STUDY MATERIAL

EXECUTIVE PROGRAMME

COST

COSTCOST

COST AND

AND AND

AND MANAGEMENT

MANAGEMENT MANAGEMENT

MANAGEMENT

ACCOUNTING

ACCOUNTINGACCOUNTING

ACCOUNTING

MODULE 1

PAPER 2

ICSI House, 22, Institutional Area, Lodi Road, New Delhi 110 003

tel 011-4534 1000, 4150 4444 fax +91-11-2462 6727

email info@icsi.edu website www.icsi.edu

© THE INSTITUTE OF COMPANY SECRETARIES OF INDIA

TIMING OF HEADQUARTERS

Monday to Friday

Office Timings – 9.00 A.M. to 5.30 P.M.

Public Dealing Timings

Without financial transactions – 9.30 A.M. to 5.00 P.M.

With financial transactions – 9.30 A.M. to 4.00 P.M.

Phones

4150444,45341000

Fax

011-24626727

Website

www.icsi.edu

E-mail

info@icsi.edu

Laser Typesetting by Delhi Computer Services, Dwarka, New Delhi, and

Printed at M.P.Printers/October, 2015/5000

EXECUTIVE PROGRAMME

COST AND MANAGEMENT ACCOUNTING

Finance and accounting have assumed much importance in today’s competitive world of business

wherein corporate organisations have to show the true and fair view of their financial position. Thus,

the application of accounting in the business sector has become an indispensable factor. Company

Secretary has to provide the complete and accurate information about the financial operations of the

company to management for decision making. This emphasises that the books of account are to be

maintained accurately, up-to-date and as per the norms.

The subject ‘Cost and Management Accounting’ is very important and useful for optimum

utilisation of existing resources. These are branches of accounting and had been developed due to

limitations of financial accounting. It is an indispensable discipline for corporate management, as the

information collected and presented to management based on cost and management accounting

techniques helps management to solve not only specific problems but also guides them in decision

making. Keeping in view the importance of this subject, various topics on Cost and Management

Accounting have been prescribed in the syllabus of CS Executive Programme with the objective of

acquainting the students with the basic concepts used in cost accounting and management

accounting having a bearing on managerial decision-making.

The entire paper has been discussed in twelve study lessons. In starting four study lessons we

have discussed about the basic of cost accounting, material, labour and overheads costing. Further

we have highlighted the concept of activity based costing, cost records, different costing systems.

Thereafter study focuses on the marginal costing, standard costing, budgeting & its applications for

decision making in business. At last we have discussed about cost accounting records, cost audit and

analysis & interpretation of financial statements.

In this study every efforts has been made to give a comprehensive coverage of all the topics

relevant to the subject. In all study lessons the requisite theoretical framework for understanding the

practical problems in the subject has been explained and wherever necessary practical illustrations

have been given to facilitate better understanding. At the end of each study lesson a brief about the

lesson have been given under the caption ‘Lesson Round Up’ as well a good blend of theoretical and

practical questions have been given under the caption ‘Self Test Questions’ for the practice of

students to test their knowledge. In fact, this being a practical paper, students need to have good

theoretical knowledge and practice to attain the requisite proficiency and confidence.

This study material has been published to aid the students in preparing for the Cost and

Management Accounting paper of the CS Executive Programme. It is part of the education kit and

takes the students step by step through each phase of preparation stressing key concepts, pointers

and procedures. Company Secretaryship being a professional course, the examination standards are

set very high, with emphasis on knowledge of concepts, applications, procedures and case laws, for

which sole reliance on the contents of this study material may not be enough.

Therefore, in order to supplement the information/contents given in the study material, students

are advised to refer to the Suggested Readings mentioned in the study material, e-bulletin, Business

Dailies and Journals.

In the event of any doubt, students may write to the Directorate of Academics and Professional

Development in the Institute for clarification at acad[email protected]du.

(iv)

Although due care has been taken in publishing this study material yet the possibility of errors,

omissions and/or discrepancies cannot be ruled out. This publication is released with an

understanding that the Institute shall not be responsible for any errors, omissions and/or discrepancies

or any action taken in that behalf.

Should there be any discrepancy, error or omission noted in the study material, the Institute shall be

obliged if the same are brought to its notice for issue of corrigendum in the `e-bulletin’.

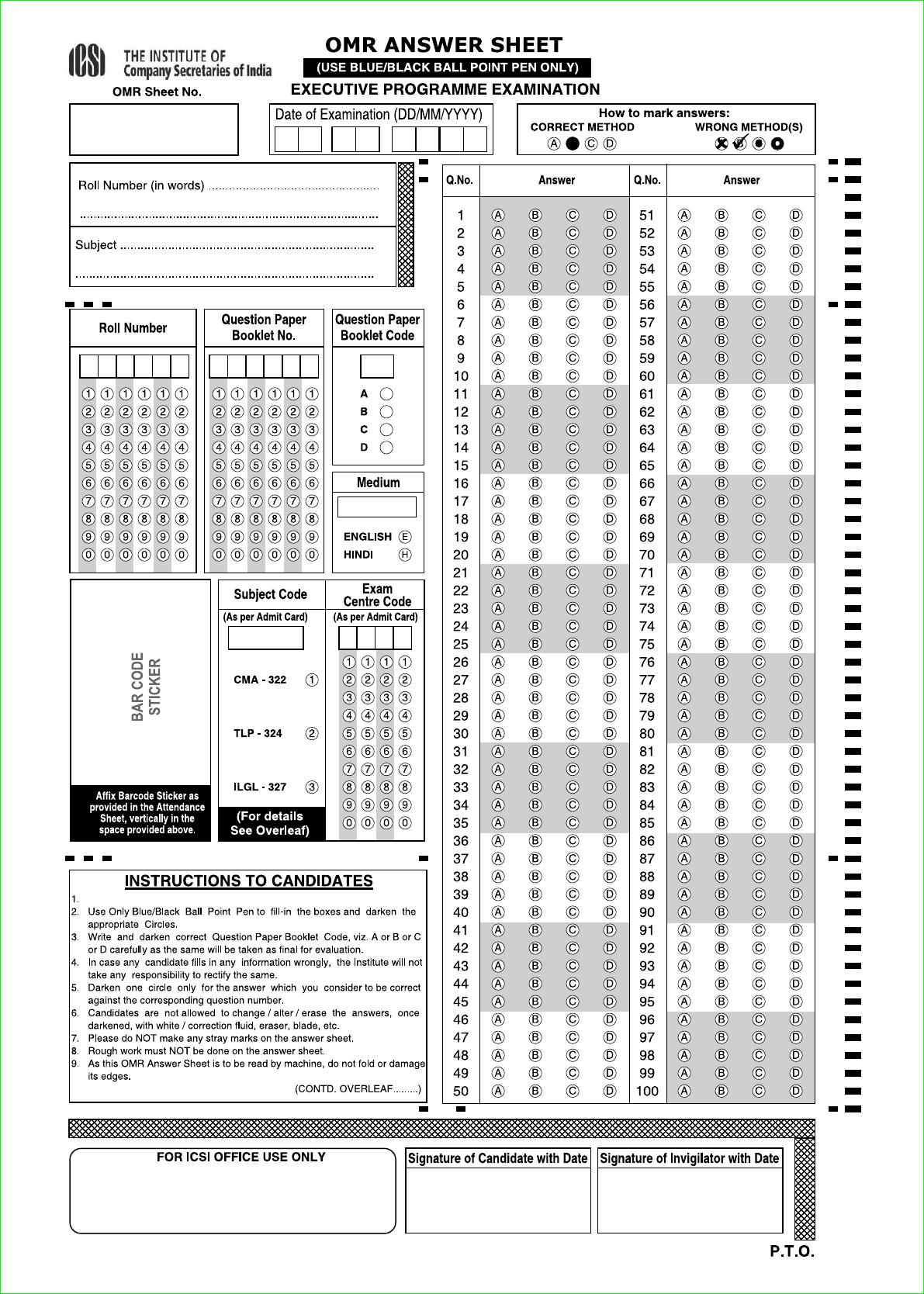

The Institute has decided that the examination for this paper under new syllabus from December

2014 session in the Optical Mark Recognition (OMR) format, whereby students are required to answer

multiple choice question on OMR sheet by darkening the appropriate choice by HB Pencil. One mark

will be awarded for each correct answer. Negative marking for wrong answers attempted by the

candidates will be implemented w.e.f. December, 2015 session of examination in the ratio of 1:4, i.e.

deduction of one (1) mark for every four (4) wrong answers and total marks obtained by the

candidates in the paper would be rounded up to next whole number. Further, the negative marks

would be limited to the extent of marks secured for correct answers so that no candidate shall secure

less than zero mark.

The specimen OMR sheet is appended at the end of the study material. There is practice test

paper in the study to acquaint students with the pattern of examination. These are for practice purpose

only, not to be sent to the institute.

(v)

EXECUTIVE PROGRAMME

SYLLABUS

FOR

MODULE 1 - PAPER 2: COST AND MANAGEMENT ACCOUNTING (100 Marks)

Level of Knowledge: Working Knowledge

Objective: To acquire knowledge and understanding of the concepts, techniques and practices of cost

and management accounting and to develop skills for decision making.

Detail Contents:

1. Introduction to Cost and Management Accounting

• Cost Accounting: Evolution, Meaning, Objectives and Scope

• Concepts of Costs , Classifications and Elements of Cost

• Cost Centre and Cost Unit

• Methods and Techniques of Costing

• Cost Accounting Standards

• Installation of a Costing System

• Practical Difficulties in Installing a Costing System

• Role of Cost Accountant in Decision Making

• Management Accounting: Evolution, Meaning, Objectives and Scope

• Tools and Techniques of Management Accounting

• Relationship of Cost Accounting, Financial Accounting, Management Accounting and

Financial Management

• Conflicts in Profit versus Value Maximisation Principle

• Role of Management Accountant in Decision Making

2. Material Cost

• Materials Control – Concept and Techniques

• Procurement Procedures and Documentation: Methods of Purchasing; Procedure of

Purchases, Stores and Issue of Material; Stock Verification

• Methods of Pricing of Material: FIFO, LIFO, Simple Average, Weighted Average

• Accounting and Control of Material Losses, Wastage, Scrap, Spoilage and Defectives

• Inventory Management: Techniques of fixing of minimum, maximum and reorder levels,

Economic Order Quantity, ABC Analysis ; Stock Verification and Perpetual Inventory

3. Labour Cost

• Meaning and Classification of Labour Costs

• Accounting and Control of Labour Costs

• Time Keeping and Time Booking

• Attendance and Payroll Procedures, Time Recording, Overtime and Idle Time

• Labour turnover and Remedial Measures

• Efficiency Rating Procedures; Remuneration Systems and Incentive Schemes

(vi)

4. Direct Expenses and Overheads

• Direct Expenses: Meaning, Nature, Collection, Classification and Treatment of Direct and

Indirect Expenses

• Overheads: Meaning, Nature, Collection and Classification Functional Analysis: Factory,

Administration, Selling, Distribution, Research and Development

• Behavioural Analysis: Fixed, Variable, Semi variable and Step Cost Allocation,

Apportionment, Absorption and Control of Overheads

• Preparation of Cost Sheet

5. Activity Based Costing (ABC)

• Meaning, Importance, Characteristics

• Elements and Steps involved

• ABC vs. Traditional Costing

• Uses and Limitations

6. Cost Records

• Cost Ledgers – Integrated Accounts and Non-Integrated Accounts

• Reconciliation of Cost and Financial Accounts

7. Costing Systems

• Unit and Output Costing

• Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of Overheads and its

Applications

• Batch Costing: Features and Applications

• Contract Costing: Features, Distinction between Job and Contract Costing, Progress

Payments, Retention Money, Escalation Clause, Contract Accounts, Accounting for

Material, Accounting for Plant Used in a Contract, Contract Profit and Accounting Entries

• Process Costing: Features, Applications and Types of Process Costing,Process Loss,

Abnormal Gains and Losses, Equivalent Units, Inter-Process Profit, Joint Products, By-

Products and Accounting

• Service Costing: Features and Applications, Unit Costing and Multiple Costing,

Application, Identification of Cost Unit and Cost Determination and Control

8. Marginal Costing

• Meaning, Advantages, Limitations and Applications

• Breakeven Analysis

• Cost-Volume Profit Analysis

• P/V Ratio and its Significance

• Margin of Safety

• Absorption Costing: System of Profit Reporting and Stock Valuation

• Difference between Marginal Costing and Absorption Costing

• Income Measurement under Marginal Costing and Absorption Costing

9. Standard Costing

• Definition, Significance and Applications

• Various Types of Standards

• Installation of Standard Costing System-for Material, Labour, and Overhead

(vii)

• Variance Analysis for Materials, Labour and Overheads and Accounting Treatment of

Variances

• Benchmarking for Setting of Standards

• Variance Reporting to Management

10. Budget, Budgeting and Budgetary Control

• Budget Concept, Manual

• Fixed and Flexible Budgets

• Preparation and Monitoring of Various Types of Budgets

• Budgetary Control System: Advantages, Limitations and Installation

• Zero Base Budgeting

• Programme and Performance Budgeting

11. Cost Accounting Records and Cost Audit

• Nature and Scope of Cost Audit

• Cost Accounting Records and Cost Audit under Companies Act, 2013

• Purpose, Scope and Advantages of Cost Audit

• Implementing Authorities of Cost Audit

• Cost Audit Techniques and Programmes

• Cost Audit Report

• Cost Auditor – Appointment, Rights and Responsibilities

12. Analysis and Interpretation of Financial Statements

• Financial Statements: Nature, Attributes, Objectives, Importance, Limitations

• Recent Trends in Presenting Financial Statements

• Financial Statements Analysis: Types, Methods, Objectives, Limitations

• Ratio Analysis: Accounting, Uses, Classification, Advantages, Limitations

• Cash Flow Statement

• Fund Flow Statement

• Difference between Cash Flow and Fund Flow Statement

• Management Reporting

(viii)

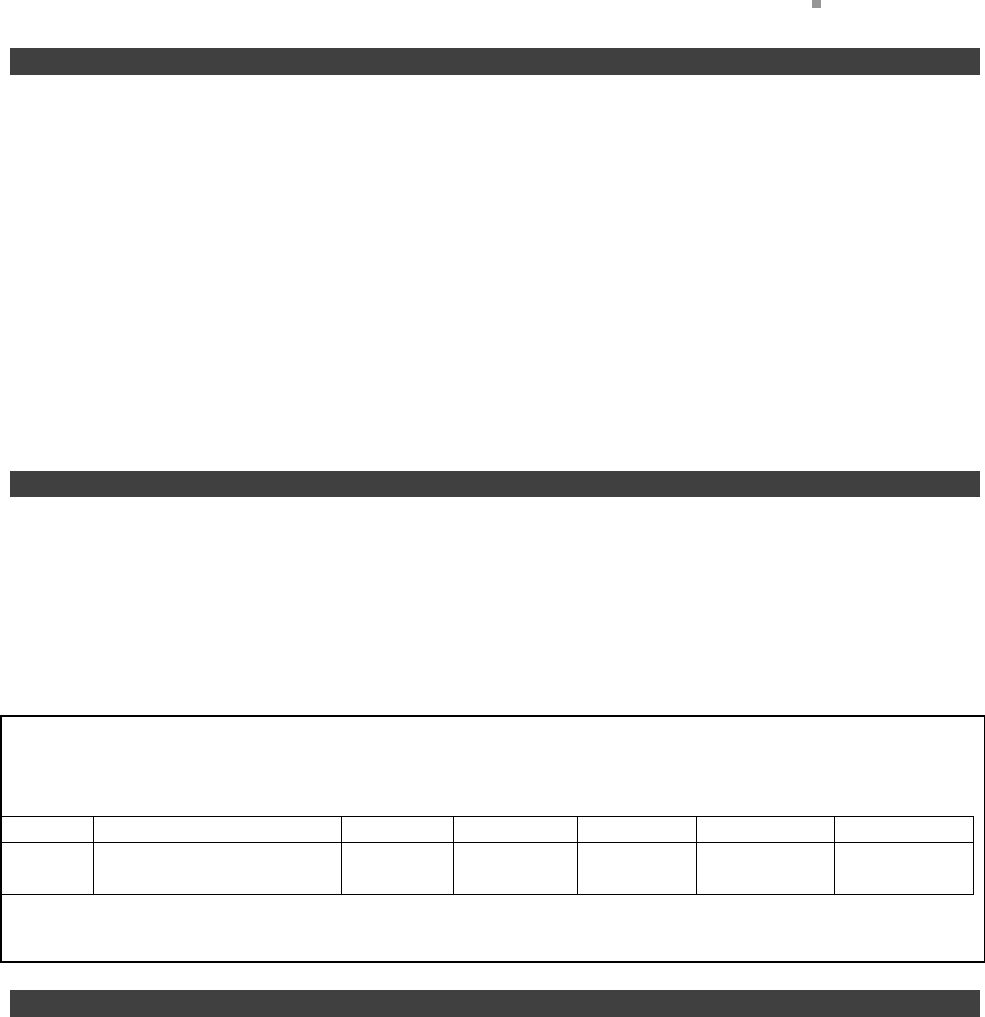

LIST OF RECOMMENDED BOOKS

MODULE I

PAPER 2: COSTAND MANAGEMENT ACCOUNTING

Recommended Readings and References:

1. N.S. Zad : Cost & Management Accounting Taxmann

Publications Pvt. Ltd.

2. Deepak Jain : Cost & Management Accounting Taxmann

Publications Pvt. Ltd.

3. S.P. Jain & K.L. Narang : Cost and Management Accounting;

Kalyani Publishers, 23, Daryaganj,

New Delhi-110 002.

4. V.K. Saxena& C.D. Vashist : Cost and Management Accounting;

Sultan Chand & Sons, 23, Daryaganj

New Delhi -110 002.

5. M.N. Arora : Cost and Management Accounting (Theory and

Problems); Himalaya Publishing House,

Ramdoot, Dr. BhaleraoMarg, Kelewadi,

Girgaon, Mumbai-400 004.

6. S.N. Maheshwari : Cost and Management Accounting;

Sultan Chand & Sons, 23, Daryaganj

New Delhi -110 002.

7. I.M. Pandey : Management Accounting;

Vikas Publishing House (P) Ltd.

A-22, Sector 4, Noida – 201 301

8. Ravi M. Kishore : Advanced Management Accounting;

Taxmann’s, Taxmann Publication (P) Ltd.

59/32, New Rohtak Road, New Delhi – 110 005.

9. M.Y. Khan & P.K. Jain : Theory and Problems of Management and Cost

Accounting; McGraw-Hill Education (India) Ltd.

B-4, Sector 63, Gautam Budh Nagar,

Noida – 201 301.

10. JawaharLal : Cost Accounting; McGraw-Hill Education (India) Ltd.

B-4, Sector 63, GautamBudh Nagar,

Noida – 201 301.

11. C.T. Horngren : Cost and Management Accounting - A Managerial

Emphasis; Pearson Education Asia,

482, F.I.E. Patparganj, Delhi-110 092.

(ix)

12. B.M. Lall Nigam & I.C. Jain :

Cost Accounting Principles and Practice;

Prentice Hall of India, M-97, Connaught Circus,

New Delhi-110 001.

13. Drury Colin :

Management and Cost Accounting; International

Thomson Business Press, London.

14. K.S. Thakur :

Cost Accounting – Theory & Practice;

Excel Books, A-45, Naraina, Phase-I,

New Delhi-110028.

15 B.M. Lall Nigam and I.C. Jain

Cost Accounting Principles and Practice - PHI

Learning Private Limited

16 Ashish K. Bhattacharyya

Principles and Practice of Cost Accounting- PHI

Learning Private Limited

(x)

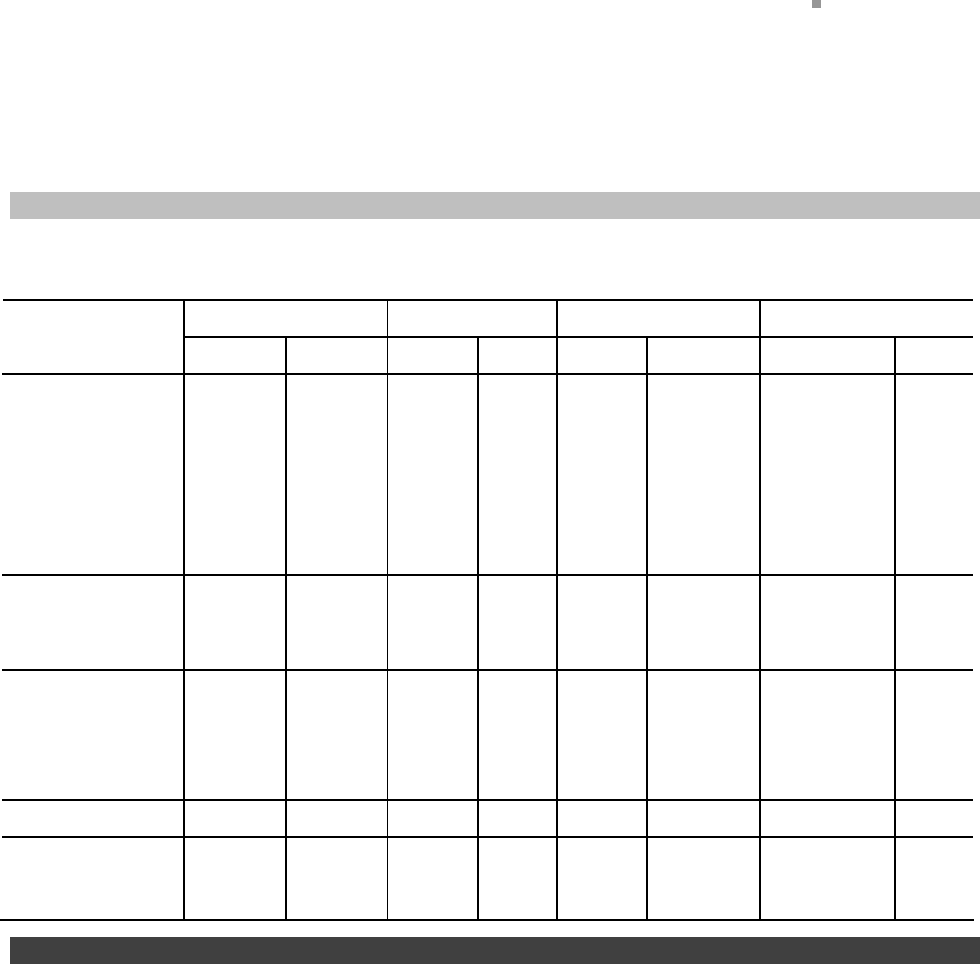

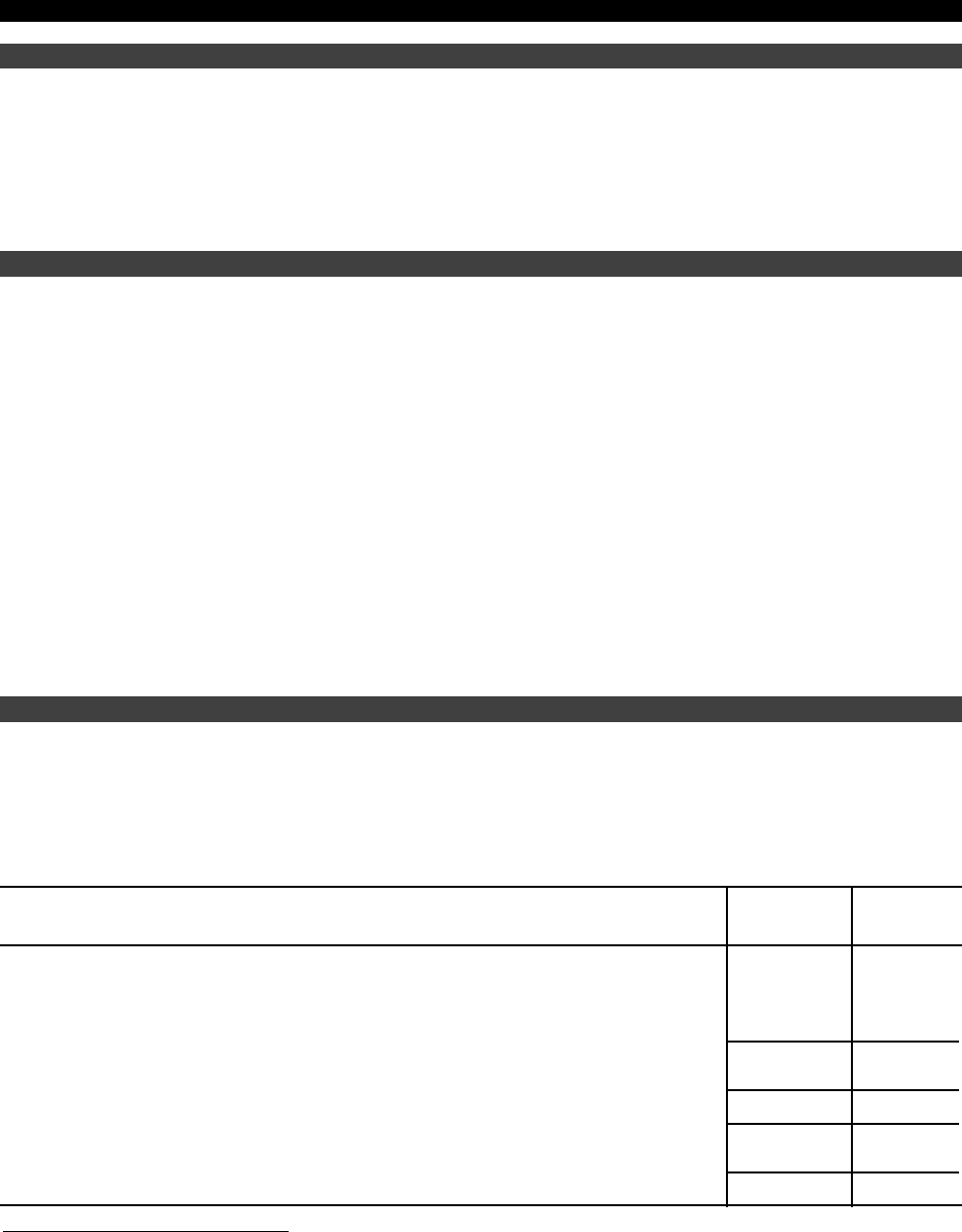

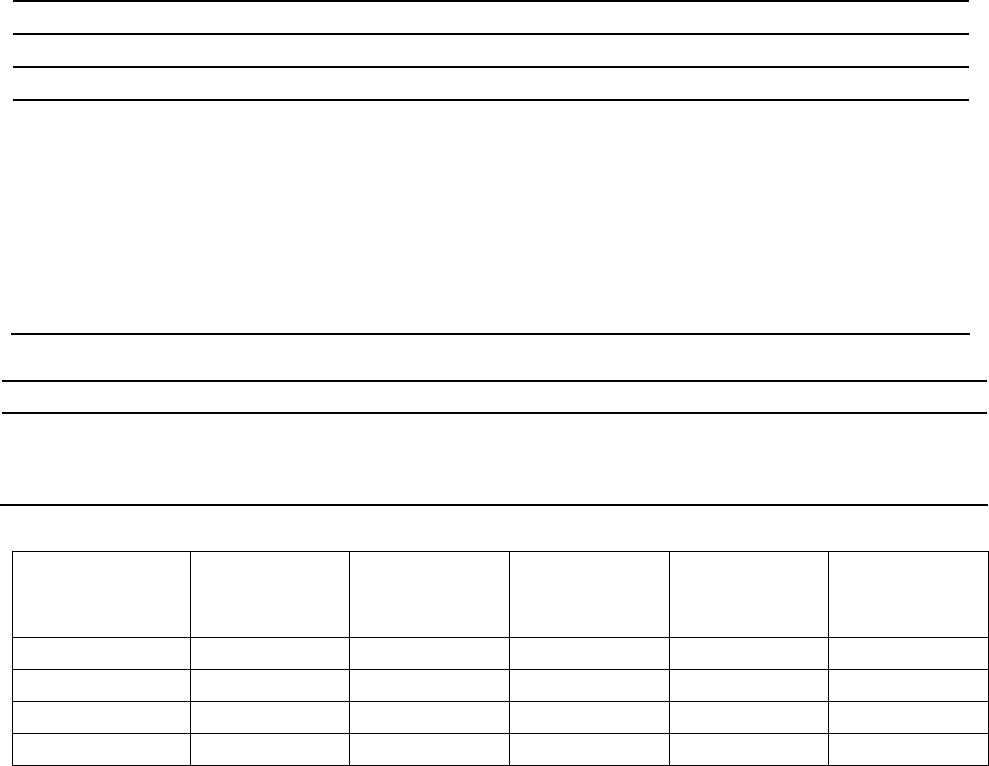

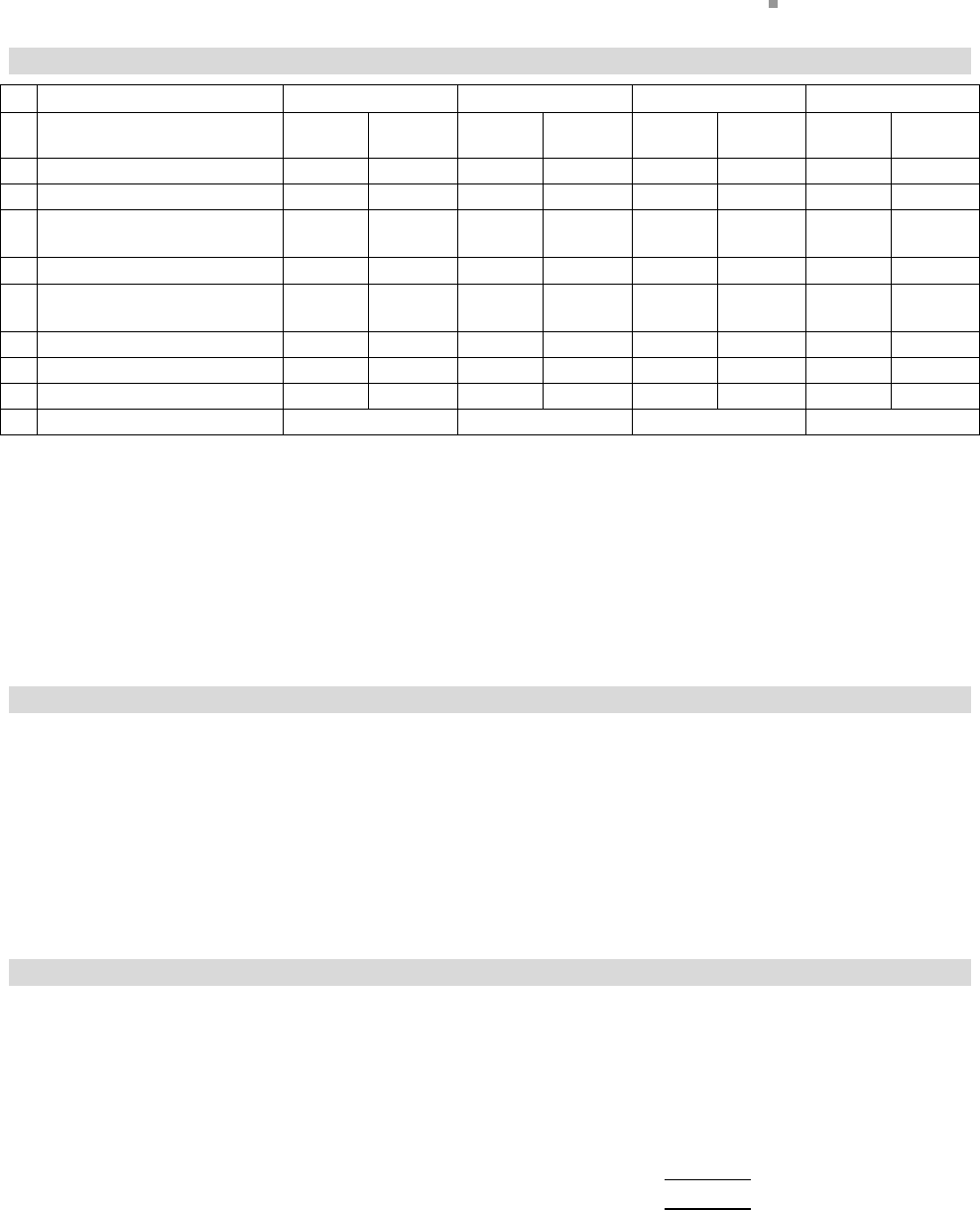

ARRANGEMENT OF STUDY LESSONS

PAPER 2: COSTAND MANAGEMENT ACCOUNTING (100 Marks)

Lesson No. Subject

1. Introduction to Cost and Management Accounting

2. Material Cost

3. Labour Cost

4. Direct Expenses and Overheads

5. Activity Based Costing (ABC)

6. Cost Records

7. Costing Systems

8. Marginal Costing

9. Standard Costing

10. Budget, Budgeting and Budgetary Control

11. Cost Accounting Records and Cost Audit

12. Analysis and Interpretation of Financial Statements

PRACTICE TEST PAPER

EXECUTIVE PROGRAMME

COST AND MANAGEMENT ACCOUNTING

CONTENTS

LESSON 1

INTRODUCTION TO COST AND MANAGEMENT ACCOUNTING

Page

Learning Objectives … 1

Concepts of Cost ... 2

Evaluation of Cost Accounting … 3

Costing, Cost Accounting and Cost Accountancy ... 3

Objectives of Cost Accounting ... 4

Importance of Cost Accounting ... 5

Scope of Cost Accounting … 6

Classifications of Costs ... 7

Cost Centre and Cost Unit ... 15

Methods of Costing ... 16

Techniques of Costing ... 18

Cost Accounting Standards … 19

Installation of a Costing System ... 21

Practical Difficulties in Installing a Costing System ... 23

Role of Cost Accounting in decision making … 24

Management Accounting ... 25

Objective of Management Accounting ... 27

Nature of Management Accounting ... 28

Scope of Management Accounting ... 28

Tools and Techniques of Management Accounting ... 29

Difference between Financial Accounting and Cost Accounting ... 31

Difference between Financial Accounting and Management Accounting ... 32

Difference between Cost Accounting and Management Accounting ... 33

Limitations of Management Accounting ... 34

Conflicts in Profit versus Value Maximization Principle … 35

Role of Management Accountant in Decision Making ... 36

LESSON ROUND-UP ... 37

SELF-TEST QUESTIONS ... 37

(xii)

LESSON 2

MATERIAL COST

Page

Learning Objectives … 41

Inventory Control ... 42

Objectives of Inventory Control ... 42

Techniques of Inventory Control ... 42

Procurement Procedure & Documentation … 61

Methods of Purchasing ... 62

Purchase Procedure ... 63

Pricing of Stores Receipts ... 65

Store-keeping ... 68

Functions of Store-keeping ... 69

Classification and Codification of Materials ... 69

Issue of Materials ... 70

Material (Stores) Requisition Note ... 70

Bill of Materials ... 70

Stock Verification … 71

Method of Pricing of Material Issues ... 72

Pricing of Material Returns ... 88

Material Transfer Note ... 89

Accounting of Material Losses ... 89

Control of Material Losses ... 92

Inventory Management … 96

LESSON ROUND-UP ... 96

SELF-TEST QUESTIONS ... 97

LESSON 3

LABOUR COST

Learning Objectives … 103

Labour Cost … 104

Classification of Labour Cost … 104

Accounting and Control of Labour Cost … 105

Time Recording … 106

Time Keeping … 106

Time Booking … 107

Attendance and Payroll Procedure … 108

(xiii)

Page

Overtime ... 109

Idle Time ... 110

Labour Turnover ... 112

Labour Remuneration System ... 117

Basic Methods of Remuneration ... 118

Incentive Schemes ... 121

Classification of Incentive Schemes ... 122

Indirect Monetary Incentive Schemes ... 128

Other Non-monetary Incentive Schemes ... 130

Miscellaneous Topics ... 142

LESSON ROUND-UP ... 144

SELF-TEST QUESTIONS ... 144

LESSON 4

DIRECT EXPENSES AND OVERHEADS

Learning Objectives … 147

Direct Expenses ... 148

Indirect Expenses ... 149

Overheads ... 150

Collection of Overheads ... 150

Classification of Overheads ... 151

Procedure for Accounting and Control of Overheads … 158

Allocation of Overheads ... 159

Apportionment of Overheads ... 160

Absorption of Overheads ... 166

Methods of Absorbing Production Overheads ... 167

Over or Under Absorption of Overheads ... 176

Treatment of Factory Overheads ... 177

Treatment of Administrative Overheads ... 178

Treatment of Selling and Distribution Overheads ... 180

Control of Overheads ... 183

Preparation of Cost Sheet … 185

LESSON ROUND-UP ... 186

SELF-TEST QUESTIONS ... 187

(xiv)

LESSON 5

ACTIVITY BASED COSTING

Page

Learning Objectives … 189

Introduction of Activity Based Costing … 190

Meaning of Activity Based Costing … 190

Basics of Activity Based Costing … 191

Evolution of Activity Based Costing … 191

Distinction between traditional absorption costing and Activity Based Costing … 192

Objectives of Activity Based Costing … 192

Terminology of Activity Based Costing … 193

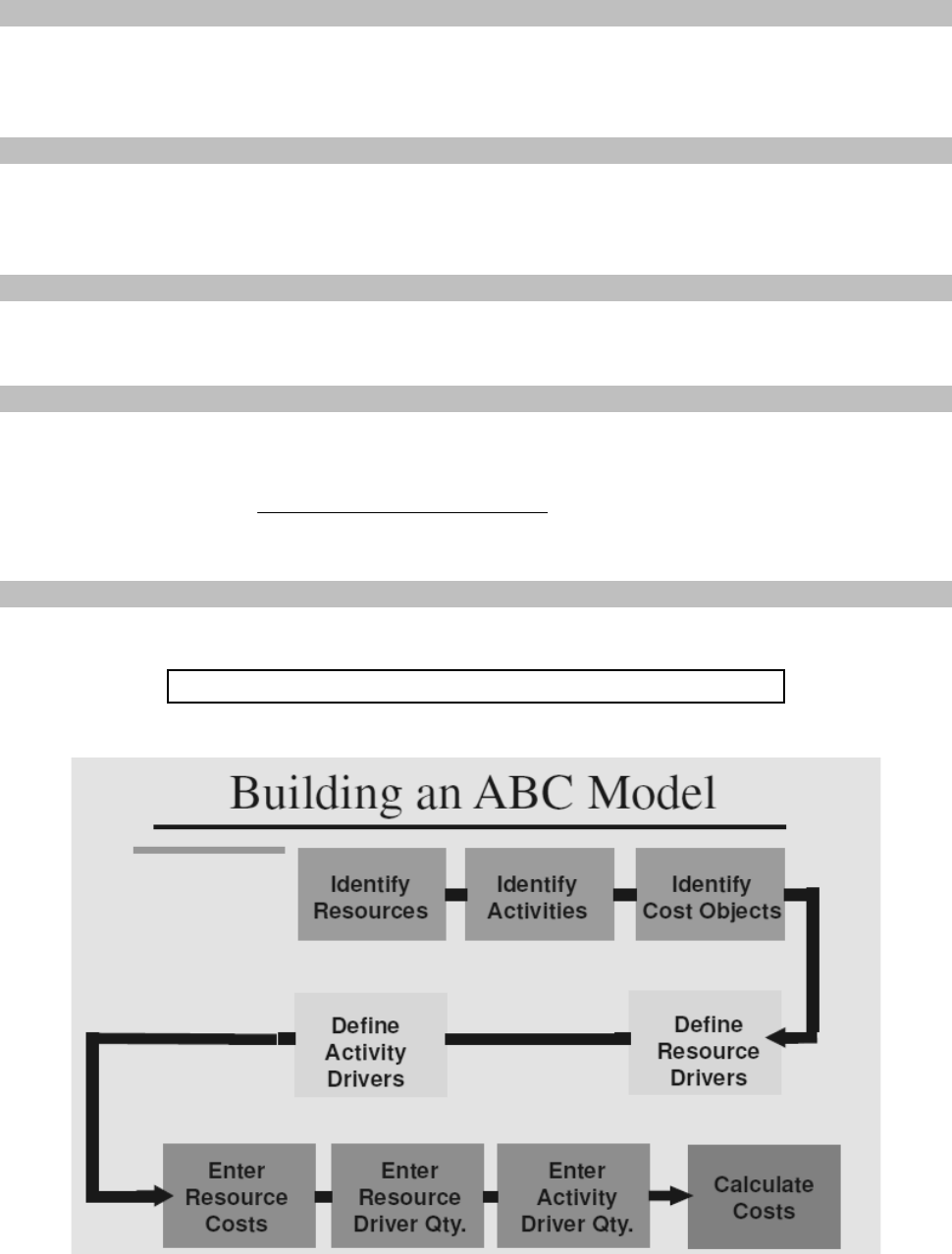

Stages in Developing Activity Based Costing … 193

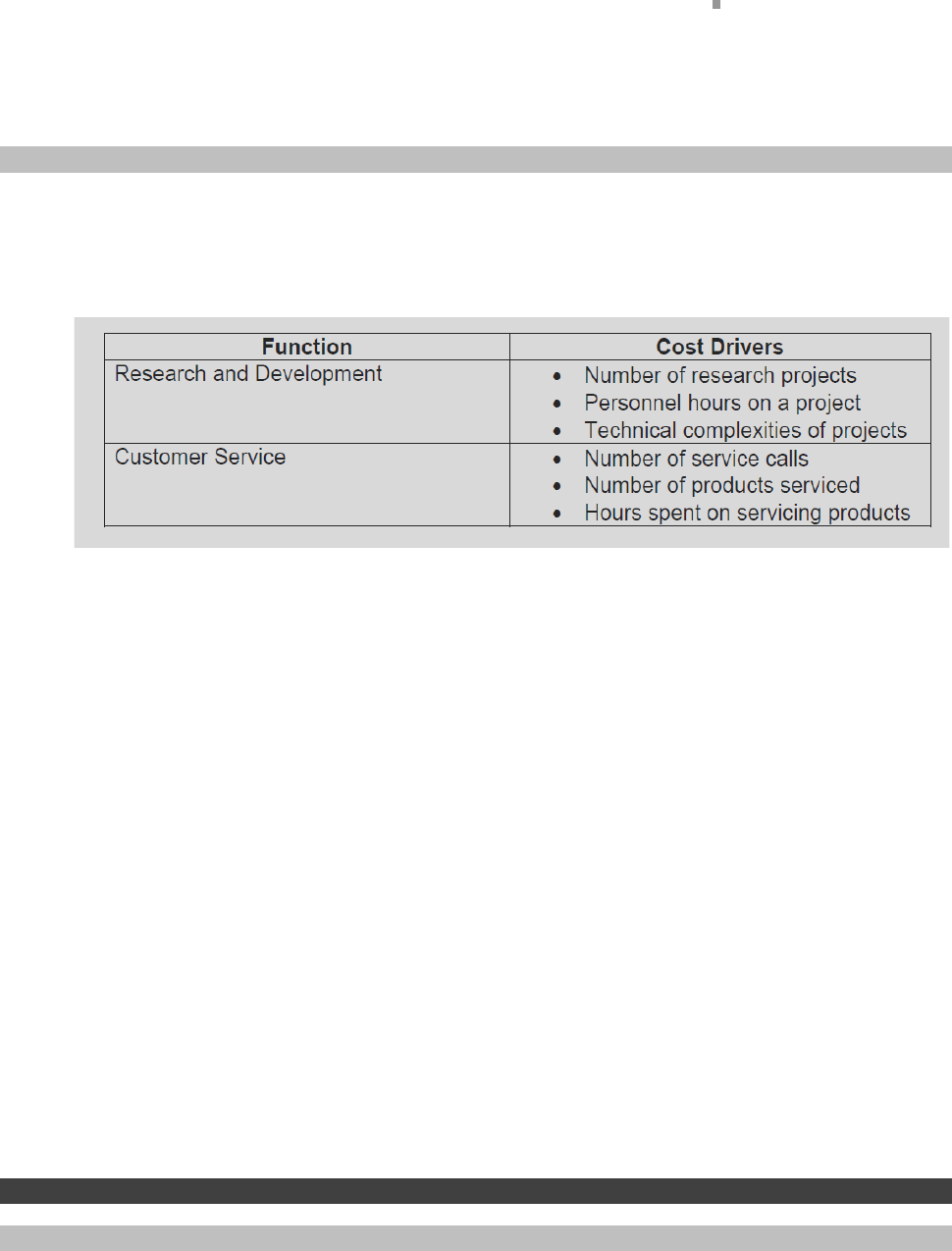

Different Types of Activities … 195

Importance of Activity Based Costing … 195

Uses of Activity Based Costing … 196

Limitations of Activity Based Costing … 197

LESSON ROUND-UP ... 203

SELF-TEST QUESTIONS ... 203

LESSON 6

COST RECORDS

Learning Objectives … 207

Cost Ledger

Introduction … 208

Non-Integrated Accounting System … 208

— Principal Ledgers … 208

— Control Accounts … 209

— Entries to record transaction … 209

Advantages of non-integrated accounting … 211

Limitations of non-integrated accounting … 212

Integrated Accounting System … 212

Benefits of Integrated Accounting System … 212

Pre-requisites for an Integrated Accounting System … 212

Essential features of Integral Accounting … 213

Reconciliation of Cost and Financial Accounts

Need for Reconciliation … 218

Causes of Difference … 219

I. Items Shown only in Financial Accounts … 219

II. Items Included in Cost Accounts Only … 220

III. Over or Under Absorption of Overheads … 220

(xv)

Page

IV. Adoption of Different Basis of Valuation of Stock … 220

V. Different Methods of Charging Depreciation … 220

VI. Abnormal Gains and Losses … 221

Preparation of Reconciliation Statement or Memorandum Reconciliation Account … 221

LESSON ROUND-UP ... 230

SELF-TEST QUESTIONS ... 230

LESSON 7

COSTING SYSTEM

Learning Objectives … 237

Single/Output/Unit Costing … 238

Cost Sheet … 238

Production Account … 240

Job Costing … 246

— Meaning … 246

— Features … 246

— Basic Principles & Special Terms … 247

— Applications … 249

— Advantages and Limitations … 249

Batch Costing … 252

— Features … 252

— Difference between Job Costing and Batch Costing … 252

— Applications … 253

Contract Costing … 254

— Distinction between job and contract costing … 254

— Specific aspects and recording of transactions of contract costing … 254

— Profits on Incomplete Contract (Based on AS-7-Revised 2002) … 262

Process Costing … 266

— General Principles of Process Costing … 266

— Features of Process Costing … 266

— Applications of Process Costing … 267

— Comparison between Job Costing and Process Costing … 267

— Advantages and Limitations of Process Costing … 268

— Accounting for Element of Cost … 269

— Cost of Process … 270

— Process Losses … 271

— Inter Process Profit … 278

— Valuation of Work in Progress (Equivalent Production) … 280

— By-Products and Joint Products … 290

(xvi)

Page

— Accounting for By-Products … 290

— Accounting for Joint Products … 291

— Co-Products … 293

Service Costing … 295

— Features of Service Costing … 296

— Applications of Service Costing … 296

— Unit Costing and Multiple Costing … 296

— Cost Unit … 297

— Transport Costing … 297

— Bailer House Costing … 300

— Canteen Costing … 301

— Hospital Costing … 302

LESSON ROUND-UP ... 313

SELF-TEST QUESTIONS ... 314

LESSON 8

MARGINAL COSTING

Learning Objectives … 321

Marginal Costing ... 322

Features of Marginal Costing … 322

Advantages of Marginal Costing … 322

Limitations of Marginal Costing … 323

Break-even Analysis/Cost-Volume-Profit Analysis ... 324

Objectives of Cost-Volume-Profit Analysis ... 325

Advantages of Break-even Analysis ... 326

Limitations of Break-even Analysis ... 326

Uses of Cost Volume Profit Analysis … 327

Contribution ... 327

Marginal Cost Equation … 328

Profit-Volume Ratio ... 328

Margin of Safety ... 329

Methods for Determining Break-even Points ... 330

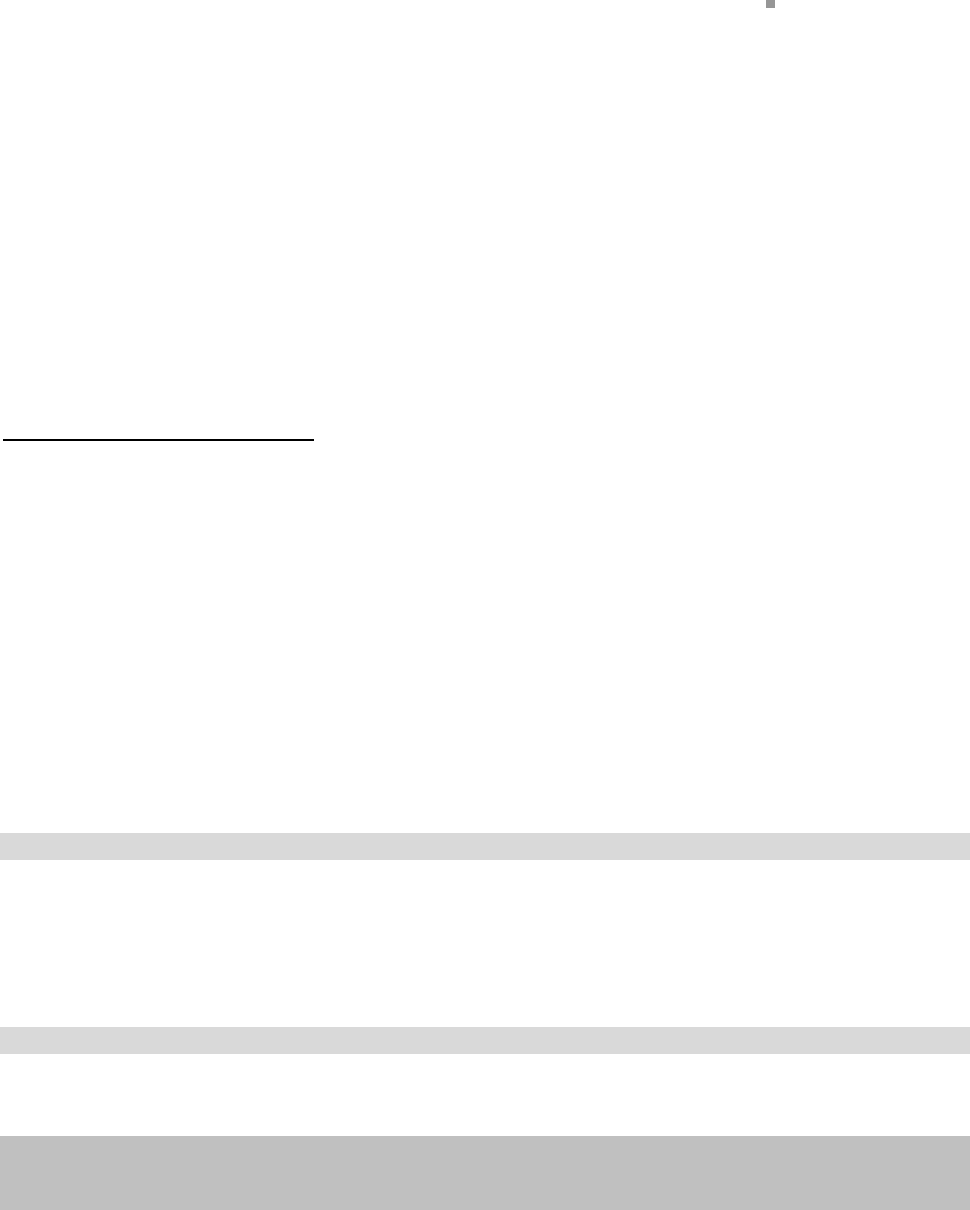

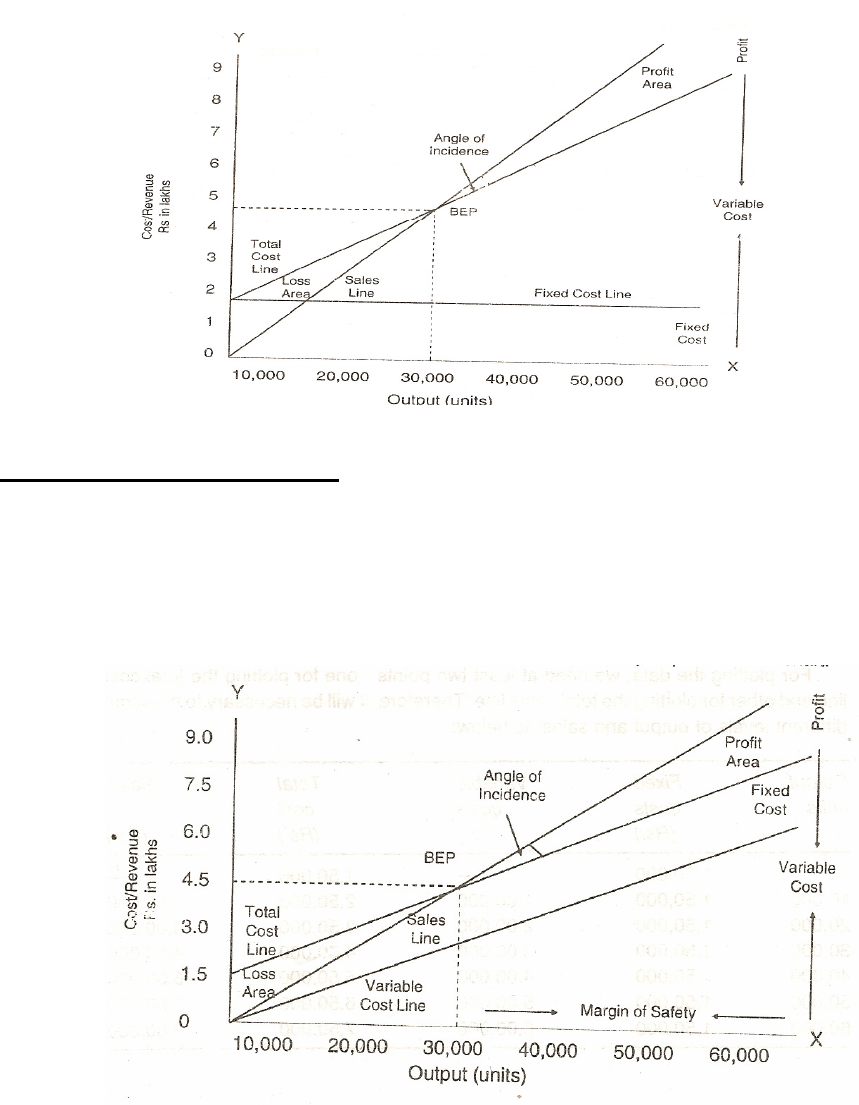

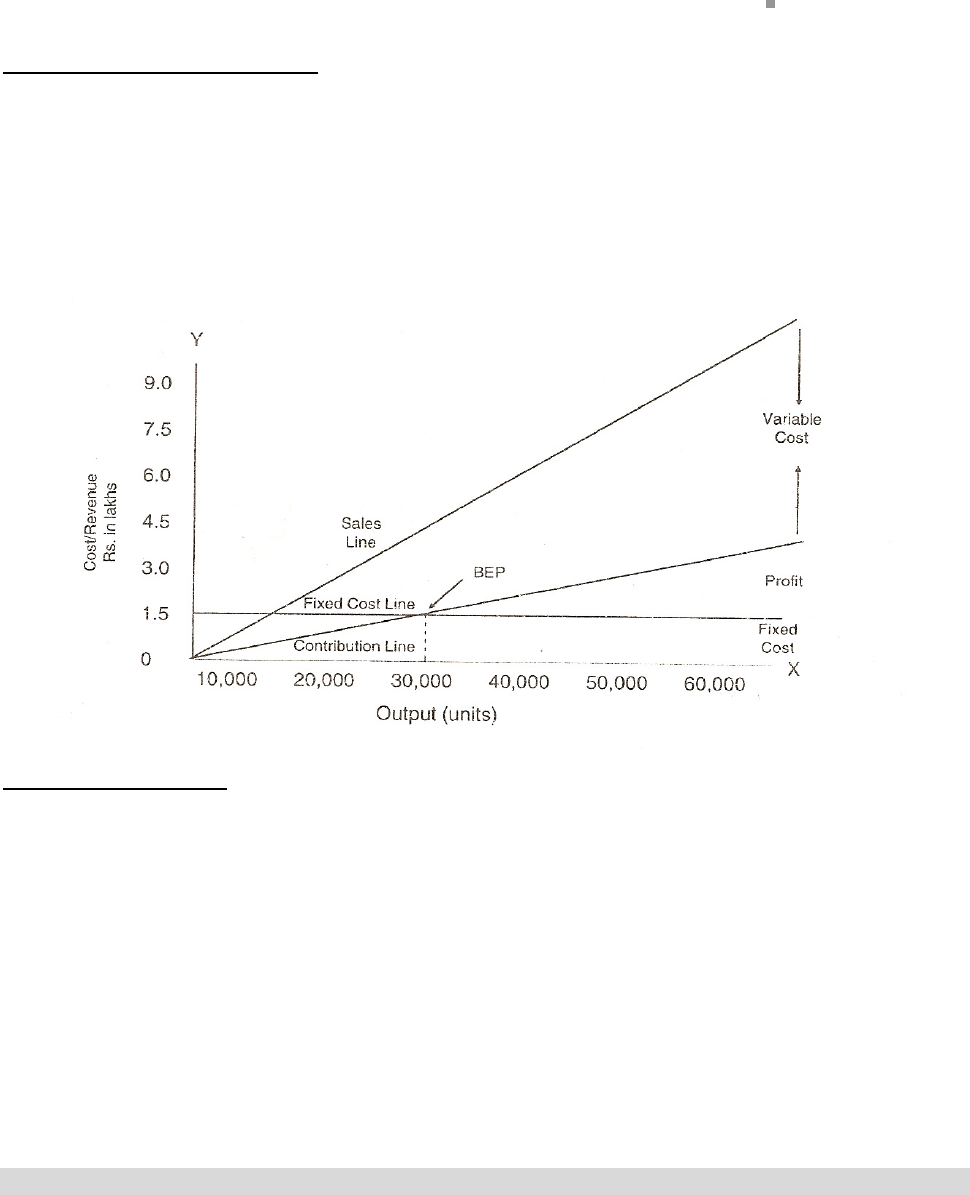

Break-even Chart … 337

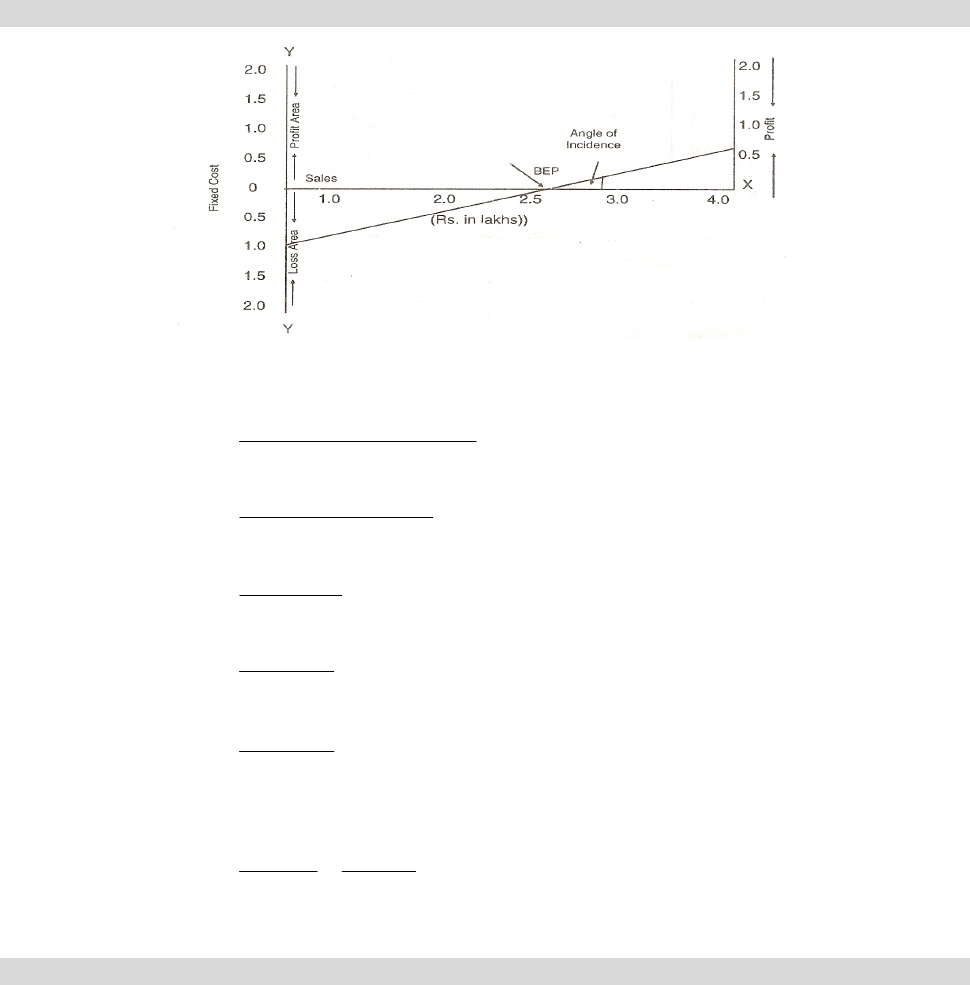

Profit-Volume Chart … 338

Applications of Marginal Costing ... 339

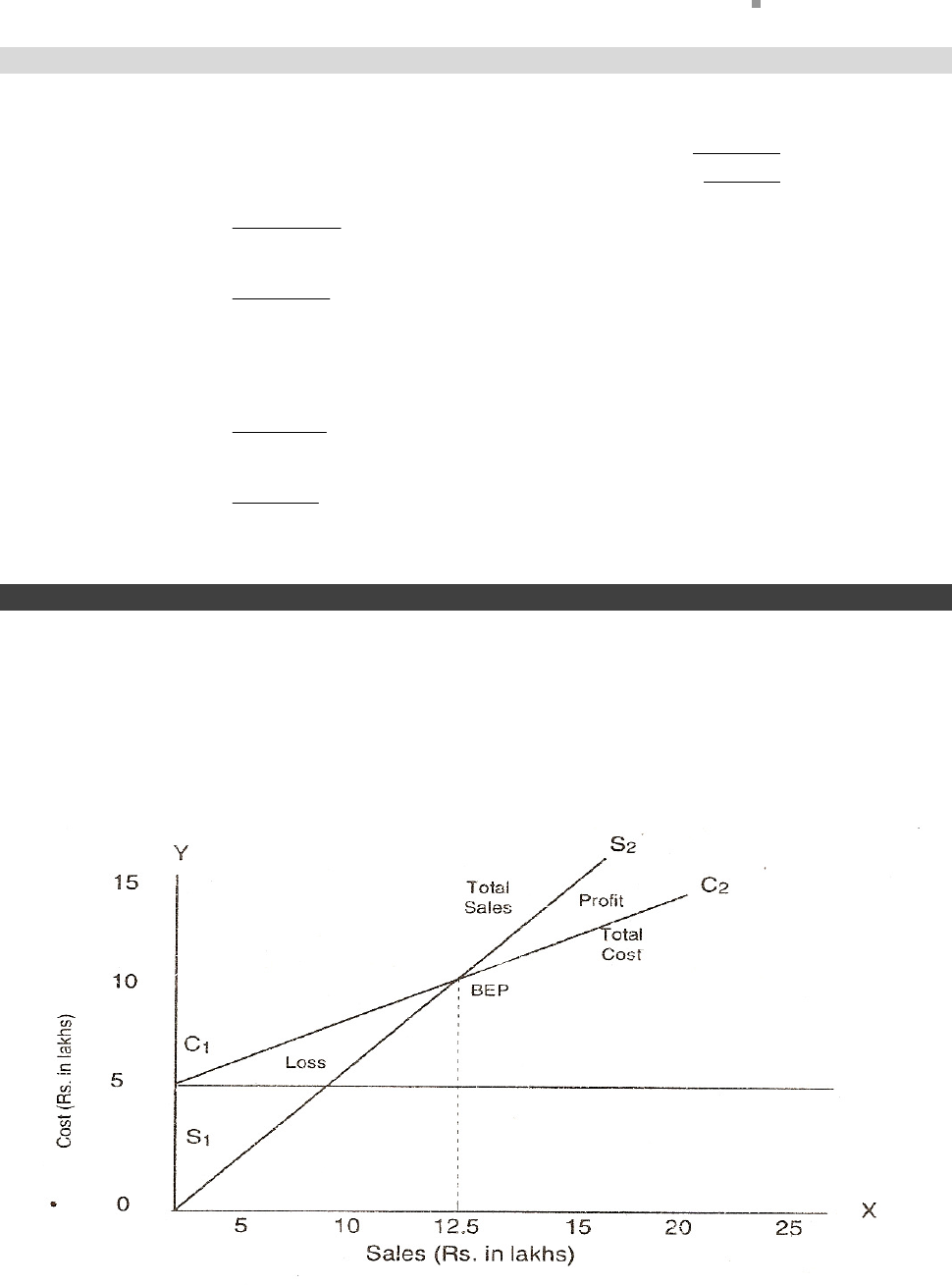

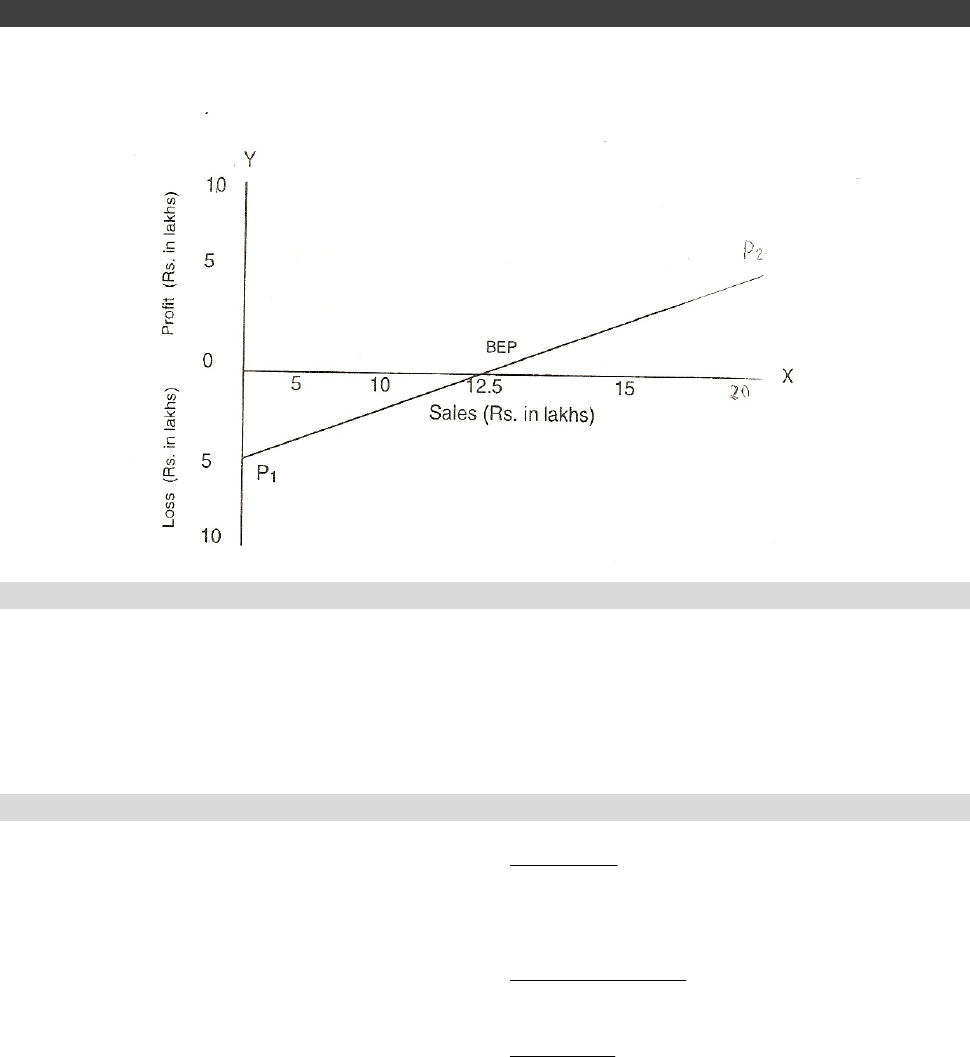

Composite Break-Even Point ... 349

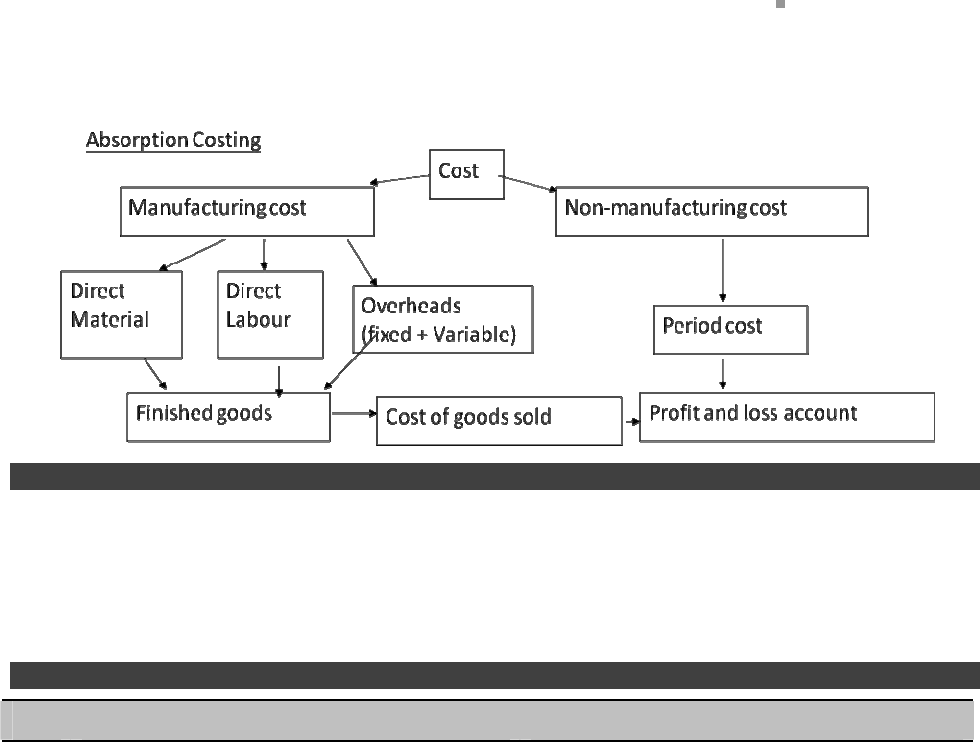

Absorption Costing … 358

System of Profit Reporting … 358

Difference between Absorption Costing and Marginal Costing ... 359

(xvii)

Page

Income Measurement under Marginal and Absorption Costing ... 360

Pricing Decisions (Discriminating Price and Differential Selling) ... 364

LESSON ROUND-UP ... 371

SELF-TEST QUESTIONS ... 373

LESSON 9

STANDARD COSTING AND VARIANCE ANALYSIS

Learning Objectives … 377

Standard Costing ... 378

Definition and Meaning of Standard Costing ... 378

Significance/Advantages of Standard Costing ... 379

Applications Standard Costing … 380

Various Types of Standards ... 381

Standard Costing System … 382

Installation of a Standard Costing System … 382

Functions of a Standard Costing System … 382

Features of a Standard Costing System … 383

Standard Cost for Material, Labour and Overhead … 383

Direct Materials Standards ... 383

Standard Cost for Direct Labour ... 384

Standard Overhead Rates ... 384

Standard Administration Costs ... 385

Standard Costs for Selling and Distribution ... 385

Variance analysis ... 385

Material Cost Variance ... 389

Labour Cost Variance ... 398

Overhead Cost Variances ... 405

Variable Overhead Variance … 406

Fixed Overhead Variance … 408

Accounting Treatment of Variance … 413

Bench Marking for setting of a standards … 414

Reporting of Variances to Management ... 415

LESSON ROUND-UP ... 415

SELF-TEST QUESTIONS ... 417

LESSON 10

BUDGET, BUDGETING AND BUDGETARY CONTROL

Learning Objectives … 419

Budget ... 420

Budgeting … 420

(xviii)

Page

Budgetary Control ... 420

Forecast and Budget ... 421

Objectives of Budgetary Control ... 422

Advantages of Budgetary Control ... 422

Limitations of Budgetary Control ... 423

Preliminaries for the Adoption of a System of Budgetary Control ... 424

Installation of Budgetary Control System ... 424

Preparation and Monitoring of various types of Budgets … 429

Zero Base Budgeting ... 443

Difference between Traditional Budgeting and Zero-base Budgeting … 444

Advantages of Zero Base Budgeting … 444

Programme Budgeting … 445

Performance Budgeting ... 445

LESSON ROUND-UP ... 446

SELF-TEST QUESTIONS ... 447

LESSON 11

COST ACCOUNTING RECORDS AND COST AUDIT

Learning Objectives … 449

Cost Audit … 450

Provisions of Companies Act, 2013 pertaining to Cost Accounting Records … 450

Provisions of Companies Act, 2013 pertaining to Cost Audit … 450

Purpose of Cost Audit … 452

Scope of Cost Audit … 453

Advantages of Cost Audit … 453

Appointment of Cost Auditor … 454

Rights and Responsibilities of Cost Auditor … 455

Implementing Authorities of Cost Audit … 456

Cost Audit Techniques … 456

Cost Audit Programme … 457

Cost Audit Report … 458

LESSON ROUND-UP … 459

SELF-TEST QUESTIONS … 459

LESSON 12

ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS

Learning Objectives … 461

Financial Statements ... 462

Nature of Financial Statements ... 462

Attributes of Financial Statements ... 463

(xix)

Page

Objectives of Financial Statements ... 465

Importance of Financial Statements ... 466

Limitations of Financial Statements ... 467

Recent Trends in Presenting Financial Statements ... 468

Analysis of Financial Statements ... 469

Objectives of Financial Statement Analysis ... 470

Limitations of Financial Statement Analysis ... 470

Types of Financial Statement Analysis ... 471

Methods of Analysing Financial Statements ... 472

Ratio Analysis … 479

Accounting Ratios ... 479

Uses of Ratio Aalysis … 480

Classification of Ratios ... 481

Advantages of Ratio Analysis ... 496

Limitations of Ratio Analysis ... 496

Cash Flow Statement … 514

Classification of Cash Flows ... 515

Special Items ... 516

Preparation of a Cash Flow Statement ... 518

Reporting of Cash Flows from Operating Activities ... 518

Format of Cash Flow Statement ... 523

Usefulness of Cash Flow Statement ... 525

Fund Flow Statement … 537

Meaning and Definition of Fund Flow Statement … 538

Steps for Preparation of Fund Flow Statement … 539

Difference between Cash Flow and Fund Flow … 551

Management Reporting … 551

Role of Management Information System … 552

LESSON ROUND-UP … 553

SELF-TEST QUESTIONS … 553

Practice Test Paper

Practice Test Paper ... 561

Specimen OMR Answer Sheet

Lesson 1

Introduction to Cost and

Management Accounting

•

Concept of Cost

•

Evolution of Cost Accounting

•

Costing, Cost Accounting and Cost

Accountancy

•

Objectives, Importance and Scope of cost

accounting

•

Classifications and Elements of Cost

•

Cost Centre and Cost Unit

•

Methods and Techniques of Costing

•

Cost Accounting Standards

•

Installation of a Costing System

•

Practical Difficulties in Installing a Costing

System

•

Role of Cost Accountant in Decision

Making

•

Management Accounting and its Evolution,

Meaning, Objectives, Nature and Scope

•

Tools and Techniques of Management

Accounting

•

Relationship of Cost Accounting, Financial

Accounting, Management Accounting and

Financial Management

•

Limitations of Management Accounting

•

Conflicts in Profit versus Value

Maximisation Principle

•

Role of Management Accountant in

Decision Making

•

Lesson Round Up

•

Self-Test Questions

LEARNING OBJECTIVES

Accounting information is important for every

business which will serve the needs of variety of

interested parties. To satisfy the needs of all

interested parties a sound accounting system is very

necessary. Accounting may be divided into three

parts i. financial accounting ii. cost accounting iii.

management accounting.

Financial accounting is mostly concerned to record

the business transactions in books of accounts so

that final accounts can be prepared.

Cost accounting developed to help the internal

management in decision making. The information

provided by cost accounting acts as a managerial

tool so that business can utilise the available

resources at optimum level.

Management accounting is an extension of

management aspects of cost accounting. It provides

the information to management so that planning,

organizing, directing and controlling of business

operations can be done in an orderly manner.

Therefore the objective of the lesson is to enable the

student to understand the meaning and purpose of

cost and management accounting. What are the

various methods and technique of cost accounting so

that various information can be provided to

management for decision making.

After going through this lesson the students will be

able to

1.

Understand the nature, scope and utility of cost

accounting, management accounting and cost

accounting standards.

2.

Understand how cost accounting arises out of the

need to make business decisions.

3.

Difference between cost accounting, management

accounting and financial accounting.

4.

To familiarize with costing terminology.

Management Accounting is concerned with the information which is useful to Management.

LESSON OUTLINE

EP-CMA

2

CONCEPTS OF COST

Cost is the amount of resource given up in exchange for some goods or services. The resources given up

are money or money’s equivalent expressed in monetary units.

The Chartered Institute of Management Accountants, London defines cost as “the amount of

expenditure (actual or notional) incurred on, or attributable to a specified thing or activity”.

This activity of a firm may be the manufacture of a product or the rendering of a service which involves

expenditure under various heads, e.g., materials, labour, other expenses, etc. A manufacturing organisation

is interested in ascertaining the cost per unit of the product manufactured while an organisation rendering

service, e.g., transport undertaking, canteen, electricity company, municipality, etc., is interested in

ascertaining the costs of the service it renders. In its simplest form, the cost per unit is arrived at by dividing

the total expenditure incurred by the total units produced or the quantum of service rendered. But this

method is applicable if the manufacturer produces only one product. If the manufacturer produces more than

one product, it becomes imperative to split up the total expenditure between the various products so that the

cost of each product can be ascertained separately. Even if only one product is manufactured, it may be

necessary to analyse the cost per unit of each item of expenditure that goes to make up the total cost. The

problem becomes more complicated where a multiplicity of products is produced and it is necessary to

analyse the cost per unit of each product into various items of expenditures that make up the total cost.

For a consumer cost means price. For management cost means 'expenditure incurred' for producing a

particular product or rendering a particular service. The process of ascertaining the cost is known as

costing. It consists of principles and rules governing the procedure of finding out the costs of goods/

services. It aims at ascertaining the total cost and also per unit cost. For instance, in transport companies the

total cost for the period is ascertained and used to find out the cost per passenger/mile. i.e. the cost of

carrying one passenger for one mile. It provides for analysis of expenditure in such a way that the

management gets complete idea about even the smallest item of cost.

It is necessary to specify the exact meaning of “cost”. When the term is used specifically, it is modified with

such terms as prime cost, fixed cost, sunk cost, etc. Each description implies a certain characteristic which is

helpful in analysing the cost. It helps cost accounting in achieving its three basic objectives namely-cost

ascertainment, cost control and cost presentation.

A cost must always be studied in relation to its purpose and conditions. Different costs may be ascertained

for different purposes and under different conditions. Work-in-progress is valued at factory cost, while stock

of finished goods may be valued at cost of production. Even if the purpose of the study of cost is the same,

different conditions may lead to variation in cost. The cost per unit of a product is sure to vary with an

increase in the volume of output since the amount of fixed expenses to be borne by each unit of output

decreases.

It is also important to note here that there is no such thing as an exact cost or true cost because no figure of

cost is true in all circumstances and for all purposes. Most of the costing information is based on estimates;

for example, the amount of overheads is generally estimated in advance; it is distributed over cost units,

again on an estimated basis using different methods. Many items of cost of production are handled in an

optional manner which may give different costs for the same product without going against the accepted

principles in any way. Depreciation is one such item, the amount of which will vary in accordance with the

method of depreciation being used. Thus, to arrive at an absolutely correct cost may be quite difficult unless

one waits for a long time by which time the costing information may lose all its value.

Lesson 1 Introduction to Cost and Management Accounting

3

EVOLUTION OF COST ACCOUNTING

The history of accounting is as old as civilization. It is the process of identifying, measuring, recording and

communicating economic information, capable of being expressed in terms of money. The utility of

accounting information lies in its ability to reduce uncertainty. The information has to be relevant, verifiable,

quantifiable and free from bias.

Prior to the industrial revolution, businesses were small and characterized by simple market exchanges

between individuals and organizations. In those times there was a need of accurate book keeping though not

that much of cost accounting.

However, the industrial revolution in the 18

th

century brought large sized process industries performing single

activities (e.g. textiles, railways etc.). During this period, there was a lack of market for intermediary products

because of which cost information gained importance as a tool for measuring efficiency of different

processes. But the concept of prime cost was used around 1875 by some Industrialists. The period, 1880 AD

-1925 AD saw the development of complex product designs and the emergence of multi activity diversified

corporations like Du Pont, General Motors etc. It was during this period that scientific management was

developed which led accountants to convert physical standards into cost standard, the latter being used for

variance analysis and control. In 1913 J.L. Nicholson published a book “Cost Accounting Theory and

Practice” from New York.

During World War I and II the social importance of cost accounting grew with the growth of teach country's

defend expenditure. In the absence of competitive markets for most of the required to fight war, the

Governments in several countries placed cost-plus contracts under which the price to be paid was the cost of

production plus an agreed rate of profit. The reliance on cost information by the parties to defence contracts

continued after World War II as well. Even today, most of the government contracts are decided on a cost

plus basis.

COSTING, COST ACCOUNTING AND COST ACCOUNTANCY

Costing

Costing is the techniques and processes of ascertaining costs. These techniques consist of principles and

rules which govern the procedure of ascertaining cost of products or services. The techniques to be followed

for the analysis of expenses and the processes of different products or services differ from industry to

industry.

The main object of costing is the analysis of financial records, so as to subdivide expenditure and to allocate

it carefully to selected cost centers, and hence to build up a total cost for the departments, processes or jobs

or contracts of the undertaking.

Cost Accounting

Cost accounting may be regarded as ``a specialised branch of accounting which involves classification,

accumulation, assignment and control of costs.

The Costing terminology of C.I.M.A. London defines cost accounting as

``The establishment of budgets, standard costs and actual costs of operations, processes, activities or

products, and the analysis of variances, profitability or the social use of funds”.

`Wheldon defines cost accounting as “classifying, recording and appropriate allocation of expenditure for

EP-CMA

4

determination of costs of products or services and for the presentation of suitably arranged data for purposes

of control and guidance of management”. It is thus, a formal mechanism by means of which costs of products

or services are ascertained and controlled.

Cost accounting is different from costing in the sense that the former provides only the basis and information

for ascertainment of costs. Once the information is made available, costing can be carried out arithmetically

by means of memorandum statements or by method of integral accounting.

Cost Accountancy

Cost Accountancy has been defined as “the application of costing and cost accounting principles, methods

and techniques to the science, art and practice of cost control and the ascertainment of profitability. It

includes the presentation of information derived there from for the purpose of managerial decision making”.

REVIEW QUESTIONS

OBJECTIVES OF COST ACCOUNTING

Cost accounting aims at systematic recording of expenses and analysis of the same so as to ascertain the

cost of each product manufactured or service rendered by an organisation. Information regarding cost of

each product or service would enable the management to know where to economise on costs, how to fix

prices, how to maximise profits and so on. Thus, the main objects of cost accounting are the following:

(1) To analyse and classify all expenditures with reference to the cost of products and operations.

(2) To arrive at the cost of production of every unit, job, operation, process, department or service and

to develop cost standard.

(3) To indicate to the management any inefficiencies and the extent of various forms of waste, whether

of materials, time, expenses or in the use of machinery, equipment and tools. Analysis of the

causes of unsatisfactory results may indicate remedial measures.

(4) To provide data for periodical profit and loss accounts and balance sheets at such intervals, e.g.,

weekly, monthly or quarterly, as may be desired by the management during the financial year, not

only for the whole business but also by departments or individual products. Also, to explain in detail

the exact reasons for profit or loss revealed in total, in the profit and loss account.

(5) To reveal sources of economies in production having regard to methods, types of equipment,

design, output and layout. Daily, weekly, monthly or quarterly information may be necessary to

ensure prompt and constructive action.

(6) To provide actual figures of cost for comparison with estimates and to serve as a guide for future

estimates or quotations and to assist the management in their price-fixing policy.

State whether the following statement is “True” or “False”

Costing and Cost Accounting are the same thing:

• True

• False

Correct answer: False

Lesson 1 Introduction to Cost and Management Accounting

5

(7) To show, where standard costs are prepared, what the cost of production ought to be and with

which the actual costs which are eventually recorded may be compared.

(8) To present comparative cost data for different periods and various volumes of output.

(9) To provide a perpetual inventory of stores and other materials so that interim profit and loss account

and balance sheet can be prepared without stock taking and checks on stores and adjustments are

made at frequent intervals. Also to provide the basis for production planning and for avoiding

unnecessary wastages or losses of materials and stores.

(10) To provide information to enable management to make short-term decisions of various types, such

as quotation of price to special customers or during a slump, make or buy decision, assigning

priorities to various products, etc.

IMPORTANCE OF COST ACCOUNTING

The limitations of financial accounting have made the management to realise the importance of cost

accounting. Whatever may be the type of business, it involves expenditure on labour, materials and other

items required for manufacturing and disposing of the product. The management has to avoid the possibility

of waste at each stage. It has to ensure that no machine remains idle, efficient labour gets due incentive, by-

products are properly utilised and costs are properly ascertained. Besides the management, the creditors

and employees are also benefited in numerous ways by installation of a good costing system. Cost

accounting increases the overall productivity of an organisation and serves as an important tool, in bringing

prosperity to the nation. Thus, the importance of cost accounting can be discussed under the following

headings:

(a) Costing as an Aid to Management

Cost accounting provides invaluable aid to management. It provides detailed costing information to the

management to enable them to maintain effective control over stores and inventory, to increase efficiency of

the organisation and to check wastage and losses. It facilitates delegation of responsibility for important

tasks and rating of employees. For all these, the management should be capable of using the information

provided by cost accounts in a proper way. The various advantages derived by the management from a good

system of costing are as follows:

1. Cost accounting helps in periods of trade depression and trade competition - In periods of

trade depression, the organisation cannot afford to have losses which pass unchecked. The

management must know the areas where economies may be sought, waste eliminated and

efficiency increased. The organisation has to wage a war not only for its survival but also continued

growth. The management should know the actual cost of their products before embarking on any

scheme of price reduction. Adequate system of costing facilitates this.

2. Cost accounting aids price fixation - Although the law of supply and demand to a great extent

determines the price of the article, cost to the producer does play an important role. The producer

can take necessary guidance from his costing records in case he is in a position to fix or change the

price charged.

3. Cost accounting helps in making estimates - Adequate costing records provide a reliable basis

for making estimates and quoting tenders.

EP-CMA

6

4. Cost accounting helps in channelising production on right lines - Proper costing information

makes it possible for the management to distinguish between profitable and non-profitable activities.

Profits can be maximised by concentrating on profitable operations and eliminating non-profitable

ones.

5. Cost accounting eliminates wastages - As cost accounting is concerned with detailed break-up of

costs, it is possible to check various forms of wastages or losses.

6. Cost accounting makes comparisons possible - Proper maintenance of costing records provides

various costing data for comparisons which in turn helps the management in formulation of future

lines of action.

7. Cost accounting provides data for periodical profit and loss account - Adequate costing

records provide the management with such data as may be necessary for preparation of profit and

loss account and balance sheet at such intervals as may be desired by the management.

8. Cost accounting helps in determining and enhancing efficiency - Losses due to wastage of

materials, idle time of workers, poor supervision, etc., will be disclosed if the various operations

involved in the production are studied carefully. Efficiency can be measured, costs controlled and

various steps can be taken to increase the efficiency.

9. Cost accounting helps in inventory control - Cost accounting furnishes control which

management requires in respect of stock of materials, work-in-progress and finished goods.

(b) Costing as an Aid to Creditors

Investors, banks and other money lending institutions have a stake in the success of the business concern

and are, therefore, benefited immensely by the installation of an efficient system of costing. They can base

their judgment about the profitability and future prospects of the enterprise on the costing records.

(c) Costing as an Aid to Employees

Employees have a vital interest in their employer’s enterprise in which they are employed. They are

benefited by a number of ways by the installation of an efficient system of costing. They are benefited,

through continuous employment and higher remuneration by way of incentives, bonus plans, etc.

(d) Costing as an Aid to National Economy

An efficient system of costing brings prosperity to the business enterprise which in turn results in stepping up

of the government revenue. The overall economic development of a country takes place as a consequence

increase in efficiency of production. Control of costs, elimination of wastages and inefficiencies led to the

progress of the industry and, in consequence of the nation as a whole.

SCOPE OF COST ACCOUNTING

The Scope of Cost Accounting Is Very Wide and Includes:

(a) Cost Ascertainment: The main function of cost accounting is the ascertainment of cost of product or

services rendered. It includes collection, analysis of expenses and measurement of production at

different stages of manufacture. The collection, analysis and measurement requires different

methods of costing for different types of production such as Historical costs, Standard costs,

Process cost, Operation cost etc.

Lesson 1 Introduction to Cost and Management Accounting

7

It can be done in two ways, namely

(i) Post Costing, where the ascertainment of cost is done based on actual information as recorded

in financial books.

(ii) Continuous Costing, where the process of ascertainment is of a continuous nature i.e. where

cost information is available as and when a particular activity is completed, so that the entire

cost of a particular job is available the moment it is completed.

(b) Control of Costs: In the era of competition, the goal of every business is to sustain; in costs at the

lowest point with efficient operating conditions. To sustain, It is essential to examine each individual

item of cost in the light of the services or benefits obtained so that maximum utilisation of the money

expended or- it may be recovered. This requires planning and use of standard for each item of cost

for locating deviations, if any, and taking remedial measures.

(c) Proper matching of cost with revenue: In cost accounting manager prepares monthly or quarterly

statements to reflect the cost and income data identified with the sale of that period.

(d) Aids to Management Decision-making: Decision-making is a process of choosing between two or

more alternatives, based on the resultant outcome of the various alternatives. A Cost Benefit

Analysis also needs to be done. All this can be achieved through a good cost accounting system

CLASSIFICATION OF COSTS

The different bases of cost classification are:

(1) By time (Historical, Pre-determined).

(2) By nature or elements (Material, Labour and Overhead).

(3) By degree of traceability to the product (Direct, Indirect).

(4) Association with the product (Product, Period).

(5) By Changes in activity or volume (Fixed, Variable, Semi-variable).

(6) By function (Manufacturing, Administrative, Selling, Research and development, Pre-production).

(7) Relationship with accounting period (Capital, Revenue).

(8) Controllability (Controllable, Non-controllable).

(9) Cost for analytical and decision-making purposes (Opportunity, Sunk, Differential, Joint, Common,

Imputed, Out-of-pocket, Marginal, Uniform, Replacement).

(10) Others (Conversion, Traceable, Normal, Avoidable, Unavoidable, Total).

1. Classification on the Basis of Time

(a) Historical Costs: These costs are ascertained after they are incurred. Such costs are available

only when the production of a particular thing has already been done. They are objective in nature

and can be verified with reference to actual operations.

(b) Pre-determined Costs: These costs are calculated before they are incurred on the basis of a

specification of all factors affecting cost. Such costs may be:

(i) Estimated costs: Costs are estimated before goods are produced; these are naturally less

accurate than standards.

EP-CMA

8

(ii) Standard costs: This is a particular concept and technique. This method involves:

(a) setting up predetermined standards for each element of cost and each product;

(b) comparison of actual with standard to find variation;

(c) pin-pointing the causes of such variances and taking remedial action.

Obviously, standard costs, though pre-determined, are arrived with much greater care than estimated costs.

2. By Nature or Elements

There are three broad elements of costs:

(1) Material: The substance from which the product is made is known as material. It can be direct as

well as indirect.

Direct material: It refers to those materials which become a major part of the finished product and

can be easily traceable to the units. Direct materials include:

(i) All materials specifically purchased for a particular job/process.

(ii) All material acquired and latter requisitioned from stores.

(iii) Components purchased or produced.

(iv) Primary packing materials.

(v) Material passing from one process to another.

Indirect material: All material which is used for purposes ancillary to production and which can be

conveniently assigned to specific physical units is termed as indirect materials. Examples, oil,

grease, consumable stores, printing and stationary material etc.

(2) Labour: Labour cost can be classified into direct labour and indirect labour.

Direct labour: It is defined as the wages paid to workers who are engaged in the production process

whose time can be conveniently and economically traceable to units of products. For example, wages

paid to compositors in a printing press, to workers in the foundry in cast iron works etc.

Indirect labour: Labour employed for the purpose of carrying tasks incidental to goods or services

provided, is indirect labour. It cannot be practically traced to specific units of output. Examples,

wages of store-keepers, foreman, time-keepers, supervisors, inspectors etc.

(3) Expenses: Expenses may be direct or indirect.

Direct expenses: These expenses are incurred on a specific cost unit and identifiable with the cost

unit. Examples are cost of special layout, design or drawings, hiring of a particular tool or equipment

for a job; fees paid to consultants in connection with a job etc.

Indirect expenses: These are expenses which cannot be directly, conveniently and wholly

allocated to cost centre or cost units. Examples are rent, rates and taxes, insurance, power, lighting

and heating, depreciation etc.

It is to be noted that the term overheads has a wider meaning than the term indirect expenses. Overheads

include the cost of indirect material, indirect labour and indirect expenses. overheads may be classified as

(a) production or manufacturing overheads, (b) administration overheads, (c) selling overheads, and (d)

distribution overheads.

Lesson 1 Introduction to Cost and Management Accounting

9

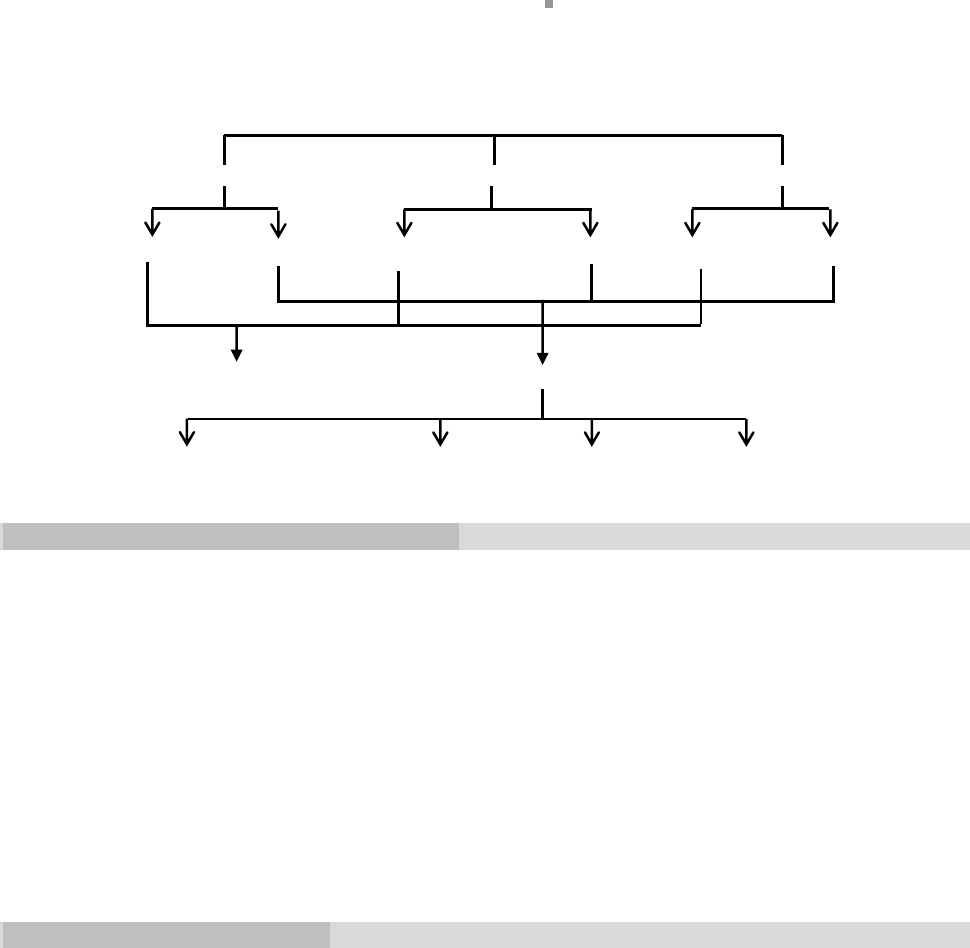

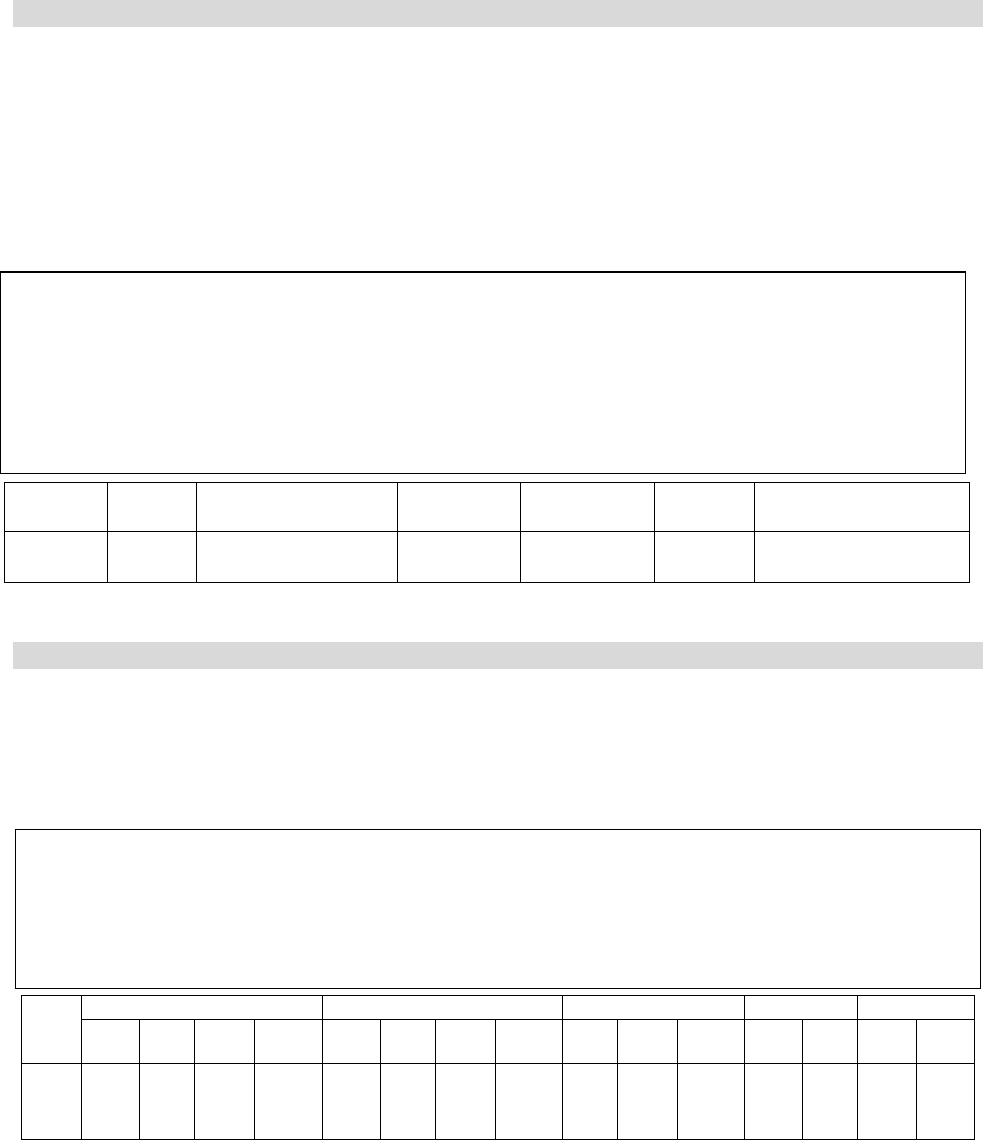

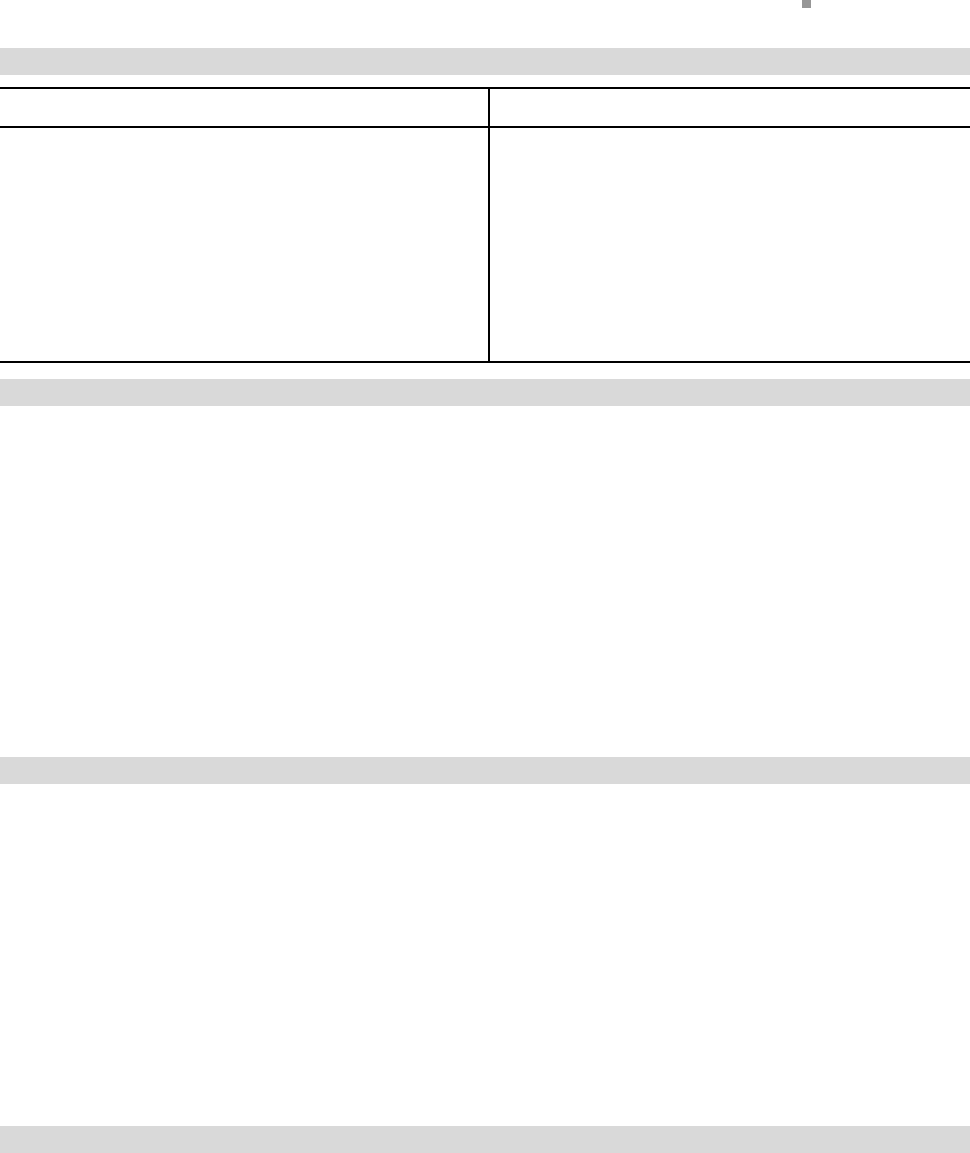

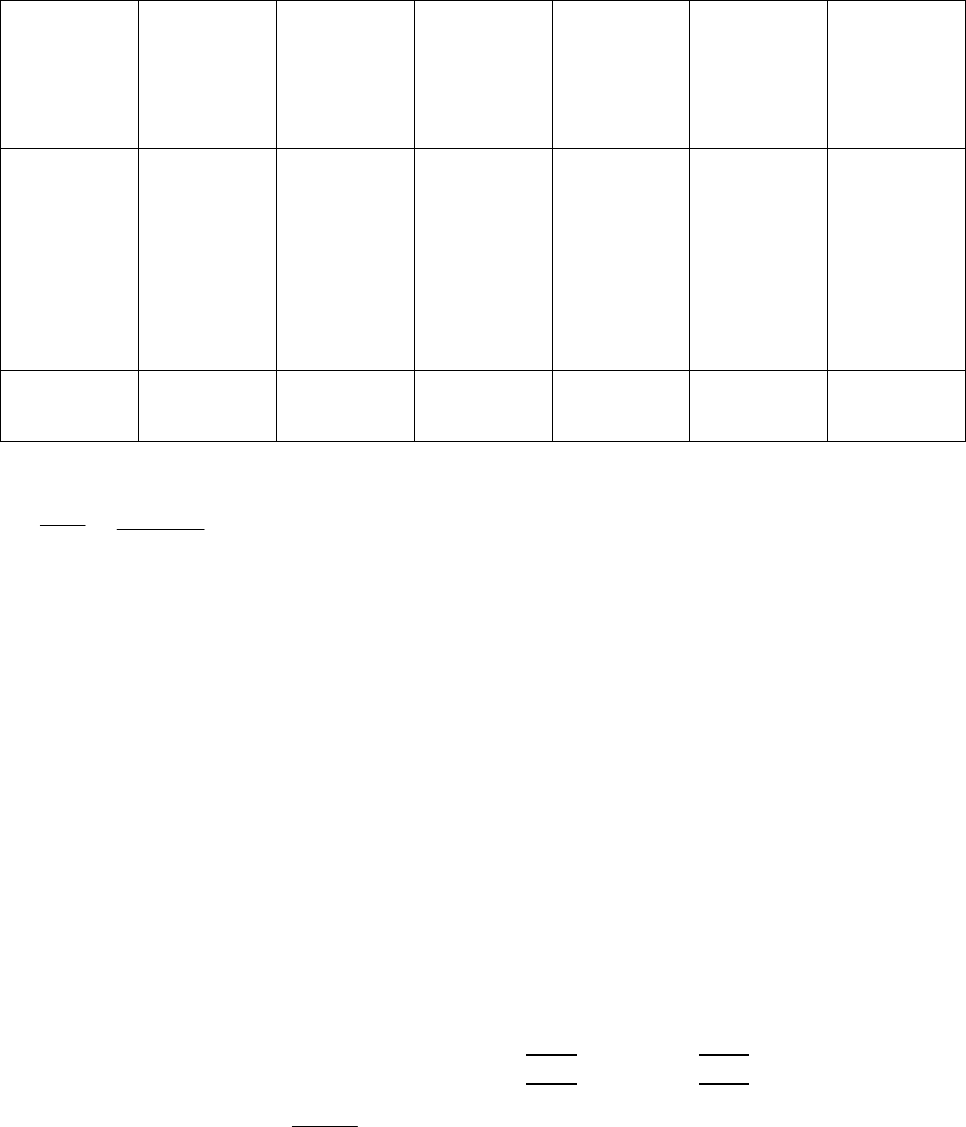

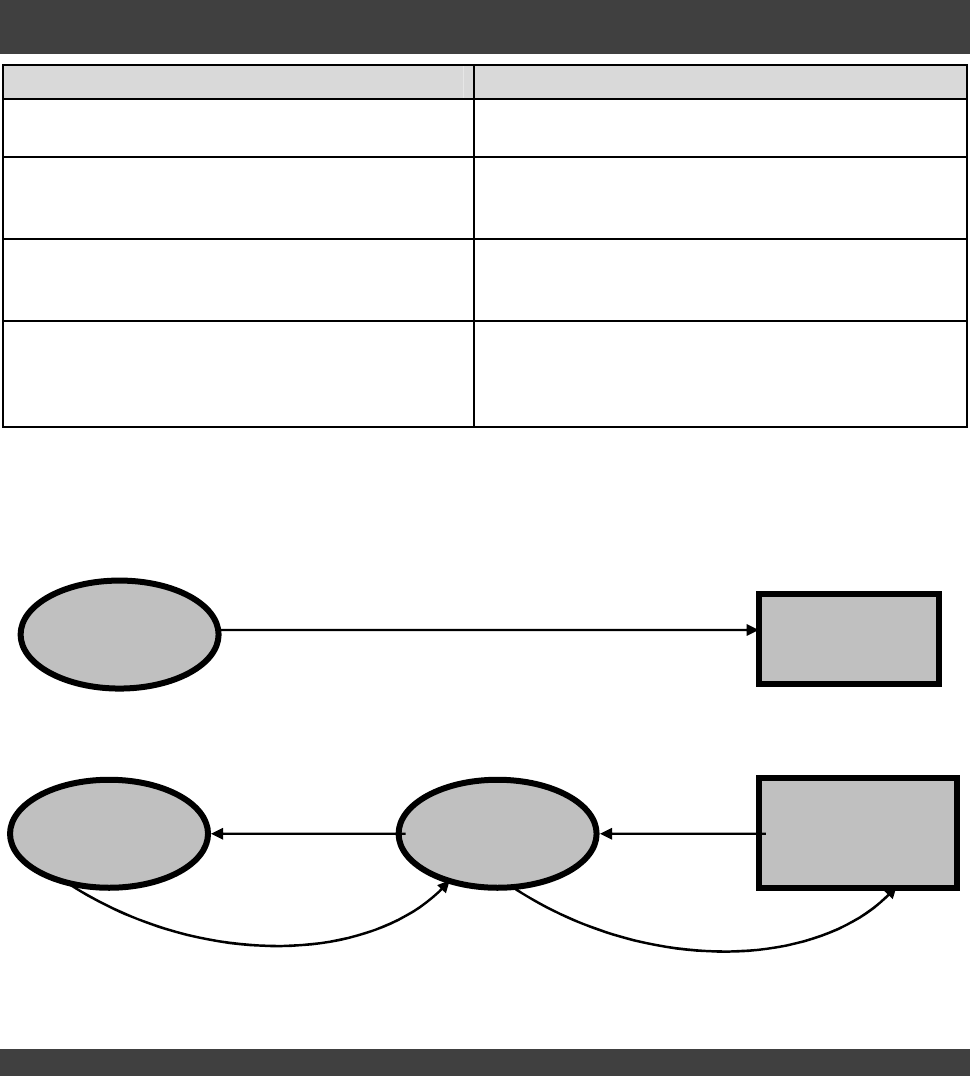

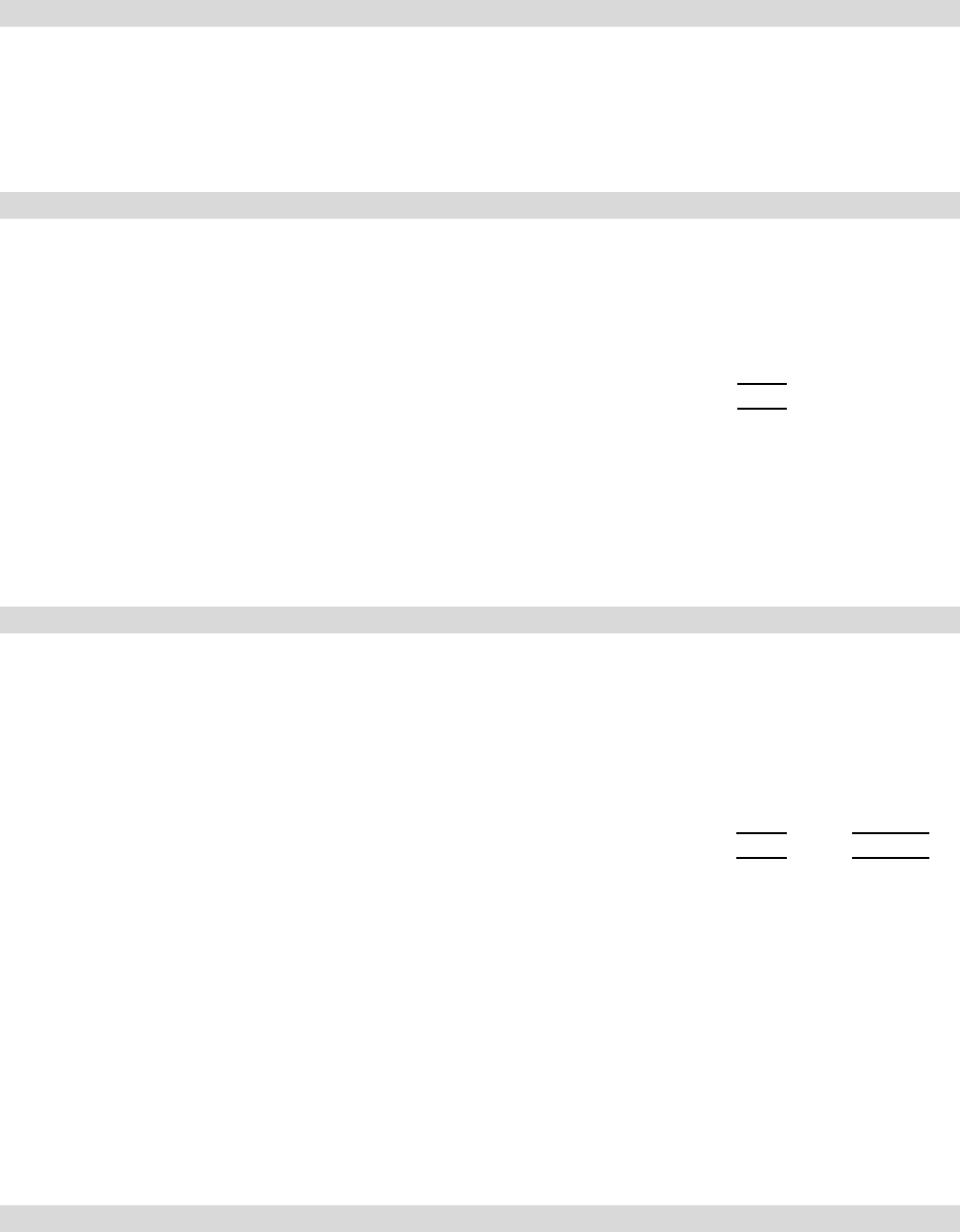

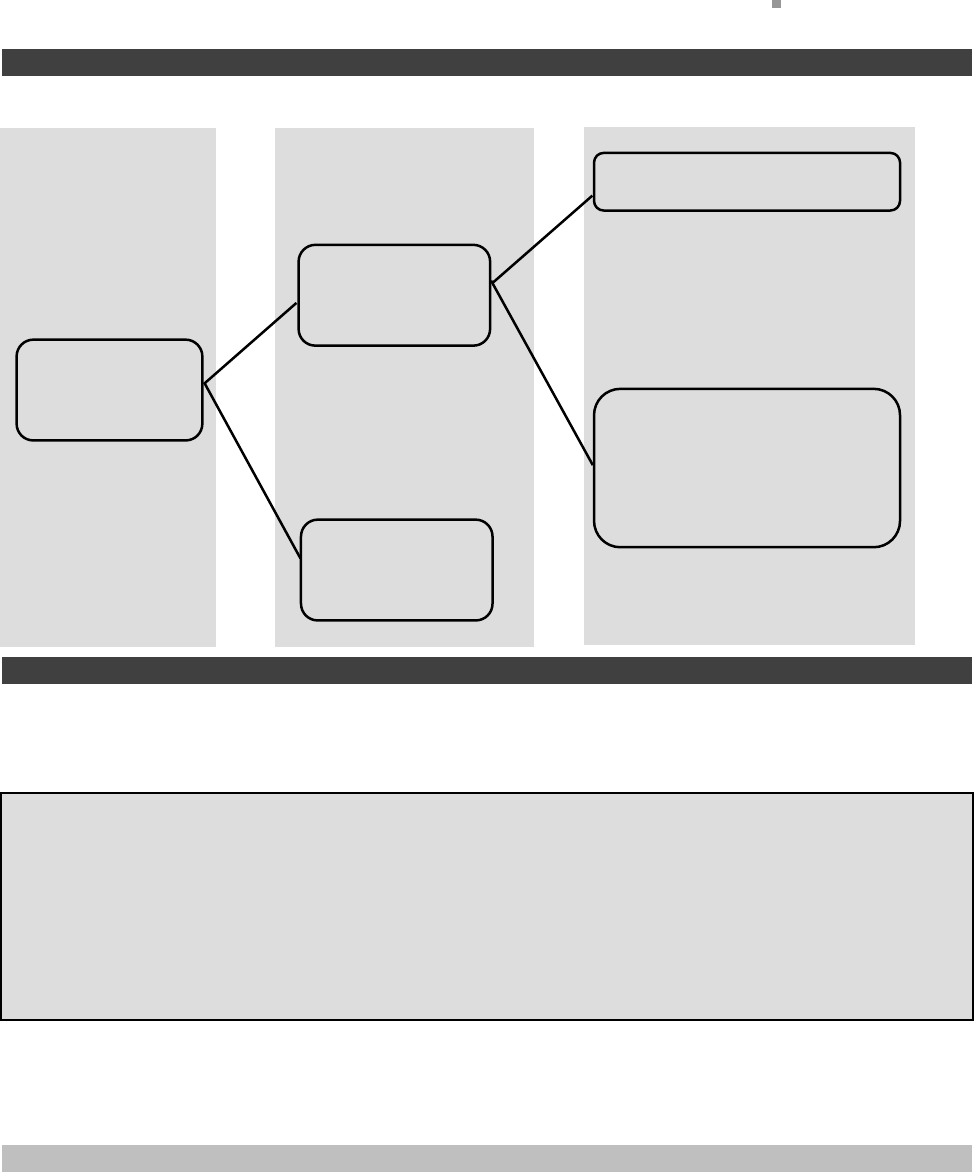

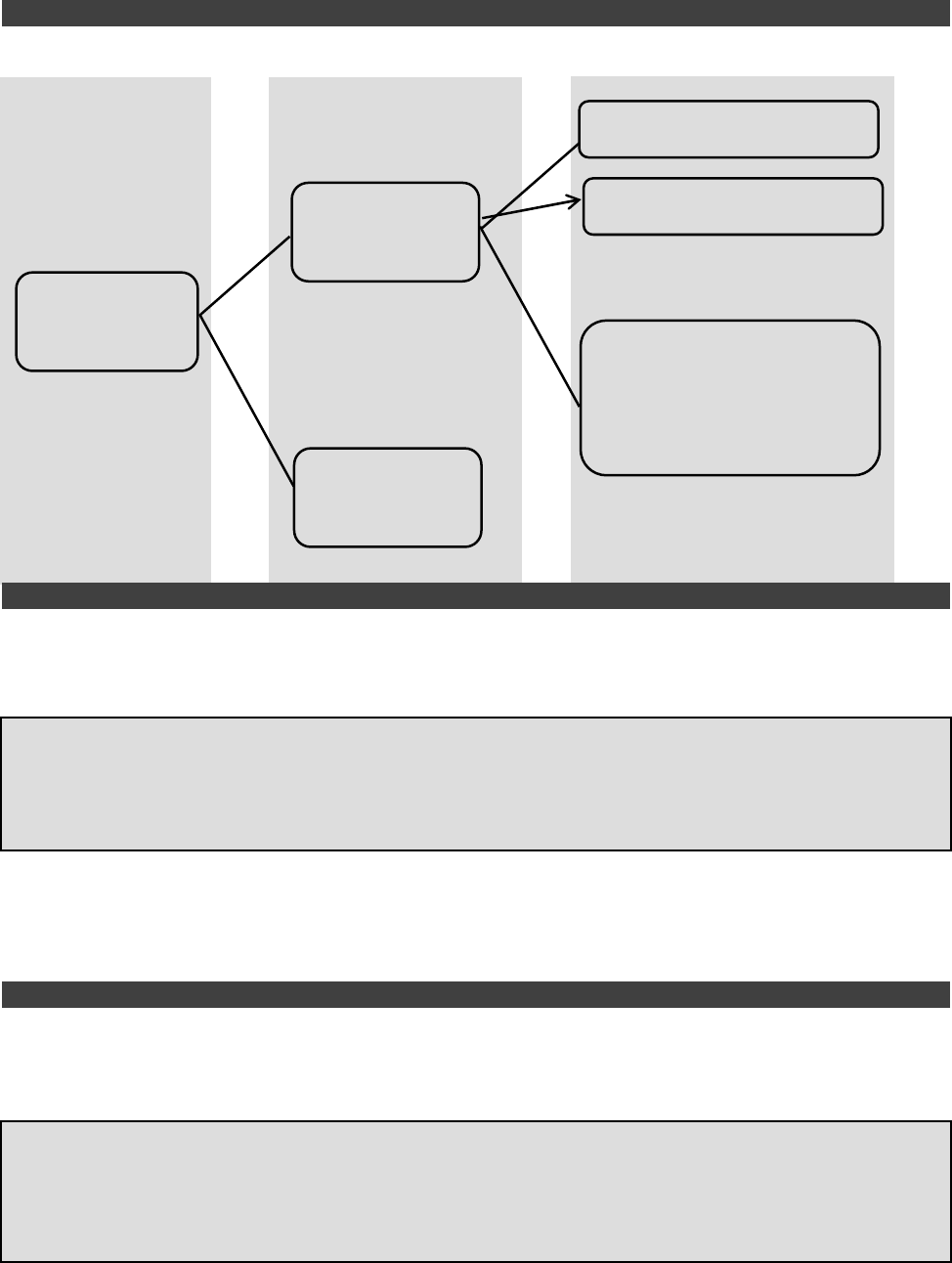

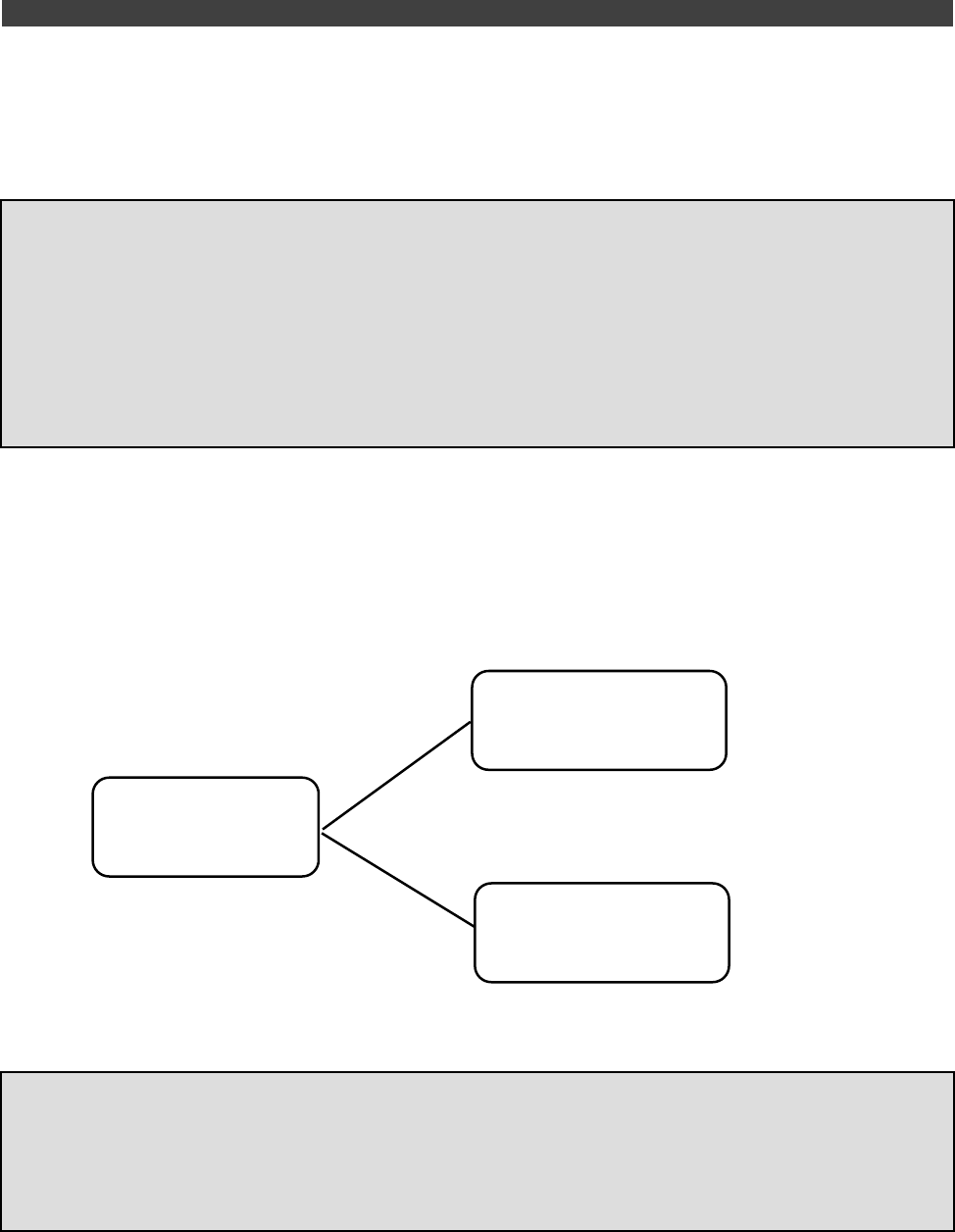

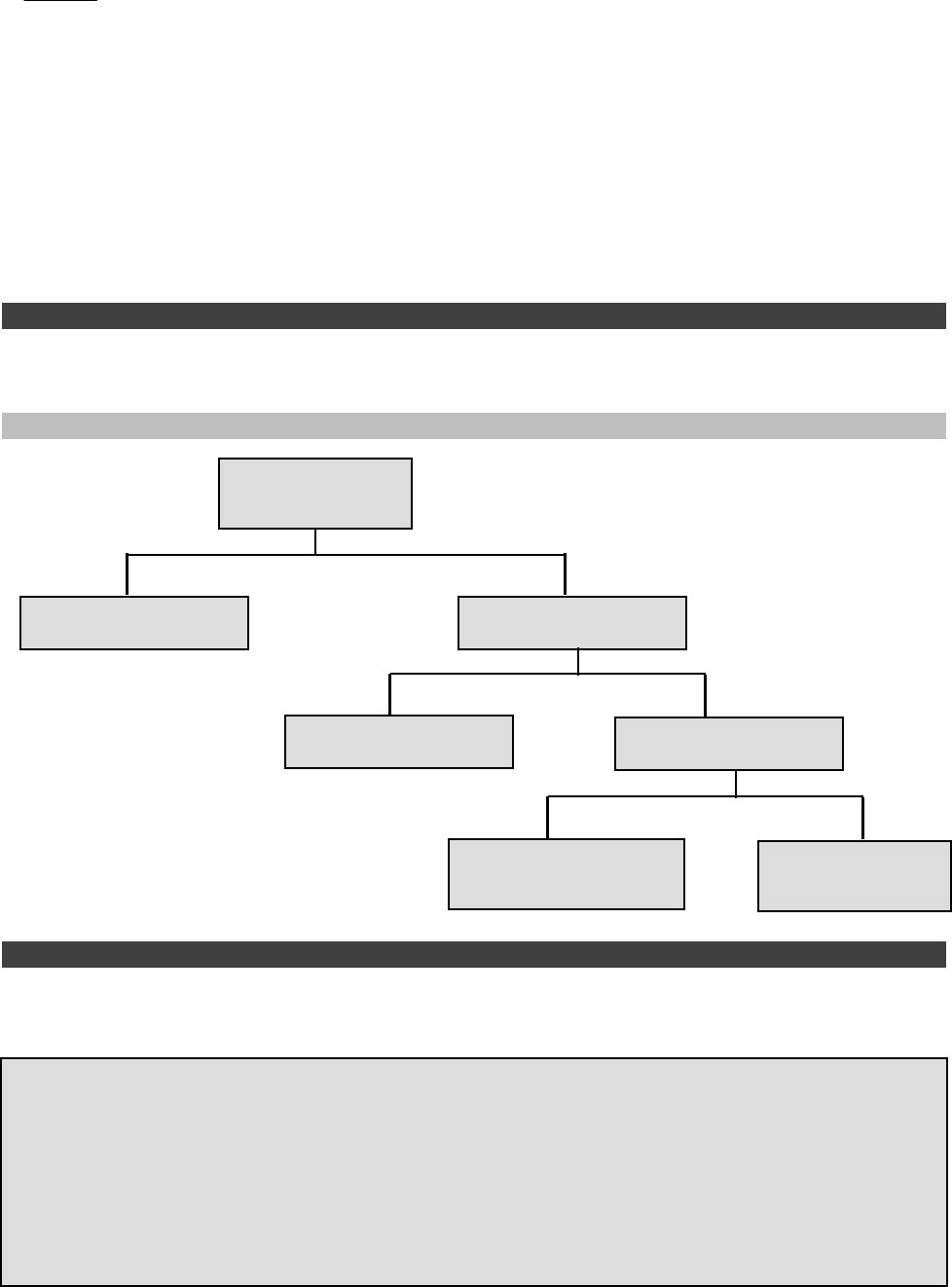

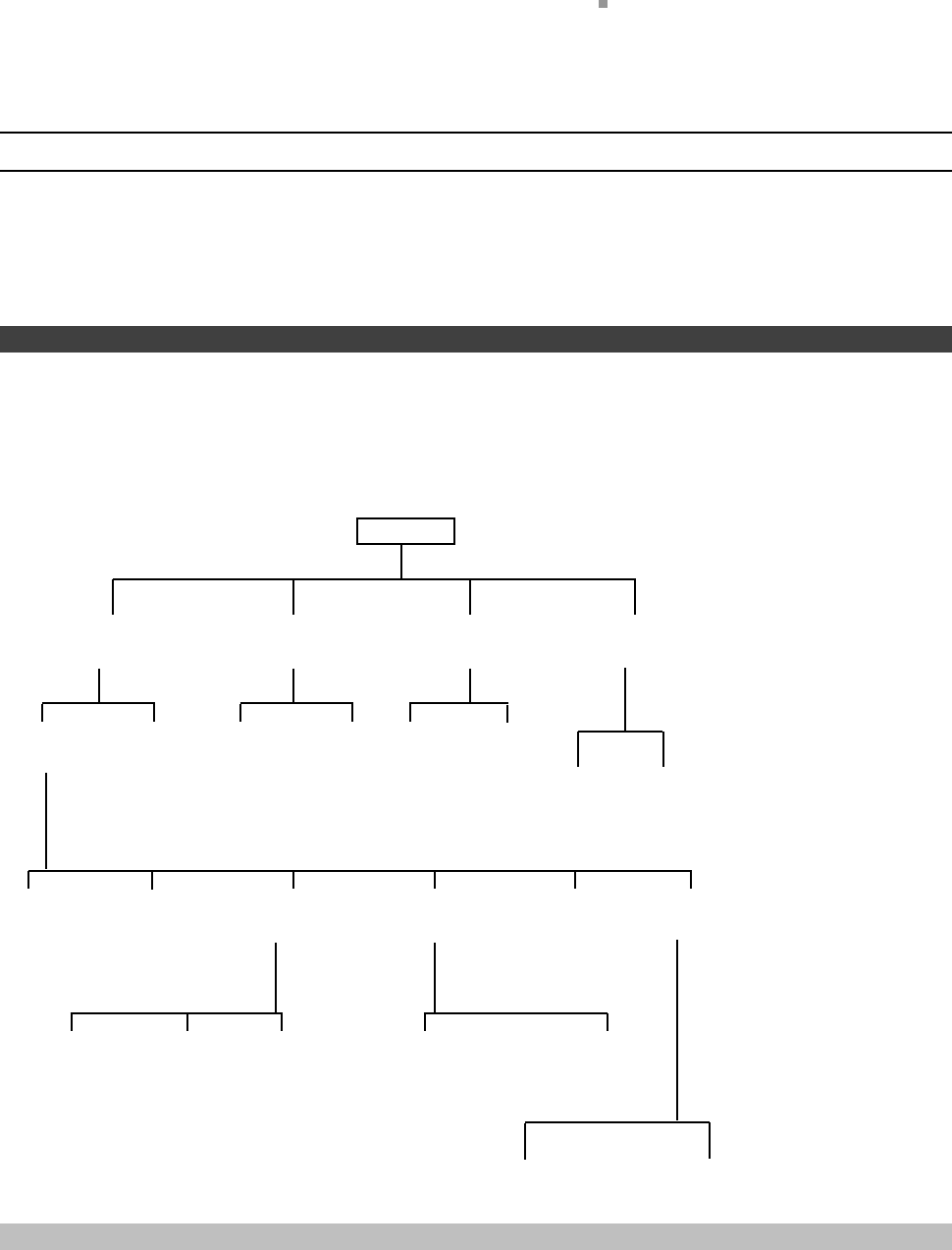

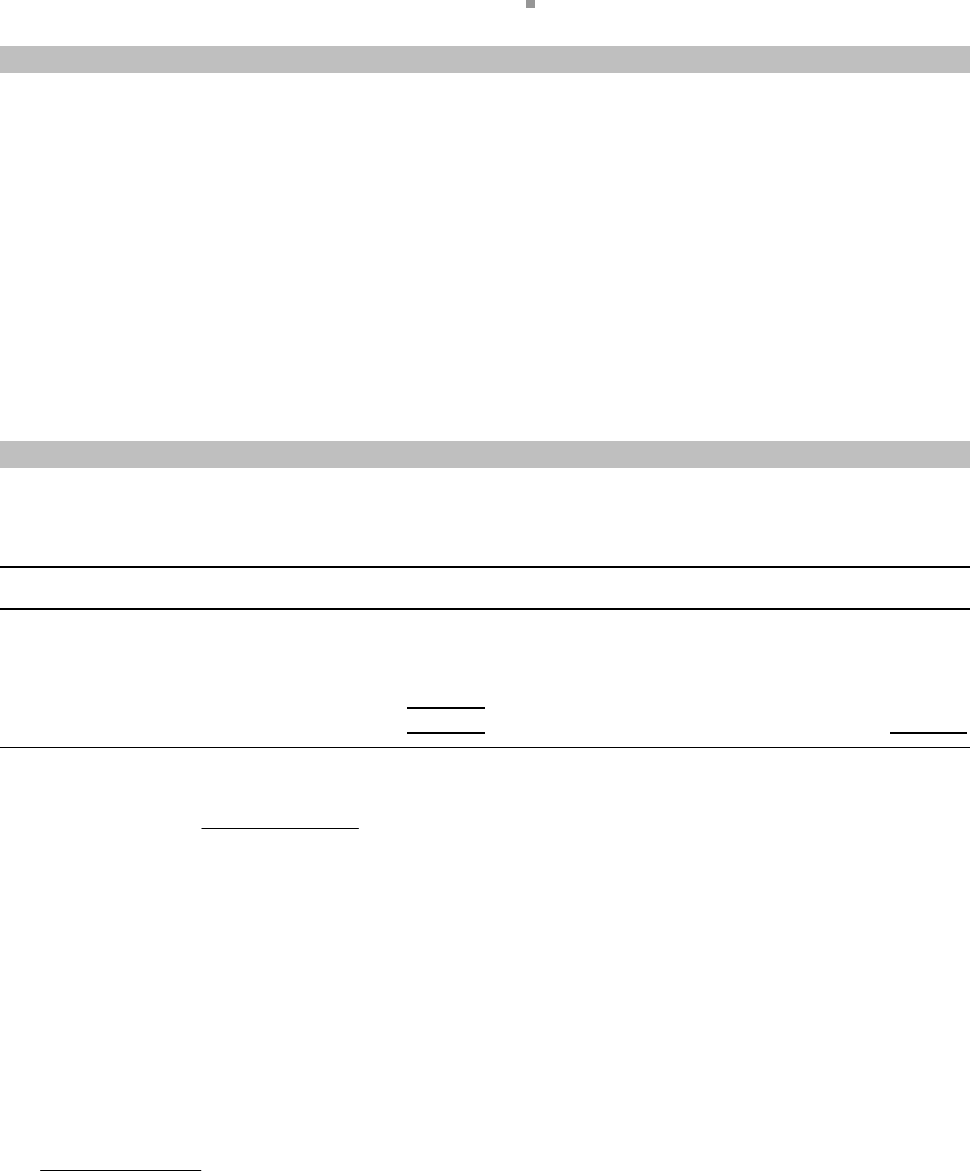

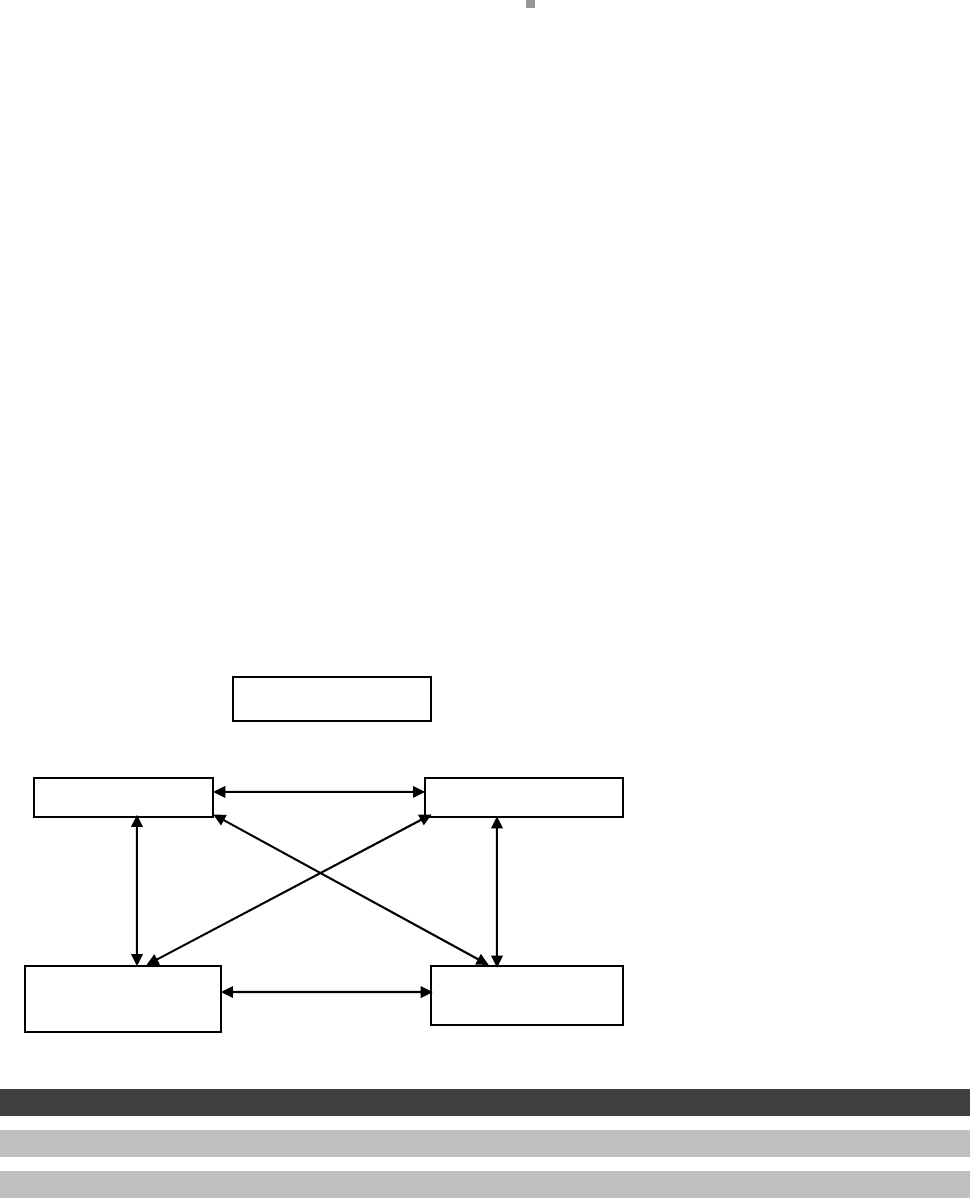

The various elements of cost can be illustrated by the following chart:

Elements of Cost

Material Labour Other expenses

Direct Indirect Direct Indirect Direct Indirect

Prime Cost Overheads

Production/Manufacturing Administration Selling Distribution

overheads overheads overheads overheads

3. By Degree of Traceability to the Products

Cost can be distinguished as direct and indirect.

Direct Costs: The direct costs are those which can be easily traceable to a product or costing unit or cost

center or some specific activity, e.g. cost of wood for making furniture. It is also called traceable cost.

Indirect Costs : The indirect costs are difficult to trace to a single product or it is uneconomic to do so. They

are common to several products, e.g. salary of a factory manager. It is also called common costs.

Costs may be direct or indirect with respect to a particular division or department. For example, all the costs

incurred in the Power House are indirect as far as the main product is concerned but as regards the Power

House itself, the fuel cost or supervisory salaries are direct. It is necessary to know the purpose for which

cost is being ascertained and whether it is being associated with a product, department or some activity.

Direct cost can be allocated directly to costing unit or cost center. Whereas Indirect costs have to be

apportioned to different products, if appropriate measurement techniques are not available. These may

involve some formula or base which may not be totally correct or exact.

4. Association with the Product

Cost can be classified as product costs and period costs.

Product Costs: Product costs are those which are traceable to the product and included in inventory values.

In a manufacturing concern it comprises the cost of direct materials, direct labour and manufacturing

overheads. Product cost is a full factory cost. Product costs are used for valuing inventories which are shown

in the balance sheet as asset till they are sold. The product cost of goods sold is transferred to the cost of

goods sold account.

Period Costs: Period costs are incurred on the basis of time such as rent, salaries, etc., include many

selling and administrative costs essential to keep the business running. Though they are necessary to

generate revenue, they are not associated with production, therefore, they cannot be assigned to a product.

They are charged to the period in which they are incurred and are treated as expenses.

Selling and administrative costs are treated as period costs for the following reasons:

(i) Most of these expenses are fixed in nature.

(ii) It is difficult to apportion these costs to products equitably.

EP-CMA

10

(iii) It is difficult to determine the relationship between such cost and the product.

(iv) The benefits accruing from these expenses cannot be easily established.

The net income of a concern is influenced by both product and period costs. Product costs are included in

the cost of the product and do not affect income till the product is sold. Period costs are charged to the

period in which they are incurred.

5. By Changes in Activity or Volume

Costs can be classified as fixed, variable and semi-variable cost.

Fixed Costs: The Chartered Institute of Management Accountants, London, defines fixed cost as “ the cost

which is incurred for a period, and which, within certain output and turnover limits, tends to be unaffected by

fluctuations in the levels of activity (output or turnover)”.

These costs are incurred so that physical and human facilities necessary for business operations, can be

provided. These costs arise due to contractual obligations and management decisions. They arise with the

passage of time and not with production and are expressed in terms of time. Examples are rent, property-

taxes, insurance, supervisors’ salaries etc.

It is wrong to say that fixed costs never change. These costs may vary depending on the circumstances. The

term fixed refer to non-variability related to the relevant range. Fixed cost can be classified into the following

categories for the purpose of analysis:

(a) Committed Costs: These costs are incurred to maintain certain facilities and cannot be quickly

eliminated. The management has little or no discretion in this cost, e.g., rent, insurance etc.

(b) Policy and Managed Costs: Policy costs are incurred for implementing particular management

policies such as executive development, housing, etc. Such costs are often discretionary. Managed

costs are incurred to ensure the operating existence of the company e.g., staff services.

(c) Discretionary Costs: These are not related to the operations and can be controlled by the

management. These costs result from special policy decisions, new researches etc., and can be

eliminated or reduced to a desirable level at the discretion of the management.

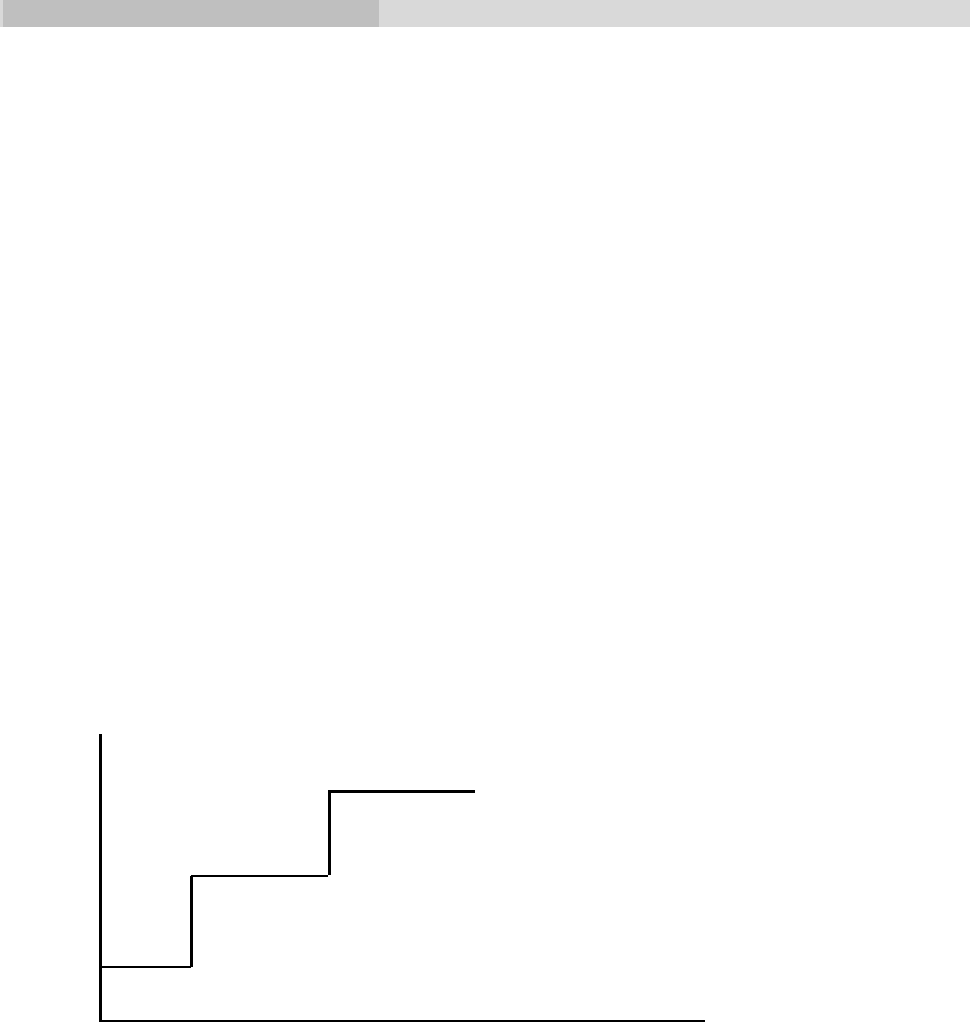

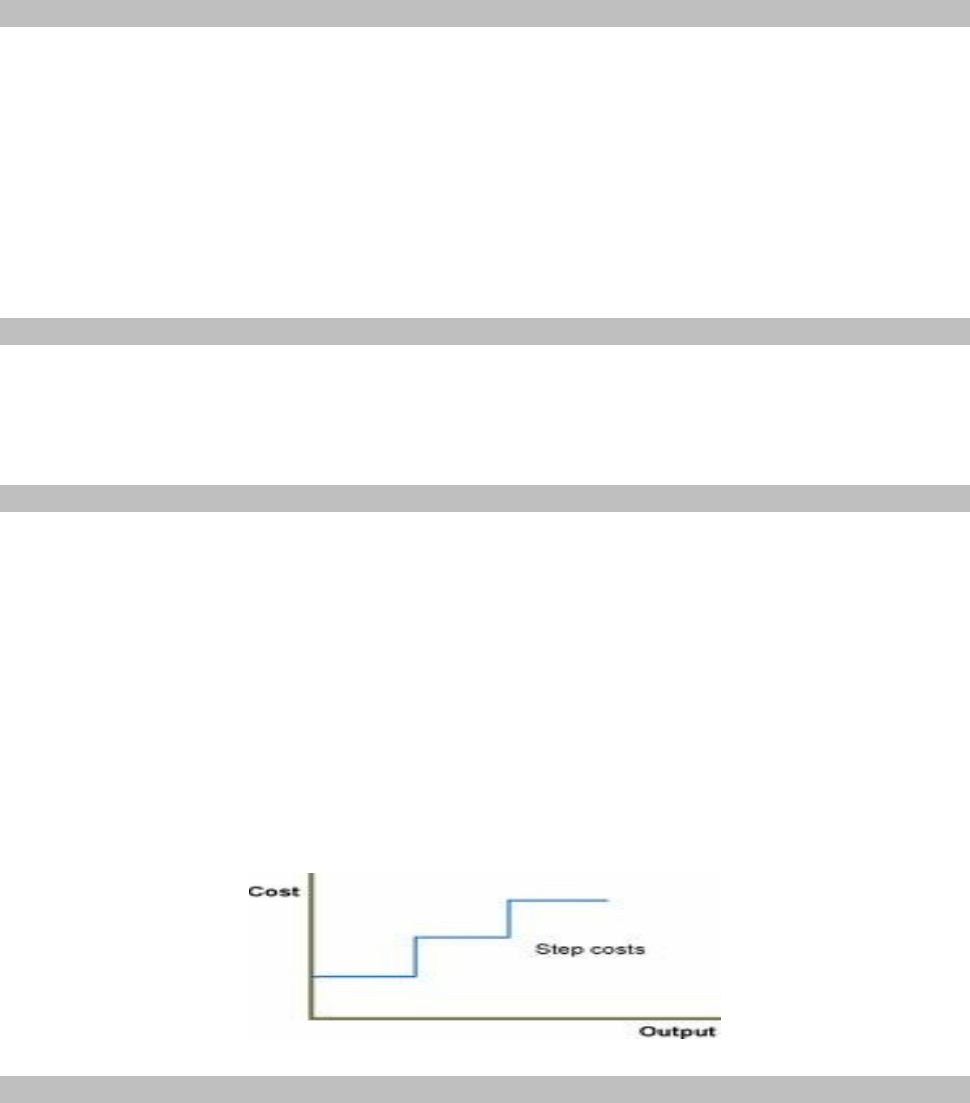

(d) Step Costs: Such costs are constant for a given level of output and then increase by a fixed

amount at a higher level of output.

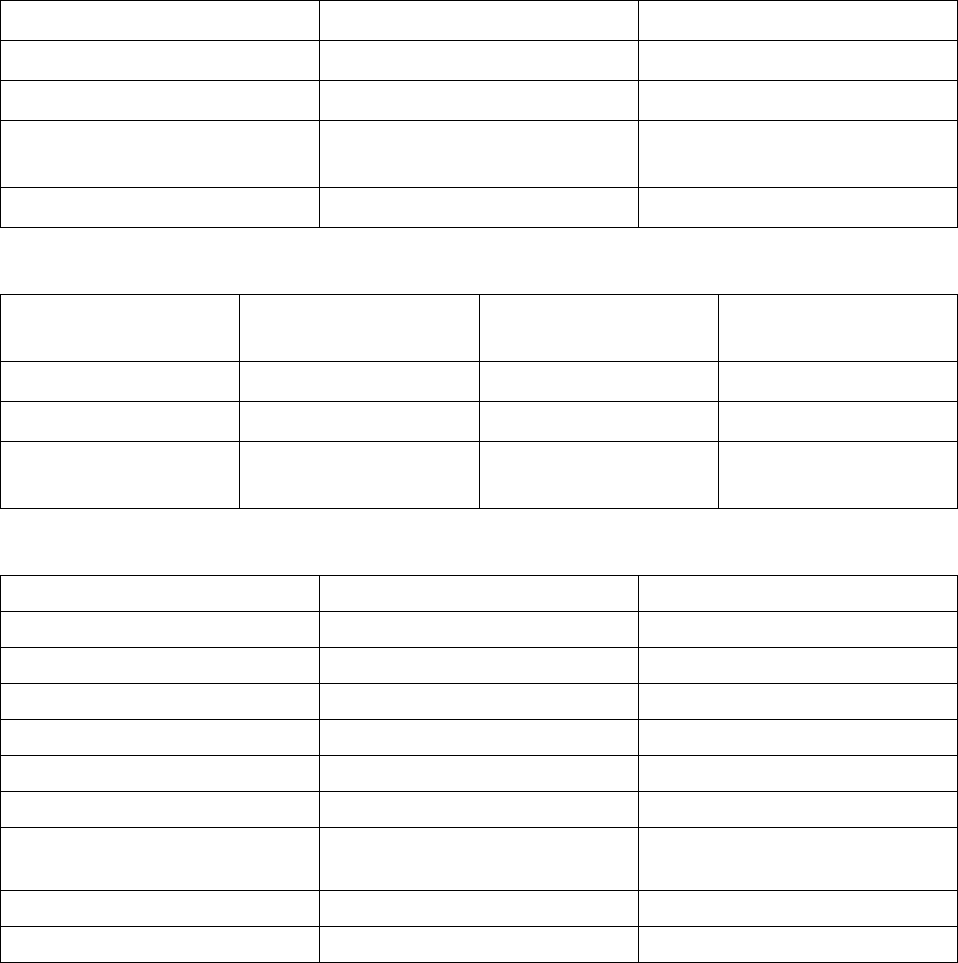

Y

50

40

30

20

10

X

0 10 20 30 40 50

Relevant Range

Production Units (in thousands)

Lesson 1 Introduction to Cost and Management Accounting

11

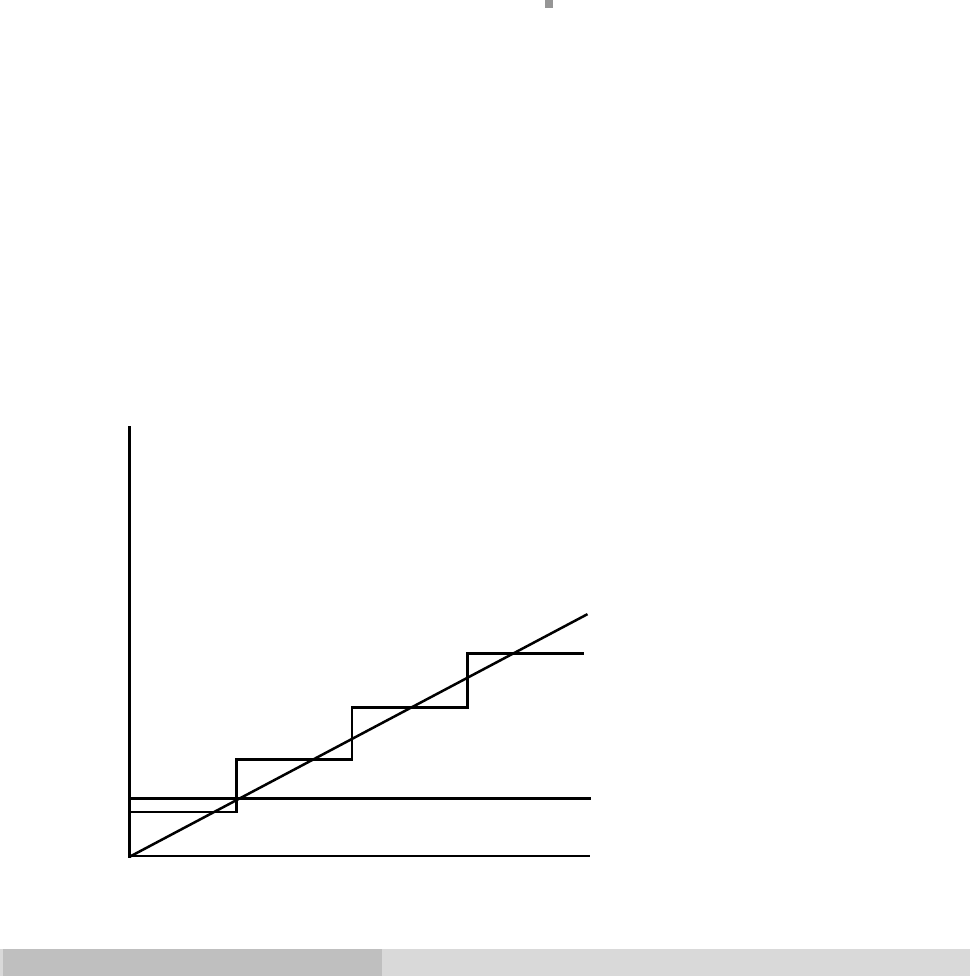

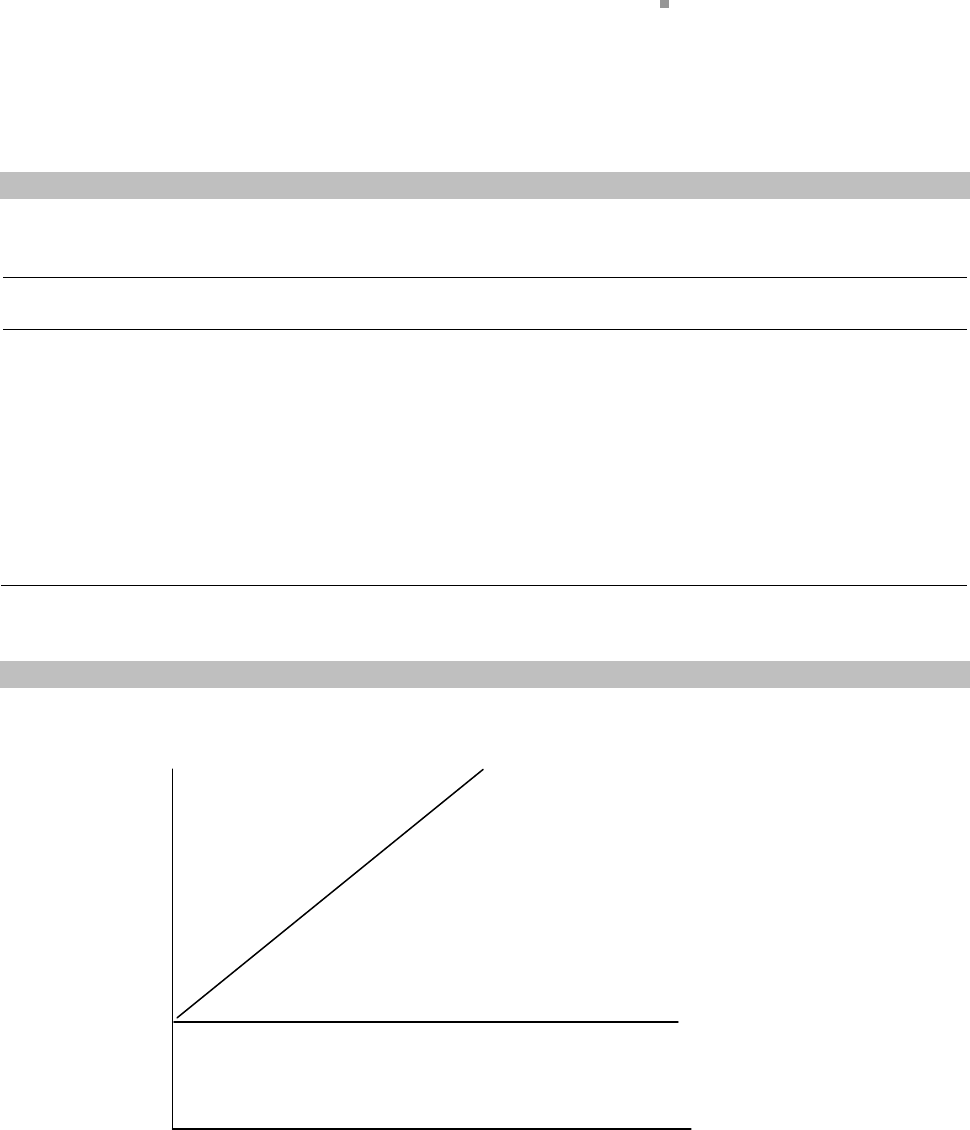

Variable Cost: Variable costs are those costs that vary directly and proportionately with the output e.g. direct

materials, direct labour. It should be kept in mind that the variable cost per unit is constant but the total cost

changes corresponding to the levels of output. It is always expressed in terms of units, not in terms of time.

Management decisions can influence the cost behaviour patterns. The concept of variability is relative. If the

conditions upon which variability was determined changes, the variability will have to be determined again.

Semi-fixed (Semi-Variable) costs: Such costs contain fixed and variable elements. Because of the variable

element, they fluctuate with volume and because of the fixed element; they do not change in direct

proportion to output. Semi-variable costs change in the same direction as that of the output but not in the

same proportion. Depreciation is an example; for two shifts working the total depreciation may be only 50%

more than that for single shift working. They may change with comparatively small changes in output but not

in the same proportion.

Y

5

4

3

Variable Cost

2

Semi Variable

1 Cost

Fixed Cost

X

0 1 2 3 4 5

Production Units (in thousands)

6. Functional Classification of Costs

A company performs a number of functions. Functional costs may be classified as follows:

(a) Manufacturing/production Costs: It is the cost of operating the manufacturing division of an

undertaking. It includes the cost of direct materials, direct labour, direct expenses, packing (primary)

cost and all overhead expenses relating to production.

(b) Administration Costs: They are indirect and covers all expenditure incurred in formulating the

policy, directing the organisation and controlling the operation of a concern, which is not related to

research, development, production, distribution or selling functions.

(c) Selling and Distribution Cost: Selling cost is the cost of seeking to create and stimulate demand

e.g. advertisements, market research etc. Distribution cost is the expenditure incurred which begins

with making the package produced available for dispatch and ends with making the reconditioned

packages available for re-use e.g. warehousing, cartage etc. It includes expenditure incurred in

EP-CMA

12

transporting articles to central or local storage. Expenditure incurred in moving articles to and from

prospective customers as in the case of goods on sale or return basis is also distribution cost.

(d) Research and Development Costs: They include the cost of discovering new ideas, process,

products by experiment and implementing such results on a commercial basis.

(e) Pre-production Cost: When a new factory is started or when a new product is introduced, certain

expenses are incurred. There are trial runs. Such costs are termed as pre-production costs and

treated as deferred revenue expenditure. They are charged to the cost of future production.

7. Relationships with Accounting Period

Costs can be capital and revenue.

Capital expenditure provides benefit to future period and is classified as an asset. On the other hand,

revenue expenditure benefits only the current period and is treated as an expense. As and when an asset is

written off, capital expenses to that extent becomes cost. Only when capital and revenue is properly

differentiated, the income of a particular period can be correctly determined. It is not possible to distinguish

between the two under all circumstances.

8. Controllability

Cost can be Controllable and Non-Controlable.

Controllable Cost: The Chartered Institute of Management Accountants defines controllable cost as “cost

which can be influenced by its budget holder”.

Non-Controllable Cost: It is the cost which is not subject to control at any level of managerial supervision.

The difference between the terms is very important for the purpose of cost accounting, cost control and

responsibility accounting.

A controllable cost can be controlled by a person at a given organisational level. Controllable cost are not

totally controllable. Some costs are partly controllable by one person and partly by another e.g., maintenance

cost can be controlled by both the production and maintenance manager. The term “controllable costs” is

often used to mean variable costs and non-controllable costs as fixed.

Belkaoni has mentioned the following fallacies about controllable costs:

(i) All variable costs are controllable and fixed are not.

(ii) All direct costs are controllable and indirect costs are not.

(iii) All long-term costs are controllable.

Sometimes the time factor and the decision making authority can make a cost controllable. If the time period

is long enough, all costs can be controlled. Proper delegation helps in establishing clear responsibility and

controllability. But all costs can be controlled by one or another person. The authority and responsibility of

cost control is delegated to different levels, though the managing director is responsible for all the costs.

9. Costs for Analytical and Decision Making Purposes

(a) Opportunity Costs: Opportunity cost is the cost of selecting one course of action and the losing of

other opportunities to carry out that course of action. It is the amount that can be received if the

asset is utilised in its next best alternative.

Lesson 1 Introduction to Cost and Management Accounting

13

Edwards, Hermanson and Salmonson define it as “the benefits lost by rejecting the best competing

alternative to the one chosen. The benefit lost is usually the net earnings or profit that might have

been earned from the rejected alternative”

Example: Capital is invested in plant and machinery. It cannot be now invested in shares or

debentures. The loss of interest and dividend that would be earned is the opportunity cost. Another

example is when the owner of a business foregoes the opportunity to employ himself elsewhere.

Opportunity costs are not recorded in the books. It is important in decision making and comparing

alternatives.

(b) Sunk Costs: A sunk cost is one that has already been incurred and cannot be avoided by decisions

taken in the future. As it refers to past costs, it is called unavoidable cost. The National Association

of Accountants (USA) defines a sunk cost as “an expenditure for equipment or productive resources

which has no economic relevance to the present decision making process”. This cost is not useful

for decision making as all past costs are irrelevant. CIMA defines it as the past cost not taken into

account in decision making.

It has also been defined as the difference between the purchase price of an asset and its salvage

value.

(c) Differential Cost: Differential cost has been defined as “the difference in total cost between

alternatives, calculated to assist decision making”. Differential cost is the increase or decrease in

total costs resulting out of:

(a) Producing and distributing a few more or few less of products;

(b) A change in the method of production/distribution;

(c) An addition or deletion of a product or a territory; and

(d) The selection of an additional sales channel.

The differential cost between any two levels of production is the difference between the marginal

costs at these two levels and the increase or decrease in fixed costs, if any. These costs are usually

‘specific purpose costs’ as they are determined for a particular purpose and under specific

circumstances.

Incremental cost measures the addition in unit cost for an addition in output. This cost need not be

the same at all levels of production. It is usually expressed as a cost per unit whereas the

differential cost is measured in total. The former applies to increase in production and is restricted to

the cost only, whereas the differential cost has a comprehensive meaning and application in the

sense that it denotes both increase or decrease.

Differential costs is useful in planning and decision making and helps to choose the best alternative.

It helps management to know the additional profit that would be earned if idle capacity is used or

when additional investments are made.

(d) Joint Costs: The processing of a single raw material results in two or more different products

simultaneously. The joint products are not identifiable as different types of product until a certain

stage of production known as the split-off point is reached. Joint costs are the costs incurred upto

the point of separation. One product may be of major importance and others of minor importance

which are called by-products.

Bierman and Djckman define it as: “Joint costs relate to a situation in which the factors of production

EP-CMA

14

by their basic nature result in two or more products. The jointness results from there being more

than one product, and these multi-products are the result of the methods of production or the nature

of raw material and not of a decision by management to produce both”.

The National Association of Accountants defines it as follows:

“Joint costs relate to two or more products produced from a common production process or

element-material, labour or overhead or any combination thereof or so locked together that one

cannot be produced without producing the other”.

Joint costs can be apportioned to different products only by adopting a suitable basis of

apportionment.

(e) Common Costs: Common costs are those costs which are incurred for more than one product, job,

territory or any other specific costing object. They are not easily related with individual products and

hence are generally apportioned.

The National Association of Accountants defines the term as “the cost of services employed in the

creation of two or more outputs which is not allocable to those outputs on a clearly justified basis”.

It should be kept in mind that management decisions influence the incurrence of common costs e.g.

rent of the factory is a common cost to all departments located in factory.

(f) Imputed Costs: Some costs are not incurred and are useful while taking decision pertaining to a

particular situation. These costs are known as imputed or notional costs and they do not enter into

traditional accounting systems.

Examples: Interest on internally generated funds, salaries of owners of proprietorship or

partnership, notional rent etc.

(g) Uniform Costs: They are not distinct costs as such. Uniform costing signifies common costing

principles and procedures adopted by a number of firms. They are useful in inter-firm comparison.

(h) Marginal Costs: It is the aggregate of variable costs, i.e., prime cost plus variable overheads. Thus,

costs are classified as fixed and variable.

(i) Replacement Costs: This is the cost of replacing an asset at current market values e.g. when the

cost of replacing an asset is considered, it means the cost of purchasing the asset at the current

market price is important and not the cost at which it was purchased.

(j) Out of Pocket Cost: It involves payment to outsiders i.e. gives rise to Cash Expenditure as

opposed to such costs as depreciation which don’t involve any cash expenditure. Such costs are

relevant for price fixation during recession or when make or buy decision is to be made.

10. Other Costs

(i) Conversion Cost: It is the cost of a finished product or work-in-progress comprising direct labour

and manufacturing overhead. It is production cost less the cost of raw material but including the

gains and losses in weight or volume of direct material arising due to production.

(ii) Normal Cost: This is the cost which is normally incurred at a given level of output in the conditions

in which that level of output is achieved.

(iii) Traceable Cost: It is the cost which can be easily associated with a product, process or

department.

Lesson 1 Introduction to Cost and Management Accounting

15

(iv) Avoidable Costs: Avoidable costs are those costs which under the present conditions need not

have been incurred.

Example: (a) Spoilage in excess of normal limit; (b) Unfavourable cost variances which could have

been controlled.

(v) Unavoidable Costs: Unavoidable costs are those costs which under the present conditions must

be incurred.

(vi) Total Cost: This is the sum of all costs associated to a particular unit, or process, or department or

batch or the entire concern. It may also mean the sum total of material, labour and overhead. The

term total cost however, is not precise, it needs to be made precise by using terms that indicate the

elements of cost included.

(vii) Value Added: Strictly, it is not cost. It means the selling price of the product/service less the cost of

materials used in the product or the service. Often depreciation is also deducted for ascertaining

“value added”.

REVIEW QUESTIONS

COST CENTRE AND COST UNIT

A cost accountant has to ascertain cost by cost centre or cost unit or by both.

Cost Centre

According to the Chartered Institute of Management Accountants, London, cost centre means, “a production or

service location, function, activity or item of equipment whose costs may be attributed to cost units”. Cost centre

is the smallest organisational sub-unit for which separate cost collection is attempted. Thus cost centre refers to

one of the convenient unit into which the whole factory organisation has been appropriately divided for costing

purposes. Each such unit consists of a department or a sub-department or item of equipment or, machinery or

a person or a group of persons. For example, although an assembly department may be supervised by one

foreman, it may contain several assembly lines. Sometimes each assembly line is regarded as a separate cost

centre with its own assistant foreman. Take another example, in a laundry, activities such as collecting, sorting,

marketing and washing of clothes are performed. Each activity may be considered as a separate cost centre

and all costs relating to a particular cost centre may be found out separately.

Cost centres may be classified as follows :

(i) Productive, Unproductive and Mixed Cost Centres: Productive cost centres are those which are

actually engaged in making the products - the raw materials are handled here and converted into

saleable products. In such centres both direct and indirect costs are incurred, machine shops,

welding shops, and assembly shops are examples of production cost centres in an engineering

factory. Service or unproductive cost centres do not make the products but are essential aids to the

productive centres. Examples of such service centres are those of administration, repairs and

maintenance, stores and drawing office departments. Mixed cost centres are those which are

A cost which does not involve any cash outflow is called_______ or

____________

Correct answer: Notional cost, Imputed cost

EP-CMA

16

engaged some on productive and other lines on service works. For instance, a tool shop serves as

a productive cost centre when it manufactures dies and jigs for specific order, but serves as

servicing cost centre when it does repairs for the factory.

(ii) Personal and Impersonal Cost Centre: A personal cost centre consists of a person or a group of

persons. An impersonal cost centre is one which consists of a department, plant or item of

equipment (or group of these).

(iii) Operation and Process Cost Centre: In case a cost centre consists of those machines and/or

persons which carry out the same operation is termed as operation cost centre. If a cost centre

consists of a continuous sequence of operations it is called process cost centre.

The determination of a suitable cost centre is very important for ascertainment and control of cost. The

manager in charge of a cost centre is held responsible for control of cost of his cost centre.

Cost Unit

The Chartered Institute of Management Accountants, London, defines a unit of cost as “a unit of product or

service in relation to which costs are ascertained”. A cost unit is a devise for the purpose of breaking up or

separating costs into smaller sub-divisions. These smaller sub-divisions are attributed to products or services

to determine product cost or service cost or cost of time spent for a particular job etc. We may for instance

determine the cost per ton of steel, per tonne kilometre of a transport service or cost per machine hour. The

forms of measurement used as cost units are usually the units of physical measurements like number,

weight, area, length, value, time etc. Unit selected should be unambiguous, simple and commonly used.

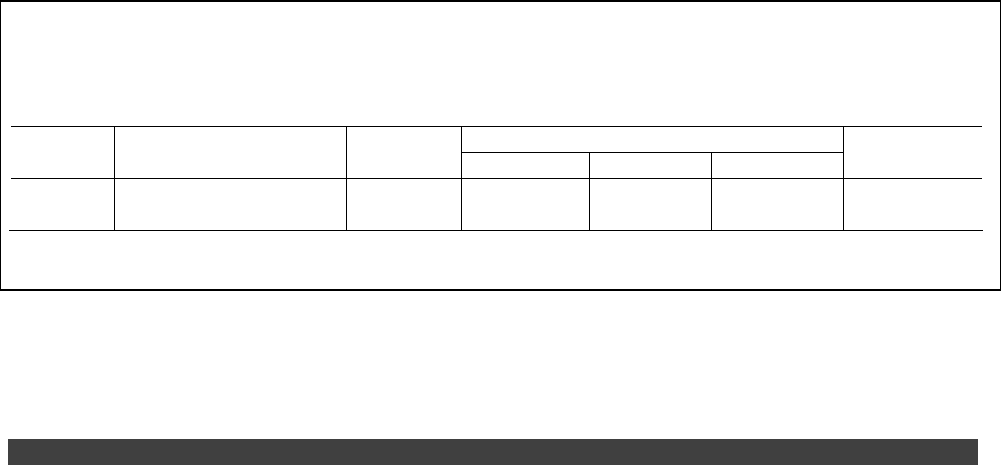

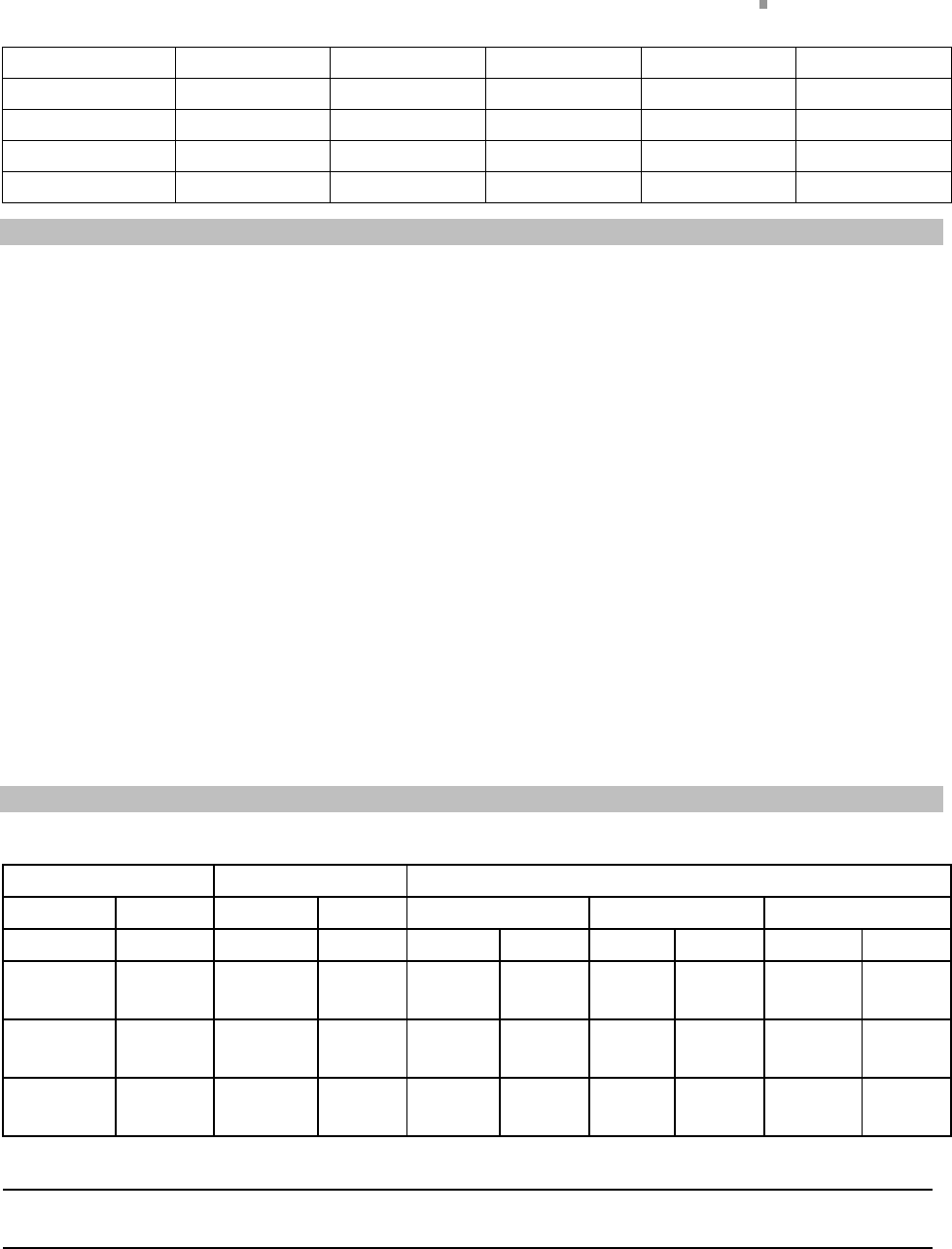

Following are some examples of cost unit:

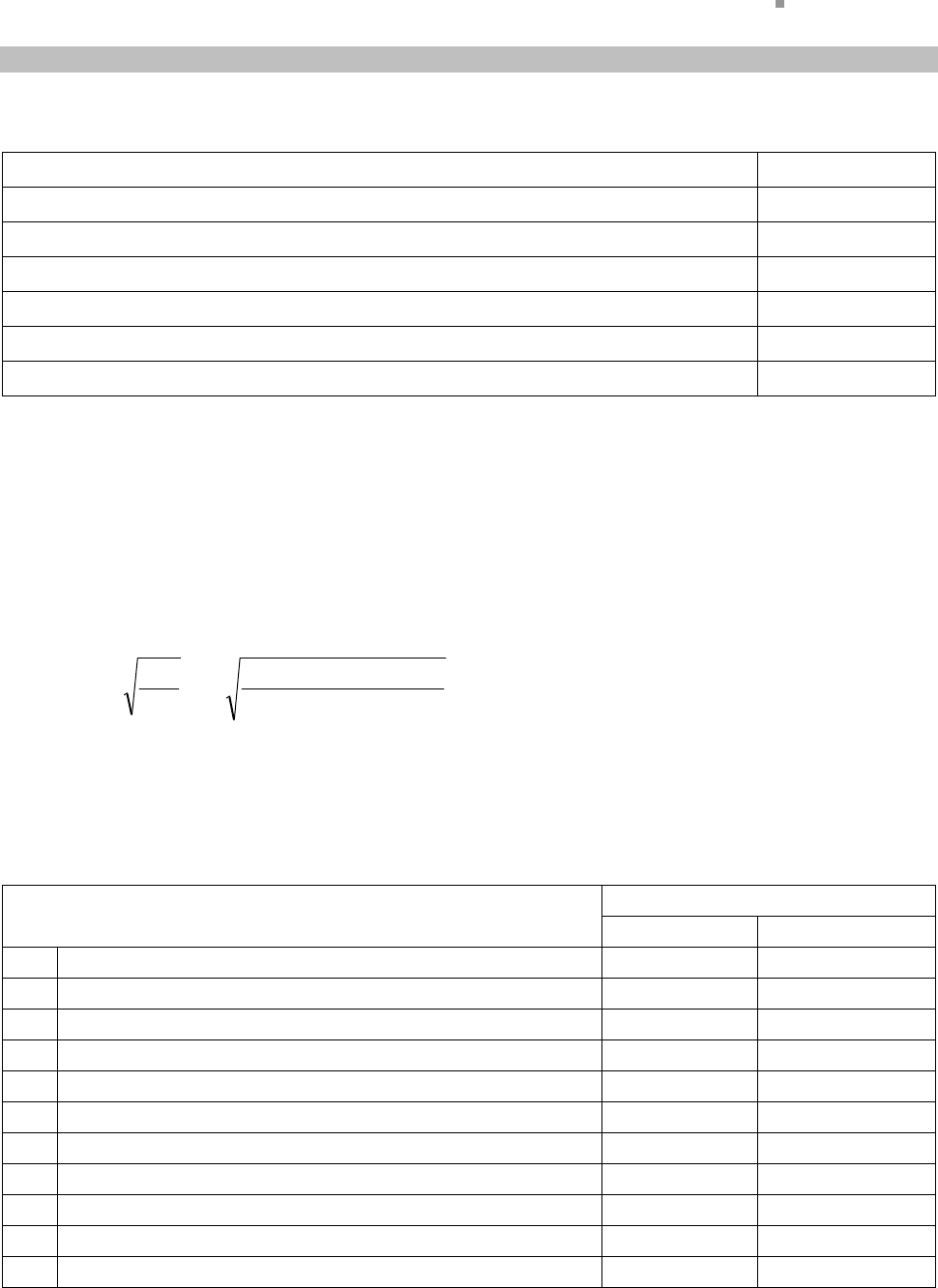

Industry/Product Cost unit

Automobile Number

Brick works 1000 bricks

Cement Tonne

Transport Tonne - Kilometre

Passenger - Kilometre

Chemicals Litre, gallon, kilogramme, tonne

Steel Tonne

Sugar Tonne