

market trends identified in the World Economic Outlook (WEO) assumptions and the Global Financial

Stability Report (GFSR), and in occasional interim updates of certain indicators.

23. The analysis of inward spillovers (both potential and actual) requires a thorough

understanding of the channels for inward spillovers for a country (e.g., trade, links through the

banking system and financial markets, FDI, corporate borrowing, commodity prices, etc.). It involves

evaluating the channels through which external developments, policies, or shocks affect a country and

to the extent possible quantifying their impact. The main issues to explore include:

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 15

What are the main vulnerabilities that can be amplified by spillovers? How might inward spillovers

affect domestic or BOP stability?

How are inward spillovers influenced by evolving global market conditions?

What should be the policy responses to inward spillovers? Is the policy framework appropriate to

address these spillovers? Discuss specific policy options to mitigate the impact of negative spillovers

before they occur and to mitigate their impact if they materialize.

Outward Spillovers and Spillbacks

24. In cases where economies have systemic outward spillovers,

15

the analysis should be fully

integrated into staff’s assessment of the current conjuncture, policy discussions and staff

appraisal. While analysis of negative spillovers is required, staff may also discuss positive spillovers from

policies. Model-based scenario analysis can help sharpen outward spillover analysis—of both potential

and actual policies. The following questions can help the analysis of outward spillovers:

What are the most significant outward spillovers from the authorities’ current or prospective policies?

Do these promote the country’s own stability? Do they have a systemic impact?

Does the country suffer from large vulnerabilities? If so, is it pursuing policies that could have adverse

impacts on other countries?

What are the channels of transmission?

What are the possible alternative policies that would reduce outward spillovers while ensuring

domestic or balance of payments stability?

25. Outward spillovers can have “spillback” effects. Spillbacks are a special case of spillovers

where, one country’s outward spillovers affect a number of other countries, triggering adverse feedback

effects on the source country. Discussing actual and potential spillbacks can deepen spillover analysis

and strengthen the traction of policy advice on outward spillovers, particularly when policies generating

the initial spillovers are promoting the source country’s stability. Spillbacks are often underestimated as

they tend to occur through channels missing from models or through feedback channels that are

inadequately captured due to their complexity, e.g., in the financial sector. The main issues are as

follows:

Do outward spillovers from the country have significant global, regional or bilateral effects that may in

turn influence the source country?

What are the channels of transmission?

What are the main vulnerabilities that could be affected by spillbacks?

Which alternative policies could dampen the impact of outward spillovers and/or spillbacks?

15

See Section II on the Scope of Surveillance for a discussion of the circumstances under which outward spillover

analysis is required in Article IVs

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

16 INTERNATIONAL MONETARY FUND

Box 6. Techniques for Risk and Spillover Analysis

Quantification of risk assessment and spillover analysis in staff reports are strongly encouraged, while

acknowledging potential limitations. The more rigorous analysis from models and quantitative techniques

needs to be accompanied by a deeper understanding of their limitations and whether they fail to capture

some spillover channels. Staff should leverage these general tools by tailoring them to country circumstances

with more transparency on their key features and limitations. However, risks and spillovers that do not lend

themselves to formal modeling or are hampered by data gaps, should be assessed by informed judgment.

Several products and processes have been put in place in order to support Article IV surveillance with

a coordinated analysis of risks and spillovers. Vulnerability Exercises, the Early Warning Exercise and other

multilateral surveillance can be drawn upon for a variety of quantitative and qualitative information inputs.

The downside scenarios in the World Economic Outlook and the Global Financial Stability Report, and the

fiscal vulnerability indicators in the Fiscal Monitor, can help design quantified scenarios. Where appropriate,

staff should draw on the External Sector Report and Spillover Reports. Regional Economic Outlooks and

cluster reports could be used to bridge the analysis between multilateral and bilateral products.

Staff is encouraged to expand the use of the Fund’s existing analytical toolkit for risks and spillovers

in Article IV consultations but be mindful of their limitations.

1/

The modeling toolkit includes:

Multi-country structural models. Various specifications of Dynamic Stochastic General Equilibrium (DSGE)

models;

Global Vector Auto Regression (GVAR) models. They can be estimated quickly including for groups of

countries not covered by the structural macro models. They also provide the flexibility to vary the choice

of variables to incorporate spillover channels not adequately captured in structural models;

Indicator-based models to identify thresholds for indicators where risks become elevated, e.g., used in

the Vulnerability Exercises;

Bank stress tests used to quantify macrofinancial linkages and the soundness of the banking sector.

Network analysis and liquidity tools. Simple spreadsheet-based tools are available to assess key liquidity

risk concepts such as the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR).

Sensitivity analyses e.g., for commodity exporters to assess the impact of commodity price changes.

The balance sheet approach (BSA)—where data are available—allows surveillance to better capture

major risks stemming from gross capital flows as well as vulnerabilities in specific sectors (i.e., from

high leverage, and currency or liquidity mismatches). A BSA matrix can be used monitor gross assets and

liabilities positions of the main sectors—government, financial sector, non-financial (e.g., corporates and

households) and non-residents—broken down by currency and maturity. It captures claims across sectors

and, thus, can be used to assess the transmission of shocks between sectors. National balance sheets can

now be constructed and used for scenario analysis in a significant number of countries. Complete balance

sheet matrices can be constructed for countries that report all the balance sheet data requested in Fund

templates, while partial balance sheets are available for many other countries.

__________________________________________________

1/

Practical applications of many of these tools were covered in a seminar in March 2014.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 17

Tools and Techniques

26. Risk assessment and spillover analysis involve an eclectic approach, integrating results

across surveillance products, drawing from a range of analytical tools, and applying judgment as

needed. Quantification of risks and spillover analysis are encouraged in staff reports to provide

rigorous, consistent analysis (see Box 6 for techniques). In particular, staff reports should strive to

include alternative quantified risks scenarios in countries where one or a combination of risks (external

or domestic) could have a material impact on the economic outlook. The usage of models and

quantitative techniques needs to be accompanied by a deeper understanding of their limitations and

whether they fail to capture some spillover channels. The communication of the risk assessment and

spillover analysis results should be complemented by acknowledging the limitations of the

methodology as needed. Staff should leverage such general tools by adapting them to better fit country

circumstances, while being transparent about their key features and limitations. However, those risks

and spillovers that do not lend themselves to formal modeling or where analysis is hampered by data

gaps need to be assessed by informed judgment.

B. Fiscal Policy

27. Appropriate fiscal policy is vital to maintain a country’s domestic and balance of

payment stability, and often global stability. Threats to stability can result directly from fiscal

policy missteps. Equally important, fiscal policy is often part of the policy mix to address macro-

critical challenges that are not necessarily directly related to public finances (e.g., slow growth, high

unemployment, and inequality).

28. Article IV should provide a clear bottom line on the state of public finances and fiscal

policies, and policy advice. This involves identifying vulnerabilities and challenges to stability,

assessing ongoing fiscal policy, and providing clear advice integrated into a policy mix. Trade-offs

(e.g., consolidation vs. supporting growth) and equity considerations will influence the design of

advice, depending on country circumstances.

Assessing the State of Public Finances and Fiscal Policy

29. The assessment of public finances should be broad based, drawing on indicators

chosen to diagnose key vulnerabilities. The assessment of initial conditions will rely on the most

relevant dimensions of public finances for the country. The medium-term outlook is shaped by

macroeconomic conditions and the authorities’ planned policies, including growth friendliness and

the equity of fiscal consolidation. Where feasible, staff should focus on general government or an

even broader definition of the public sector, rather than central government, to ensure coverage of

a full range of fiscal developments.

16

Coverage could include:

16

The statistical issues annex should discuss cases where general government data are unavailable. See also the

Board paper, Review of the Implementation of Government Finance Statistics to Strengthen Fiscal Analysis.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

18 INTERNATIONAL MONETARY FUND

Fiscal policy stance (expansionary, neutral, or contractionary) along the cycle (procyclical or

countercyclical), with a discussion of its appropriateness. The assessment will preferably be

based on a measure of the fiscal balance that strips out cyclical, one-off, or other relevant

factors (e.g., structural balance,

17

balance net of revenue from non-renewable resources, or

primary balance) in addition to the overall fiscal balance. The choice of indicators will be guided

by country circumstances, and operational and data constraints, taking into account the

significant analytical challenges involved in estimating structural balances.

Composition of expenditure and revenue. Both the aggregate expenditure-revenue mix and

the composition of each individual dimension are relevant. Focusing on the efficiency of

spending rather than the mix of current and capital expenditures can help assess if expenditure

policy supports growth, equity, and other objectives.

18

Similarly, the tax burden and design of tax

policies influence economic behaviors and dynamics.

19

Financing needs, accounting notably for the fiscal position, debt service, market access, and

risks. Liquidity strains can also have an impact on fiscal sustainability. In this context, staff should

also monitor any domestic arrears, including to assess their impact on corporate sector liquidity

and the health of bank loan portfolios.

Fiscal sustainability, informed by a public debt sustainability analysis (DSA) that accounts

comprehensively for risks, including external risks. Where data are available, assessing public

sector net worth using balance sheet analysis would allow broader coverage and help capture

the evolution of overall risks to the balance sheet.

20

Vulnerabilities, including financing needs

(with focus not only on amounts but also debt rollover and structure), the adequacy of fiscal

buffers, long-term spending pressures (e.g., health care, pensions and education), and threats to

revenue collection (e.g., demographic trends, migration, growth outlook, and international tax

arbitrage) are also relevant for assessing sustainability.

Fiscal risks, notably macroeconomic uncertainty, statistical revisions, contingent liabilities (from

public and publicly-guaranteed loans, public-private partnerships (PPPs), and the financial

sector), policy implementation, and feedback loops between the financial, private, and public

sectors.

17

The cyclically-adjusted balance is the difference between the overall balance and the automatic response of fiscal

variables to changes in output, called automatic stabilizers. Some structural balances account for factors beyond the

business cycle, including for example credit booms and asset price cycles (housing, stock markets). Estimating the

structural balance can be challenging because of operational and data constraints (Bornhorst and others, 2011).

FAD’s webpage features templates to estimate structural fiscal balances.

18

See IMF pamphlet No. 48.

19

See the IMF pamphlet No. 55.

20

The SPR‘s debt policy webpage includes DSA templates and operational guidance on how to conduct a DSA. For

market access countries, staff should use the Market Access Country (MAC) DSA template, which captures a wide

range of risks. For Poverty Reduction Growth Trust (PRGT)-eligible countries, staff should generally use the LIC DSA

template.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 19

Principles for Fiscal Policy Advice

30. Fiscal policy advice should be well-articulated, and targeted to country circumstances.

Staff should discuss short- and medium-term fiscal policy objectives, acknowledging and where

possible reconciling inconsistencies, and explain how their advice will address identified challenges.

Advice would:

be articulated around a well-justified anchor, which can be specified in terms of levels (e.g.,

fiscal balance, debt stock) or changes (e.g., a recommended amount of adjustment). The

underlying indicator would preferably be cyclically-adjusted where relevant and correspond to

key vulnerabilities and challenges.

determine the size and pace of proposed fiscal measures. These will depend on initial

conditions including the state and composition of public finances, domestic and global

macroeconomic conditions, the type of measures (stimulus or consolidation), available fiscal

buffers or ‘space,’

21

risks and tradeoffs between short-term cyclical and medium-term

sustainability objectives, and the size and persistence of fiscal multipliers.

22

Other important

factors such as timeliness and the pros and cons of frontloading could also be discussed, in

particular during consolidation.

23

be as specific as possible, discussing the role of automatic stabilizers and the composition

of proposed discretionary measures, where relevant. The design of discretionary measures

will normally depend on the size of automatic stabilizers. Where relevant, staff could analyze

automatic stabilizers and discuss if they should be allowed to operate freely or be modified.

Discretionary measures should be specific and well-motivated, appropriately balancing revenue

and expenditure measures, and the mix of permanent and temporary measures. Criteria to

consider include initial conditions, the size of adjustment, efficiency considerations, equity,

growth, and long-term challenges.

31. Fiscal policy outcomes reflect interactions with other policies. For instance, the size and

persistence of fiscal multipliers during expansions in advanced economies are higher when

monetary policy is accommodative. Therefore, effective policy design would entail ensuring

consistency in the policy mix, by accounting for the impacts of other policies on fiscal policy

outcomes and vice versa, especially in countries where monetary policy has reached the zero lower

21

There is no universally accepted definition of fiscal space (see Fiscal Monitor, October 2012, Box 1). Recent IMF

research papers define fiscal space as the distance between the current or projected debt ratio and the debt limit

above which the country loses market access (Ostry and others, 2010; Ghosh and others, 2013). The ratio of debt-to-

revenue is sometimes used as a simple measure of fiscal space.

22

Multipliers are typically larger in downturns than in booms. There are also larger for expenditure than for revenue

measures, and depend on country characteristics including monetary policy stance, zero-lower bound, financial

systems effectiveness, and economic classification.

23

See IMF Board paper, Reassessing the Role and Modalities of Fiscal Policy in Advanced Economies and the informal

guidance on fiscal consolidation.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

20 INTERNATIONAL MONETARY FUND

bound, or financial markets are impaired.

24

Using a thematic approach throughout the report can

facilitate integration.

32. Political economy considerations, as well as operational and implementation

constraints will influence the feasibility of fiscal policy advice. Measures that are practical,

feasible, and backed by analytical evidence or lessons from cross-country experience can help build

traction. Advice on implementation, including the timing of implementation and withdrawal as well

as mitigating measures could help build public support and avoid reversal of unpopular policies.

This is particularly relevant for subsidy and benefit cuts, or tax increases during downturns. Advice

could also cover alternative policies to implement if risks materialize, such as devoting revenue

windfalls to public investment.

Structural and Institutional Issues

33. Article IVs should discuss fiscal institutions where relevant, and take these into

account when designing fiscal policy advice. Well-designed fiscal institutions can promote

credibility and sustainability, enhance transparency and controls, help assess risks, and ensure

appropriate use of public resources.

25, 26

However, they could also impede effectiveness if not

properly designed. For example, fiscal rules based on nominal variables and non-cyclically adjusted

indicators could prove procyclical, hampering the authorities’ ability to respond effectively to

adverse shocks. At the same time, such rules need to be simple and transparent to serve as effective

instruments of communication for government policy objectives. Staff should discuss the quality of

fiscal institutions, as well as their ability to deliver on the fiscal policy agenda, and role in supporting

policy objectives. Advice on how to improve the effectiveness of institutions could build on TA

findings, where relevant.

34. Surveillance should cover fiscal structural issues and discuss how fiscal policy could

support other structural objectives, to the extent they satisfy criteria defined in Section E. Building

on technical assistance, staff could provide advice in areas such as public financial management

(PFM),

27

tax policy and revenue administration, natural resource management, and reforms to

24

See the Staff Discussion Note, Fiscal Multipliers (Spilimbergo and others, 2009).

25

For example, medium-term budget frameworks and fiscal rules are useful in fostering discipline, while allowing

flexibility to cyclical conditions and exceptional circumstances (e.g., through escape clauses) and accounting for fiscal

decentralization. By intervening at various stages of policymaking, including at the planning and policy-formulation

stage, fiscal councils promote sound fiscal policies and sustainable public finances through influence and persuasion.

Other legal frameworks such as the Fiscal Transparency Code facilitate the diagnosis of vulnerabilities. See the IMF

papers Fiscal Rules—Anchoring Expectations for Sustainable Public Finances, Function and Impact of Fiscal Councils,

Reassessing the Role and Modalities of Fiscal Policy in Advanced Economies, and Fiscal Frameworks for Resource

Rich Developing Countries.

26

Fiscal transparency—the comprehensiveness, clarity, reliability, timeliness, and relevance of public reporting on the

public finances—is critical for effective fiscal management and accountability. The IMF’s Fiscal Transparency Code, is

the international standard for disclosure of information about public finances.

27

In this context, staff should encourage the authorities to clear any domestic payment arrears.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 21

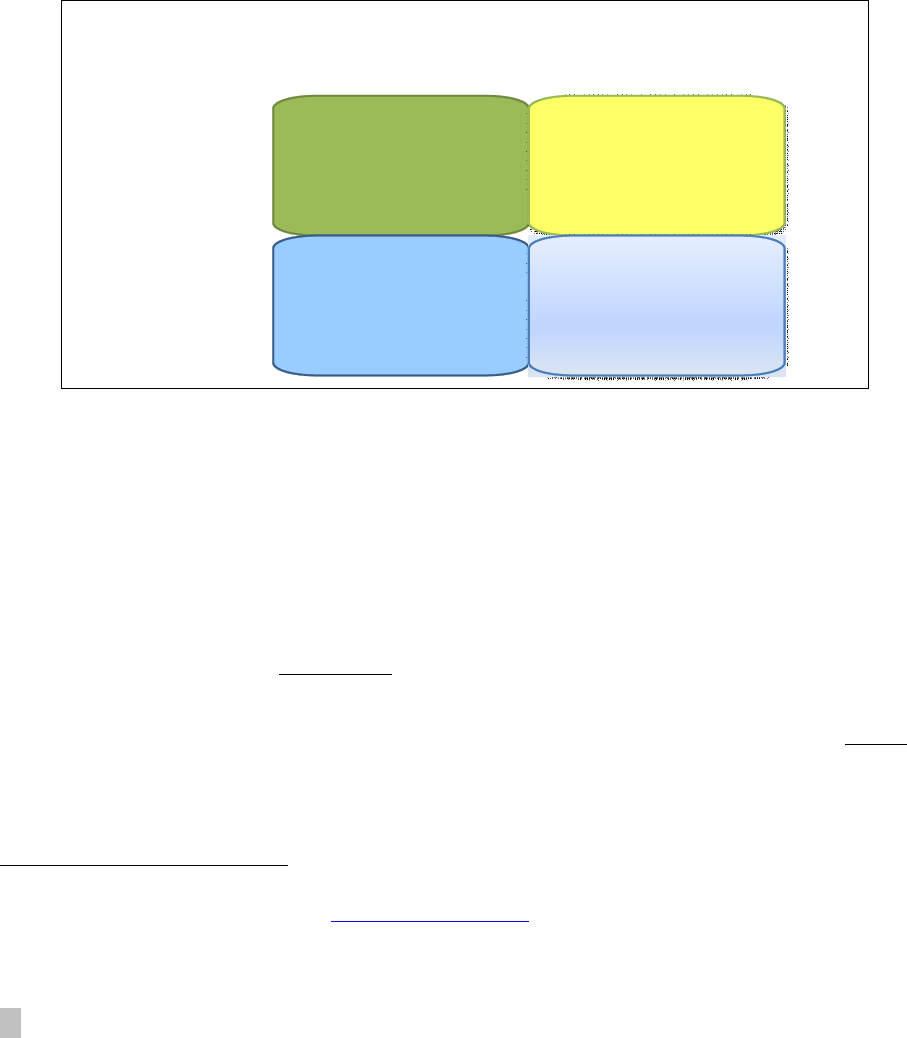

Financial System Macroeconomy

Analysis of Macro-

Financial Linkages

Systemic Risk

Analysis

Macro-Financial Analysis

energy subsidies, pensions and public health care. Staff could also draw on operational guidance on

the contribution of fiscal measures in areas such as low growth, unemployment, inequality, and

gender.

28

Issues for LICs

35. Fiscal policy advice in LICs could discuss the following issues, in addition to other

issues of relevance for all countries:

29

Preserving or rebuilding buffers, while supporting potential growth.

Ensuring that enough resources are devoted to poverty-reducing spending and productive

investment; improving budget execution and PFM.

Improving revenue collection, notably by broadening the tax base.

Strengthening the management of natural resources where relevant, including through

reforming the mining code to ensure proper taxation and fostering transparency in managing

revenue from non-renewable resource.

Managing financing constraints, notably making sure that public financing needs do not crowd

out private sector needs.

C. Macrofinancial Analysis and Monetary Policy

36. A lesson of the global financial crisis is that surveillance of macrofinancial linkages and

of monetary policy often needs to be done in conjunction. The monetary transmission

mechanism has changed markedly in many countries

due to developments in the financial system

(e.g., banking system weaknesses), making it

necessary to analyze macrofinancial linkages when

assessing the impact of monetary policy. The analysis

of the policy framework (e.g., inflation targeting) and

monetary operations remains central; but, unless the

financial system is functioning well, its conditions

need to be taken into account when assessing

monetary transmission. This section first discusses

macrofinancial analysis then turns to monetary policy.

37. Macrofinancial Analysis (MFA) should be an integral part of Article IV surveillance—

both in baseline and risk scenarios. This involves a fully integrated analysis of macrofinancial

28

See IMF papers, Fiscal Policy and Employment in Advanced and Emerging Economies, Energy Subsidy Reform-

Lessons and Implications, The Challenge of Public Pension Reform in Advanced and Emerging Economies, Macro-

Fiscal Implications of Health Care Reform in Advanced and Emerging Economies, Fiscal Policy and Income Inequality,

Fiscal Frameworks for Resource Rich Developing Countries.

29

While these issues are typical for LICs, they could also be relevant for some emerging or advanced economies.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

22 INTERNATIONAL MONETARY FUND

linkages and systemic risk. These two dimensions of surveillance need to be conducted jointly as

they represent different sides of a dynamic feedback loop that links the financial system and

macroeconomy. The analysis of macrofinancial linkages assesses how financial conditions affect the

medium-term baseline outlook, while the analysis of systemic risk covers linkages in the other

direction as the functioning of the financial system is impacted by macroeconomic developments,

external shocks or disruptions originating in the system itself. The latter involves assessing the

health of the financial sector and its capacity to provide financing needed to support economic

growth in the baseline via credit or capital markets.

Macrofinancial Analysis in the Baseline

38. MFA assesses the consistency between financial conditions and the baseline

macroeconomic outlook. It evaluates how effectively the financial system finances economic

growth, by providing credit or through the capital markets, and the consequences for the baseline

outlook if this financing fails to materialize or proves excessive. This analysis can also cover how

financial deepening contributes to economic growth over a longer time horizon and the

effectiveness of macroeconomic policies (i.e., by improving the monetary transmission mechanism

and fiscal-financing conditions).

39. Article IV surveillance of the macrofinancial baseline should be guided by key

questions:

What are the key macro and financial trends and how are they related? And, to what extent do

financial conditions drive macro trends?

Is the quantified baseline for the real and financial sectors likely to be internally consistent both in

the short run and over the medium term? In particular, are credit projections consistent with

growth projections? And, are the financing needs of corporates, households, and the public sector

in line with the financial sector’s capacity to meet them? How might the system adjust to bring

about consistency? And, could this affect the baseline?

What are the key financial factors affecting macroeconomic stability? And, does the functioning of

the financial system exacerbate macroeconomic instability?

Do financial conditions weaken or alter the effectiveness of macro policy?

How do financial conditions affect medium-term growth prospects?

40. Where data are available, staff can assess the consistency of the outlook and financing

conditions. This involves an analysis of financing sources and uses, which builds on the Fund’s

macro framework. First, the net financing needs of each sector—corporate (for investment),

households (if any, i.e., for real estate), and government—needed to achieve the growth outlook are

estimated. Then, the availability of this financing through bank credit and capital markets, either

domestically or from abroad, drawing on an analysis of balance sheet vulnerabilities. An

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 23

inconsistency between the outlook and financing can arise when, for example, banks are

deleveraging or access to external financing is limited.

41. Staff’s views can be informed by an assessment of the country’s position in the

‘financial cycle’ and the risk that entails.

30

The term “financial cycle” is used in this note to signify

the level and evolution of slack (or excess) in the financial sector. Staff can attempt to gauge a

country’s position in the cycle by comparing credit to its expected level, and by examining

developments in indicators such as asset prices and risk appetite. This can help inform whether

developments are consistent with stability, or conversely whether risks are growing—either of an

excessive buildup of systemic risk, or a damaging credit crunch. Staff could use this analysis to

examine whether, for example, the banking system is under exceptional deleveraging pressures to

contract credit—or, conversely, driving a credit boom where risks are underpriced and building.

31

Similarly, do domestic capital markets

32

provide financing—and price risk properly; or are there

impediments to the efficient functioning of these markets that constrain financing?

Systemic Risk Analysis

42. Beyond the baseline, systemic risk analysis is the identification and quantification of

risks to the stability and functioning of the financial system. Systemic risk is the risk of

disruption in the provision of finance caused by an impairment of the financial system with serious

negative effects for the real economy. These are risks that can lead to a significant deviation from

the baseline and, in extremis, to a permanent shift in it. They are systemic in the sense that the

operation of the financial sector gives rise to adverse feedback effects that amplify the impact of

shocks (e.g., though the buildup in leverage, pro-cyclicality of bank credit and financing terms).

These amplification effects arise from linkages that can be assessed as part of surveillance. They

include both linkages across sectors, such as between the sovereign and banks, or across

systemically important banks where they create channels for contagion.

43. The systemic risk assessment should be guided by key questions:

What are the main sources of systemic risk? And, what could be their impact?

What are the external sources of risk and spillover channels through which they impact the

financial system? For highly interconnected economies, what is the potential for outward spillovers

to other economies?

How resilient is the financial sector to risks that materialize? And, are there significant weaknesses

in financial oversight and/or infrastructure that increase its vulnerability?

30

The notion of a financial cycle, independent from the business cycle, is becoming more frequently used, although

is not yet universally accepted. See The financial cycle and macroeconomics: What have we learnt?

31

See IMF SDN: Policies for Macrofinancial Stability: How to Deal with Credit Booms

32

This could cover domestic securities markets and direct financing from non-bank financial institutions such as

leasing or factoring companies.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

24 INTERNATIONAL MONETARY FUND

What are the linkages among financial institutions and markets? Could they give rise to

contagion? And, are specific institutions systemically important and in need of closer monitoring?

44. Systemic risks analysis should cover all significant parts of the financial sector. This

always includes the banking system and the non-bank financial sector when it is large or

interconnected enough to be systemic. Foreign-owned financial institutions often need to be

analyzed separately from domestic ones, owing to their recourse to capital and funding from their

parents, particularly because these cross-border linkages represent potential spillover channels for

external sources of risk. Finally, risks originating in financial markets need to be assessed, including

whether asset prices appear not to be fairly valued.

45. When analyzing systemic risk, it is important to:

Analyze balance sheet risks and fragility by assessing the adequacy of the system’s capital

and liquidity, asset quality, the main risk exposures and linkages among sector balance sheets.

This should seek to identify vulnerabilities from excessive leverage, maturity and currency

mismatches, and how risks are transmitted from one sector to others and the broader economy

through these linkages. This analysis of aggregated balance sheets may need to be

supplemented by scrutiny of risk concentrations in individual markets or banks using micro data.

Teams can also use Financial Soundness Indicators for this analysis if they need to assess the

reliability of the underlying data (i.e., to detect ‘evergreening’ or reliance on weak capital

instruments).

Identify the key credit and market risks and quantify their impact. Scenario analysis can

help trace out their impact on the banking sector were they to materialize. This would vary by

country—for example, in a dollarized economy more attention would need to be paid to indirect

credit risk in the event of a depreciation. Simple, spreadsheet-based tools are available to

conduct these basic stress tests that Article IV teams can adapt to conduct alternative scenarios.

Evaluate systemic liquidity risk through an analysis of funding structure. The aim is to

assess vulnerability to disruptions in domestic or external wholesale financing; and, where

confidence in banks is low, the potential for a deposit run. Where dollarization is high, this could

include the availability of liquidity in foreign currency, including from the central bank.

46. Systemic risk analysis can draw on a set of tools, many of which were developed for

the FSAP.

33

Recent FSAPs represent a valuable source of analysis that Article IV teams can draw on

and update, for example, by rerunning FSAP stress tests with more recent data. However, FSAPs

cannot substitute for Article IV financial surveillance given their narrower focus (i.e., on systemic risk)

and low frequency.

Policies to Contain Risks to Financial Stability

33

The vulnerability exercises are also a useful resource for systemic risk analysis.

GUIDANCE NOTE FOR SURVEILLANCE UNDER ARTICLE IV CONSULTATIONS

INTERNATIONAL MONETARY FUND 25

47. Well designed macroprudential policies can help limit systemic risk and reduce the

frequency and severity of financial crises.

34

They do so through three interrelated functions:

First, they seek to increase the resilience of the financial system to aggregate shocks, by building